American Hartford Gold is a significant gold dealer and has received a lot of praises from Intelligence Commissioner users. They have established themselves as an industry leader.

American Hartford Gold is a reputable and trustworthy option for those wishing to invest in precious metals as part of their retirement plan. With an emphasis on client happiness, straightforward service, and a diverse selection of investment alternatives, the company has emerged as a pioneer in the precious metals market. American Hartford Gold’s focus to compliance, security, and customer education enables investors to make informed decisions and achieve their financial objectives.

We suggest working with a trustworthy broker with specialized staff, latest tech and most importantly, customer-centric trading conditions. After reviewing 1000+ brokers, we rank the following company as the best:

American Hartford Gold is a well-known corporation headquartered in Los Angeles, California, that sells precious metals such as gold, silver, and platinum. The company offers a variety of IRA-related services, allowing consumers to invest in physical precious metals as part of their retirement portfolios. American Hartford Gold has established itself as a leader in the precious metals business, offering both physical gold delivery and secure storage within retirement accounts such as IRAs, 401Ks, and TSPs.

American Hartford Gold provides a wide range of products and services tailored to the needs of customers seeking to diversify their portfolios with precious metals. By offering comprehensive retirement planning and asset management solutions, the organization caters to each client’s specific needs and preferences, assuring a tailored experience that corresponds with their financial goals.

Gold and silver IRAs: A Key Investment Vehicle

American Hartford Gold’s primary feature is the facilitation of self-directed IRAs with precious metals. These IRAs allow individuals to include physical gold and silver in their retirement funds, offering additional diversification and protection against market volatility. By including precious metals in their portfolios, investors can benefit from the historical stability and inherent value these assets provide, preserving their money against economic downturns and inflationary pressures.

The procedure of opening a Gold or Silver IRA with American Hartford Gold is straightforward and user-friendly. Clients are helped through each process, from opening an account to selecting and purchasing precious metals. The company’s trained personnel verify that all transactions follow IRS requirements and that funds are held in secure, recognized depositories.

Self-directed IRAs are a popular choice for investors who want more control over their retirement assets. Unlike regular IRAs, which typically include equities, bonds, and mutual funds, self-directed IRAs enable investors to diversify their portfolios with alternative assets such as real estate, private equity, and precious metals. American Hartford Gold’s expertise in precious metal IRAs ensures that clients have access to the information and resources they need to make sound investment decisions.

The benefits of storing actual gold and silver in an IRA go beyond diversification. Precious metals have historically served as an inflation hedge, protecting investors’ purchasing power over time. Investors who include gold and silver in their retirement plans can protect their wealth from the ravages of inflation and economic uncertainty.

In addition to serving as an inflation hedge, precious metals provide investors with a tangible asset that they can physically own and store. Investors have direct control over their assets, which gives them a sense of security and ownership. American Hartford Gold collaborates closely with third-party custodians and storage providers to assure the safe and compliant safekeeping of these assets, providing peace of mind to clients who value the safety and security of their investments.

Physical Bullion and Coins: A Broad Product Offering

In addition to its IRA offerings, American Hartford Gold allows clients to acquire a variety of real bullion and coins. These products can be delivered straight to customers’ homes or kept in safe depositories. The range includes numerous types of gold and silver bullion, as well as coins that appeal to both investors and collectors.

American Hartford Gold offers experienced guidance to help clients select the best solutions based on their specific investing objectives and preferences. Whether clients are looking for gold bars, silver rounds, or rare coins, the organization has a diverse range and cheap pricing.

The purchase of real bullion and coins helps investors to diversify their holdings while reaping the benefits of tangible assets. Compared to stocks and bonds, which are ethereal financial instruments, precious metals are tangible assets that can be physically possessed and kept. Investors benefit from this tangibility since they have direct control over their investments.

Furthermore, investing in real bullion and coins has the potential for long-term gains. Gold and silver demand has steadily increased throughout the years, driven by causes like as industrial use, jewelry desire, and investment interest. This persistent demand supports precious metals’ long-term value appreciation, making them an important component of a balanced and resilient investment portfolio.

American Hartford Gold aids clients in transferring monies from current retirement accounts to precious metal IRAs. This procedure allows investors to move from typical investment vehicles like equities and bonds to precious metals without incurring penalties. The company’s team of specialists collaborates with clients to ensure that rollovers are smooth and seamless, while also meeting all legal and regulatory standards.

The company takes pride in providing individual service, assisting clients through the entire rollover process and answering any questions or concerns. This approach guarantees that clients are confident and educated as they make key retirement savings decisions.

IRA rollovers and transfers allow participants to tailor their investment strategy to changing market conditions and personal financial goals. By transferring monies from standard retirement accounts to precious metal IRAs, investors can diversify their portfolios while protecting their wealth from market volatility and economic instability.

American Hartford Gold’s experience with IRA rollovers and transfers guarantees that clients have access to the knowledge and resources they need to handle this procedure successfully. The company’s staff of specialists is well-versed in the complexities of retirement account rules and works hard to guarantee that all client accounts are compliant.

American Hartford Gold offers a full range of products and services, including Gold and Silver IRAs, actual bullion and coins, and IRA rollovers, giving clients the tools and resources they need to diversify and safeguard their capital. The company’s commitment to great customer service, affordable pricing, and creative solutions guarantees that clients get the best support and value.

These regulatory bodies play a crucial role in maintaining the integrity of the forex market by enforcing rules and regulations, ensuring transparency, and protecting traders and investors from fraudulent activities.

Checking the regulatory status of brokers like American Hartford Gold is quite beneficial. It inspires trust in the brand.

While American Hartford Gold is known for offering competitive pricing, no exact prices are provided on their website. Clients are advised to contact staff for current price information, ensuring that they get the most accurate and up-to-date information. This strategy demonstrates the company’s dedication to openness and individualized service.

One of the defining elements of American Hartford Gold is its pricing structure, which is intended to provide outstanding value to clients while remaining transparent and affordable.

Unlike many other organizations in the industry, American Hartford Gold does not charge a startup fee when starting a gold IRA account. This fee waiver is part of the company’s efforts to make precious metal investments more accessible to the general public.

The elimination of startup fees demonstrates American Hartford Gold’s dedication to lowering barriers to entry for investors looking to diversify their portfolios with precious metals. By waiving this cost, the company allows clients to devote more of their resources to purchasing valuable assets, so increasing the overall potential for development and profits.

American Hartford Gold has set minimum investment requirements to appeal to a wide spectrum of investors. The minimum investment for cash purchases is $5,000, and for gold or silver IRA rollovers, it is $10,000. These thresholds are intended to guarantee that clients can make major investments while being flexible in their financial plans.

The minimum investment amounts are chosen at levels that allow investors to successfully diversify their portfolios while also reaping the benefits of precious metals as a long-term asset preservation strategy. By establishing these limits, American Hartford Gold ensures that clients can engage in strategic asset allocation that is consistent with their personal financial objectives.

The company charges an annual fee of $180 to keep and store assets obtained through American Hartford Gold. This fee covers the costs of secure storage, account management, and administrative support, ensuring that clients’ investments are safeguarded and managed effectively.

American Hartford Gold’s annual price structure is intended to provide affordable pricing while retaining the greatest levels of protection and service. The company’s dedication to fair and straightforward pricing arrangements allows clients to plan their investments with confidence, knowing that there will be no hidden costs or unexpected charges.

Custody and storage fees

Custody and storage fees, which are commonly levied by self-directed IRA institutions, rarely surpass $180 per year. These fees cover the costs of depositing precious metals in secure, IRS-approved depositories, giving investors piece of mind about the safety and security of their assets.

The use of reputable third-party custodians and storage providers guarantees that clients’ precious metals are stored in accordance with regulatory guidelines and industry best practices. American Hartford Gold’s emphasis on secure storage solutions reflects its dedication to protecting clients’ wealth while upholding the greatest levels of integrity and professionalism.

American Hartford Gold runs a range of promotions to increase the value of its services and attract new customers. These deals offer free maintenance storage and insurance for up to three years on gold IRA rollovers with a $10,000 minimum purchase amount. These incentives indicate the company’s dedication to offering great value and service to its customers.

In addition, American Hartford Gold does not charge any additional fees for insured shipping. The company also offers a no-fee repurchase scheme, which allows customers to quickly sell their metals back to the corporation. This program ensures that clients have a clear exit path if they decide to liquidate their investments.

By offering a variety of promotions and incentives, American Hartford Gold demonstrates its commitment to increasing the value of its services and giving clients with the tools and resources they need to reach their financial objectives.

The tailored approach to client interactions demonstrates the company’s commitment to customer service excellence. From the initial consultation to ongoing account management, American Hartford Gold’s experienced specialists guarantee that clients receive the best possible support and guidance.

Precious Metals and Retirement Planning Strategic Approach

Investing in precious metals as part of a retirement strategy has various advantages, making it a popular choice for many investors. American Hartford Gold offers clients the ability to include these valuable assets into their retirement portfolios via Gold and Silver IRAs.

One of the key benefits of investing in precious metals is diversification. By integrating gold, silver, and other metals in a retirement portfolio, investors can lessen their reliance on traditional financial markets and mitigate the effects of economic volatility. Precious metals have historically held their value over time and frequently perform well during times of economic volatility.

Diversification is an important part of an efficient investment plan because it helps to balance risk and reward by distributing investments across multiple asset classes. By including precious metals in their portfolios, investors can improve their ability to weather market volatility and preserve their wealth from unexpected economic setbacks.

Precious metals are usually regarded as efficient inflation hedges. As the purchase power of fiat currencies falls owing to inflation, the value of gold and silver rises, protecting investors’ wealth. This feature makes precious metals an important part of a well-balanced and resilient retirement strategy.

Precious metals’ capacity to keep value in the face of inflationary pressures is a major reason why many investors include them in their retirement savings. Precious metals safeguard investors’ funds against the eroding effects of inflation, ensuring that they keep purchasing value over time and provide greater financial security in retirement.

Compared to stocks and bonds, which are ethereal financial tools, precious metals are tangible assets that investors can physically own and store. Investors have direct control over their assets, which gives them a sense of security and ownership.

Tangible assets are appealing because of their intrinsic value and durability. Unlike paper assets, which are susceptible to market swings and counterparty risk, precious metals provide a secure and long-term store of value on which investors can rely.

Precious metals are frequently viewed as a safe haven during economic downturns, but they also have long-term growth potential. Gold and silver demand has steadily increased throughout the years, driven by causes like as industrial use, jewelry desire, and investment interest. This steady demand suggests that the value of precious metals may rise over time.

Precious metals have long-term growth potential, making them an appealing addition to retirement portfolios. Individuals that invest in these assets can benefit from both the stability and growth chances they provide, thereby improving their entire financial situation.

American Hartford Gold’s commitment to compliance and security

American Hartford Gold prioritizes compliance and security, ensuring that all client transactions follow regulatory requirements and industry best practices. The company’s commitment to these objectives is shown in its relationships with reputable third-party custodians and storage companies.

The company’s commitment to compliance and security is a pillar of its operations, showing its determination to protecting clients’ interests while upholding the greatest levels of honesty and expertise.

The company follows all applicable requirements for the selling and storage of precious metals, including IRS guidelines for self-directed IRAs. American Hartford Gold’s team of specialists is well-versed in these standards and works hard to keep all client accounts compliant.

The company’s emphasis on regulatory compliance allows clients to invest with confidence, knowing that their accounts are being managed in conformity with all applicable laws and standards. By prioritizing compliance, American Hartford Gold protects its clients’ interests while also instilling trust and confidence in its services.

Secure Storage

American Hartford Gold collaborates with top storage companies to provide secure and dependable storage solutions for clients’ precious metals. These depositories have cutting-edge security features such as 24/7 monitoring, advanced access controls, and strong physical security. Clients can select from a variety of storage choices, including segregated and non-segregated storage, based on their preferences and requirements.

The company’s commitment to secure storage solutions shows its desire to protect clients’ investments and provide peace of mind. By collaborating with trusted storage providers, American Hartford Gold ensures that clients’ precious metals are safe from potential threats and vulnerabilities.

All precious metals housed with American Hartford Gold are fully insured, giving clients greater security and peace of mind. This insurance coverage protects clients’ valuables against potential threats such as theft or damage.

The introduction of comprehensive insurance coverage reflects American Hartford Gold’s dedication to safeguarding clients’ money while upholding the highest levels of security and reliability. By providing insured storage solutions, the company gives clients confidence and security about the safety of their possessions.

American Hartford Gold is committed to maintaining openness in all parts of company operations. The organization gives clients clear and extensive information about pricing, fees, and investment possibilities, allowing them to make informed selections. Furthermore, the company’s open communication and responsiveness to consumer inquiries fosters a strong and trustworthy relationship with its customers.

Transparency is an essential component of American Hartford Gold’s corporate strategy, showing the company’s dedication to ethical procedures and customer-centric service. By emphasizing transparency, the organization builds trust and confidence with its customers, fostering long-term relationships and repeat business.

You should always check the fee structure of a gold dealer.

That’s primarily because they have a direct impact on your potential returns. Moreover, each gold dealer such as American Hartford Gold has distinct trading conditions.

A major part of checking the trading conditions of a broker is to verify their available payment methods.

In the case of American Hartford Gold, you can see that there are multiple options available.

It makes them accessible to traders. Furthermore, it ensures that people can trade freely.

We recommend working with a reliable and trusted broker.

How to Check the Fees of a Gold IRA Company

Navigating the fees of a gold IRA company like American Hartford Gold can seem daunting, but following these simple steps can make it much easier:

1. Visit the Company’s Website

Most gold IRA companies list their fees on their websites, so that’s a great place to start. Look for sections labeled “Fees,” “Pricing,” or “Cost Structure.” For example, Vantage IRA details fees like a $50 setup fee, a $275 annual record-keeping fee, and $75 transaction fees for buying or selling.

2. Request a Fee Schedule

If you can’t find the information online, give the company a call or send them an email asking for a detailed fee schedule. Make sure it covers all the potential costs, including account setup, annual maintenance, storage, transaction, and shipping fees. You can get in touch with American Hartford Gold to learn more about their fee structure.

3. Compare Across Companies

Don’t settle for the first fee schedule you see. Check out multiple gold IRA companies to see how their fees stack up against each other. Some might have lower setup fees but higher annual costs, so it’s important to look at the total picture.

4. Read Customer Reviews

Customer reviews can offer valuable insights into how fair and transparent a company’s fees are. Look for testimonials that specifically mention fees to see what others are saying about their experiences. Checking out American Hartford Gold reviews can be quite helpful. That’s a major reason why we prepared this American Hartford Gold review.

5. Consult Financial Advisors

If you’re feeling uncertain about the fees or how they might affect your investment, talk to a financial advisor who knows the ins and outs of retirement accounts. They can help you understand which fees are reasonable and how they compare to industry norms.

By taking these steps, you can get a clear understanding of the fees associated with a gold IRA company before diving in. This way, you’ll be well-equipped to make informed decisions that align with your financial goals.

American Hartford Gold’s commitment to providing great customer service is essential to its success. The company has a staff of experienced precious metals specialists who offer clients personalized advice and support throughout their investment journey. These specialists collaborate extensively with clients to understand their specific goals and needs before providing unique advise and solutions.

Whether clients are new to precious metal investing or experienced investors, American Hartford Gold provides the support and information they need to make informed decisions. This customer-centric strategy develops long-term connections and trust among clients.

The drive to ongoing improvement and innovation demonstrates American Hartford Gold’s focus on customized service and client happiness. By collecting feedback on a regular basis and incorporating client insights into its operations, the company guarantees that its services are current and successful in fulfilling its clients’ changing needs.

Good customer service is vital for any trader.

You should always check if a gold IRA company remains accessible to its customers and whether it offers multiple contact channels or not.

The most popular ways for recent customers are live chat and email.

While email is becoming a bit obsolete, it is still among the most common methods for a customer to contact the support staff of a broker.

In the case of American Hartford Gold, it’s clear that they offer proper customer support with a significant variety of ways to contact them.

According to multiple users, American Hartford Gold’s customer support is quite active and responds promptly to general queries and grievances.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

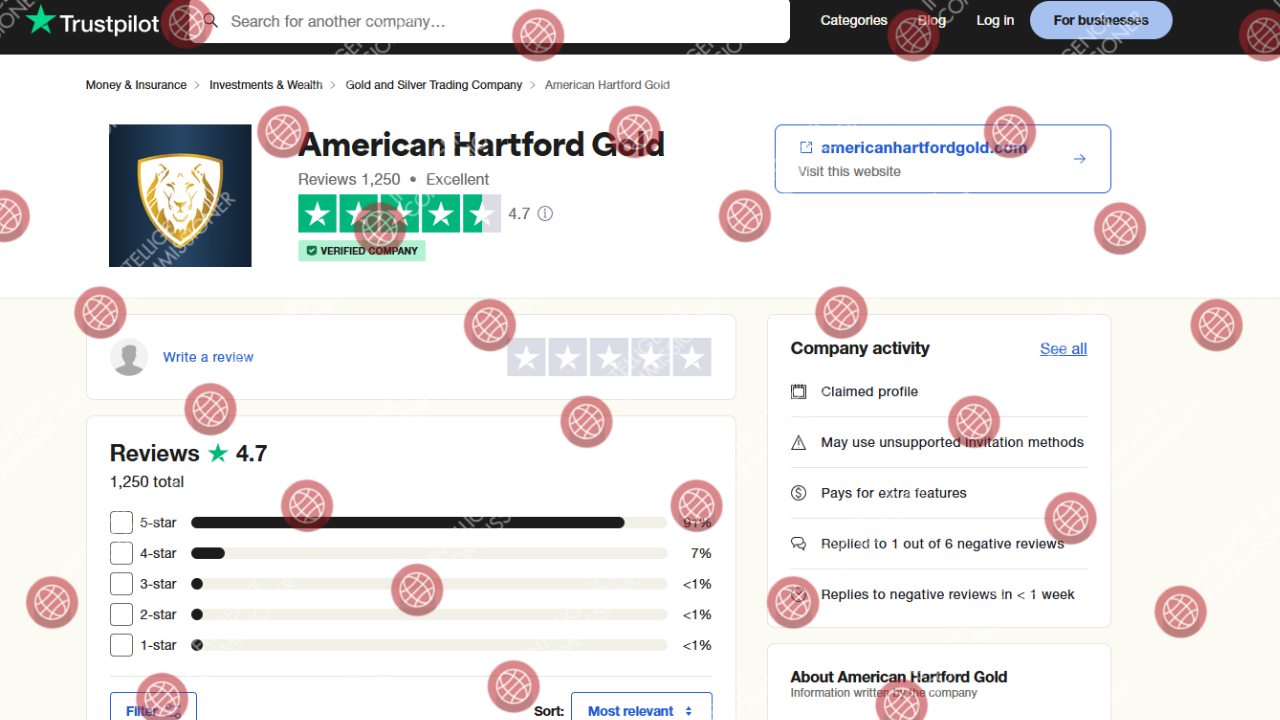

On Trustpilot, American Hartford Gold has a flawless 5-star rating, signifying outstanding customer satisfaction. Clients routinely appreciate the organization for its transparency and good service throughout the gold purchasing process. Testimonials emphasize the convenience of purchasing, the professionalism of the service, and the high quality of the products available.

The positive feedback on Trustpilot demonstrates American Hartford Gold’s commitment to providing a seamless and enjoyable customer experience. By emphasizing transparency and open communication, the organization builds trust and confidence in its customers, fostering long-term relationships and repeat business.

ConsumerAffairs gives the company a high rating of 4.6 out of 5 stars based on 862 reviews. Customers value the courteous, informed, and professional staff, as well as the competitive cost and convenience of purchase. These reviews demonstrate American Hartford Gold’s dedication to offering a pleasant and satisfying customer experience.

ConsumerAffairs reviews highlight the company’s commitment to understanding and meeting each client’s unique demands and preferences. By providing bespoke solutions and individual care, American Hartford Gold ensures that clients have the support and tools they need to reach their financial objectives.

American Hartford Gold’s BBB A+ grade adds to their reputation for trustworthiness and client satisfaction. The organization has a proven track record of responding to consumer complaints quickly and effectively, maintaining open lines of communication, and upholding high standards of ethics and professionalism.

The BBB’s endorsement of American Hartford Gold demonstrates the company’s dedication to ethical business practices and customer-centric service. By focusing on transparency and accountability, the organization has gained the trust and devotion of its clients and industry partners.

American Hartford Gold has been sponsored by well-known people such as Bill O’Reilly and Rick Harrison, which contributes to its solid reputation. These endorsements, together with the company’s high ratings and reviews, establish American Hartford Gold as a respected leader in the precious metals business.

The endorsement of well-known individuals and industry experts demonstrates American Hartford Gold’s dedication to providing great value and service to its clients. These endorsements boost the company’s credibility and visibility, attracting new customers and cementing its position as a top provider of precious metal investment options.

Based on user-submitted reports, most of the American Hartford Gold reviews are quite positive.

Customers praise the company for its prompt customer service and trader-friendly conditions.

However, it’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

While American Hartford Gold doesn’t seem like a shady broker, many others rely on fake reviews to increase their credibility.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why we recommend doing extensive research on forex brokers before finalizing your selection.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews posted by temporary accounts (profiles that only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of American Hartford Gold, however, we noticed that their reviews are legitimate.

Unlike their competitors, it seems American Hartford Gold has put in a lot of resources into providing its traders with specialized customer service. This way, their customers remain happy and satisfied with their experience.

Also, we didn’t notice many significant American Hartford Gold complaints. However, if you have any American Hartford Gold reviews to share, feel free to contact us or share them in the comment section.

You should always look out for consumer complaints. The most common complaints in forex are usually regarding:

- Poor customer support

- Delays in payments

- High fees

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about American Hartford Gold? You can share your complaint in the comment section or submit an anonymous tip.

As the world faces economic difficulties and opportunities, American Hartford Gold remains committed to assisting clients in realizing the benefits of precious metal investing and securing a healthy financial future. By leveraging its experience and resources, the company hopes to empower clients to make informed investment decisions and achieve their financial objectives in an ever-changing global landscape.

In essence, American Hartford Gold is a reliable partner for those looking to incorporate precious metals into their retirement plans. With a strong emphasis on client satisfaction, regulatory compliance, and new solutions, the firm offers a complete and individualized approach to precious metal investing. American Hartford Gold’s commitment to transparency, security, and education guarantees that clients have the knowledge and resources they need to manage the intricacies of the investment landscape and achieve long-term financial success.

American Hartford Gold is a regulated entity. They are licensed and operate under the watch of a major financial regulator.

So, it’s clear that American Hartford Gold is a legit gold broker.

You should avoid working with unregulated brokers. The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind the unregulated broker can run away with your money without any prior notice. It would help if you were extremely cautious when dealing with an unregulated service provider.

However, that’s not the case with American Hartford Gold. It’s clear in our American Hartford Gold broker review that they are a legitimate entity and enjoy a positive reputation in the market.

Can You Trust American Hartford Gold?

All the evidence suggests that American Hartford Gold is legit. However, we recommend checking out more options before finalizing your choice.

That’s why we recommend working with a trusted broker. That way, you can avoid any hiccups and be certain of their reliability.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.