Xera has been identified as a risky opportunity by Intelligence Commissioner users. It is similar to The Blockchain Era. We’ve received over 5 complaints against Xera.

In December 2023, Italy had the highest website traffic on The Blockchain Era’s platform, accounting for more than 50% of its monthly visits. Xera’s formation is evident from the private registration of the domain “xera.pro” in January 2024, suggesting that a launch is on the horizon. Xera offers a wide range of investment options, with amounts ranging from 110 to 1.11 million EUR. These investments provide different returns, including those from simulated mining and a new cryptocurrency called EURX. However, there have been some concerns about EURX being a revival of a defunct coin. Xera’s MLM structure and lack of regulation, along with its opaque leadership and absence of licensing, strongly indicate that it may be operating as a scam.

Get Your Money Back From These Scammers!

[mychargeback-form]

Italy constituted 51% of the overall monthly traffic to The Blockchain Era’s website in December 2023, as reported by SimilarWeb. The site received approximately 57,000 visits per month. The domain name “xera.pro,” which was registered privately on January 8, 2024, is particularly significant for Xera’s launch strategy. At this moment, a countdown timer on the Xera website indicates that a launch is imminent.

Tiers of investment at Xera range in value from 110 to 1.11 million EUR.

By selecting the highest investment bundle offered by Xera, one can acquire a CloudK NFT, an additional 2.2 million in Quantwize, and supplementary returns via simulated mining.

Xera is presently seeking investors for EURX, a term derived from a defunct cryptocurrency that Xera claims to be introducing for the first time.

CLFI, an additional token referenced in Xera’s promotional materials, appears to be a holdover from The Blockchain Era.

With respect to multilevel marketing, Xera implements a unilevel compensation structure that entails both direct commissions and residuals for compensation. Several incentives are accessible, which are contingent upon the volumes of personal and downline investments.

Analogous to Safir International, Success Factory, and The Blockchain Era, the ability of investors to withdraw funds concurrently with the influx of new participants leads to monetary setbacks.

It appears that investors who are already a part of Safir, Success Factory, and The Blockchain Era are joining Xera’s Ponzi scheme, which is anticipated to go public on or after February 4th.

The lack of regulation or the presence of poor regulation is a huge red flag. It means Xera is a scam and most likely, an illegal operation.

Companies offering investment services or opportunities without having a license can vanish without leaving a trace. Furthermore, the lack of a regulatory license allows them to get away with it and face no legal consequences.

That’s why it’s vital for you to always check a company’s regulation status as well as its license information. The presence of a license allows consumers to reach out to an authority if something goes wrong.

In the case of Xera, victims have nowhere to go due to the absence of a watchdog or license.

You should ask yourself the following questions when you come across a new investment firm or opportunity:

- Does the investment provider maintain transparency about its CEO?

- Do they have a license from a renowned regulatory authority?

- If the need arises, can I reach out to an authority to report this company as a scam?

Xera would provide appealing trading conditions as part of its effort to attract a diverse variety of investors. This could include promises of extremely high leverage, minimal spreads, and access to a wide range of markets, such as cryptocurrency, forex, and commodities.

However, these appealing conditions may be outweighed by a lack of transparency and regulatory control, generating concerns about the authenticity of the trading results and the security of the assets invested.

In typical Ponzi scheme fashion, the platform may display falsified trading triumphs and manipulated returns to maintain the appearance of prosperity.

Methods for Deposits and Withdrawals

Xera provides a range of deposit and withdrawal methods to cater to investors from different jurisdictions. These options include bank transfers, credit cards, and potentially cryptocurrencies, which are gaining popularity and offer an extra level of anonymity. However, although deposits would probably be processed quickly to promote investment, withdrawals might be subject to various and complex conditions, delays, or even rejection.

This discrepancy would help to ensure that funds stay within the scheme for as long as possible, supporting payouts to earlier investors and funding the extravagant lifestyles of the scheme’s operators.

However, it’s worth noting that many scammers disable their payment channels before shutting down their operations.

They might give you multiple reasons including:

- A technical error

- A glitch in their system

- Banking issues

- A “hacking attack”

And many others.

But in 9/10 cases, the scammers actually stop making payments and keep the money to themselves. Hence, the payment methods we discussed here might not work.

If you want to get your money back from a scammer, you’d need to file a chargeback.

The consumer complaint resolution strategy of Xera lacks clarity. The lack of clarity is concerning, particularly considering Xera’s background as the combination of three failed Ponzi schemes.

With a background like that, it’s hard to have confidence in the company’s commitment to providing excellent customer service and an effective complaint handling system.

It raises concerns about the platform’s overall legitimacy and ethical practices, as it suggests a potential disregard for customer satisfaction and the integrity of complaint resolution systems.

When it comes to scammers, you should only measure the quality of their customer service if they respond to your complaint.

In the beginning, scammers tend to remain very accessible.

This means their representatives will keep calling you until you invest with them. Furthermore, they will act friendly and make it seem as if you’re one of their most valuable consumers.

However, they do all this just to win your trust.

Scammers understand that in order to convince someone to give them a large sum, they will need to seem like a friend.

Nevertheless, when you have invested a considerable amount of money and need to get it back, their customer support will become inaccessible.

All of a sudden, their numbers would either stop responding or become unavailable.

Still, they might remain accessible to convince you to invest further. Also, they might begin by making a few excuses regarding your payment.

However, in the end, the customer support won’t resolve your issues and become increasingly unavailable.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

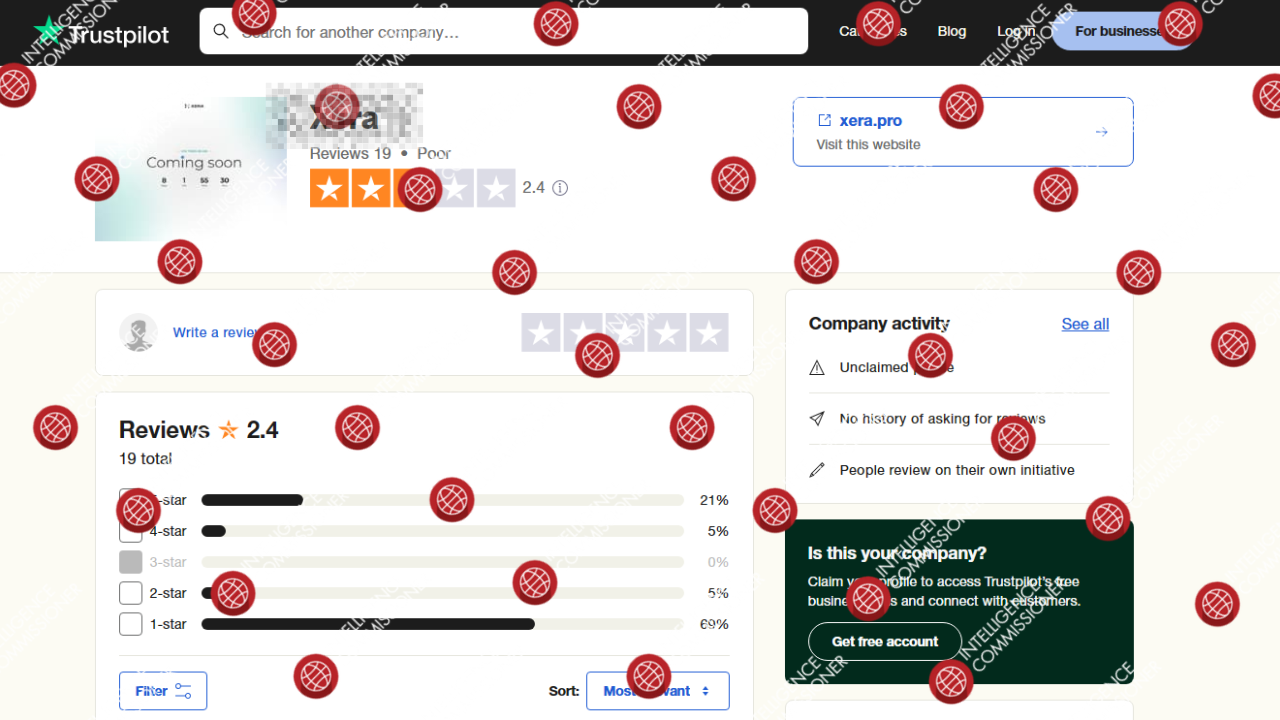

It’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

Trustpilot Uncovers Troubling Patterns of Deception and Harm. Trustpilot reviews reveal a concerning narrative surrounding Xera, portraying it as a platform with questionable ethics that negatively impacts both users and those affected by its operations.

From the feedback, a disturbing trend emerges, with stories of people who were enticed by the prospect of cutting-edge solutions and trustworthiness, only to encounter practices that raise significant concerns about potential scams.

This concerning combination of testimonials not only damages Xera’s reputation, but also serves as a clear warning about the platform’s failure to uphold fundamental principles of customer satisfaction and trust. Trustpilot plays a vital role in this situation, serving as a crucial platform for revealing the truth.

It offers prospective customers a window to accurately assess the extent of Xera’s unethical practices and questionable reliability.

Scammers like Xera tend to purchase fake reviews for their online profiles to make themselves seem more credible.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why you shouldn’t trust Xera reviews easily.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews that are posted by temporary accounts (profiles which only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of Xera, chances are, you wouldn’t find many legitimate reviews.

Another prominent way scammers like Xera enhance their credibility is by burying negative reviews and complaints under a lot of fake reviews.

This way, when you’ll look up “Xera reviews”, you might not find many complaints. Or, you might find them buried within numerous reviews praising Xera.

You should always look out for consumer complaints. In the case of Xera, the most common complaints I found were about:

- Poor customer support

- Delays in payments

- High fees and charges

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about Xera? You can share your complaint in the comment section or submit an anonymous tip.

Xera arises from the consolidation of three previously collapsed Dubai-based schemes: Safir International, Success Factory, and The Blockchain Era, creating what seems to be a large-scale fraudulent operation.

These entities, notorious for their MLM crypto scams, have come together under the Xera brand, unveiling a questionable business model focused on an AI trading bot and cryptocurrency gimmicks. Xera offers a wide range of investment options, from 110 EUR to 1.11 million EUR.

They claim to generate returns through various methods such as simulated mining and a new cryptocurrency. Additionally, they have direct and residual commission schemes in place. This formation raises concerns about potential fraud and loss for participants.

Xera is an unregulated entity. Although they might fall under the jurisdiction of a watchdog, they don’t have the license to offer financial services to consumers.

The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind Xera can run away with your money without any prior notice. You should be extremely cautious when dealing with an unregulated service provider.

The absence of a watchdog also means you cannot report to them to anyone.

Also, due to the absence of specific regulations, there is no provision protecting you from the insolvency of this entity. If they go bankrupt, you won’t be able to do anything about it.

Can You Trust Xera?

All the evidence suggests that Xera is a scam. If you have lost money to them, there is still a chance you can get it back.

To recover your funds, you’d need to file a chargeback.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.