CapitalHall has been identified as a risky opportunity by Intelligence Commissioner users. It is similar to Tonoit. We’ve received over 5 complaints against CapitalHall.

Engaging in online trading can be a lucrative endeavor, but it’s important to be aware of the risks involved, particularly when dealing with unregulated platforms such as CapitalHall. This in-depth analysis explores the various aspects of CapitalHall, including its range of services, educational resources, investment strategies, and tools for individuals navigating the intricate world of financial markets. When considering CapitalHall as an educational platform, it is important to carefully evaluate the quality of its materials and approach with caution, given the absence of regulation. It is important for potential investors to thoroughly research and prioritize security when considering involvement with this platform.

Get Your Money Back From These Scammers!

[mychargeback-form]

Participating in Internet trading has the possibility of financial gains, but it also carries inherent hazards, particularly when dealing with unregulated or dubious sites. CapitalHall, also known as CapitalHall, has arisen as a platform that offers attractive promises to traders.

This extensive analysis explores the complexities of CapitalHall, providing insights into its services, educational materials, investing strategies, and tools designed for individuals entering the intricate world of financial markets.

Initially, the site seems to serve as a portal for traders who are looking for a method to enter the realm of online trading. Nevertheless, the appeal of promises necessitates a more thorough analysis. The online trading environment comprises both genuine prospects and, regrettably, a plethora of questionable businesses.

- Key Aspects of CapitalHall: Commitment to instructional Resources: CapitalHall presents itself as an online trading platform dedicated to offering instructional information. It is crucial to thoroughly examine the depth and legitimacy of these materials to guarantee that they truly empower users with knowledge and skills.

- Investment Plans: The platform promotes investment plans, which are essential for prospective traders. Nevertheless, it is crucial to thoroughly assess the openness and practicability of these proposals. Dishonest platforms frequently make extravagant claims that are highly unlikely to be fulfilled.

- Array of Tools: CapitalHall asserts to provide a diverse selection of tools to aid traders. The effectiveness and dependability of these technologies are crucial variables to take into account. Traders depend on precise and reliable instruments for their financial judgments.

- Exercise Prudence: Although CapitalHall may appear appealing to traders, it is crucial to exercise prudence. A thorough and meticulous investigation, careful evaluation of customer feedback, and a thorough assessment of the platform’s regulatory standing are crucial prerequisites before interacting with any online trading organization.

Education Program CapitalHall

CapitalHall is an internet-based trading platform that specifically emphasizes offering educational materials to empower its users. Their education program is comprehensive and tailored to improve traders’ expertise and comprehension of the financial markets.

E-books are an essential tool for acquiring knowledge about trading concepts, techniques, and market analysis. CapitalHall provides a diverse selection of e-books that encompass a broad spectrum of subjects, appealing to both inexperienced traders and individuals in search of more sophisticated techniques.

It is essential to stay updated on the latest developments that affect financial markets. CapitalHall offers immediate access to up-to-date market news and updates, empowering traders to make well-informed decisions based on ongoing events.

The portal offers a video academy that caters to visual learners, including educational films and lessons. The videos encompass a wide range of topics related to trading, including technical analysis and market insights. They provide an engaging and interactive learning opportunity.

Daily signals refer to expert suggestions that are provided for certain trades. Traders can utilize these signals to guide their investing decisions, taking advantage of the valuable insights offered by seasoned experts.

A financial calendar that enumerates noteworthy economic events is an important instrument. Traders utilize this resource to construct their strategies based on pivotal events such as economic data, central bank meetings, and company earnings announcements.

CapitalHall offers a trading glossary to assist novices in understanding the complexities of trading terminology. This resource provides concise explanations of essential terminology and specialized language, making it a valuable point of reference for individuals who are unfamiliar with the trading industry.

Although these instructional tools may be attractive, it is crucial to carefully evaluate their quality and efficacy. The credibility of a trading platform is frequently contingent upon the comprehensiveness and precision of its teaching resources. Traders must thoroughly research and investigate to ensure that the resources offered are in line with their learning goals and make a significant contribution to their trading progress.

In the ever-changing realm of Internet trading, the importance of making careful judgments cannot be emphasized enough. Prospective traders must exercise caution, distinguishing trustworthy platforms from possible risks to protect their assets and financial security.

The lack of regulation or the presence of poor regulation is a huge red flag. It means CapitalHall is a scam and most likely, an illegal operation.

Companies offering investment services or opportunities without having a license can vanish without leaving a trace. Furthermore, the lack of a regulatory license allows them to get away with it and face no legal consequences.

That’s why it’s vital for you to always check a company’s regulation status as well as its license information. The presence of a license allows consumers to reach out to an authority if something goes wrong.

In the case of CapitalHall, victims have nowhere to go due to the absence of a watchdog or license.

You should ask yourself the following questions when you come across a new investment firm or opportunity:

- Does the investment provider maintain transparency about its CEO?

- Do they have a license from a renowned regulatory authority?

- If the need arises, can I reach out to an authority to report this company as a scam?

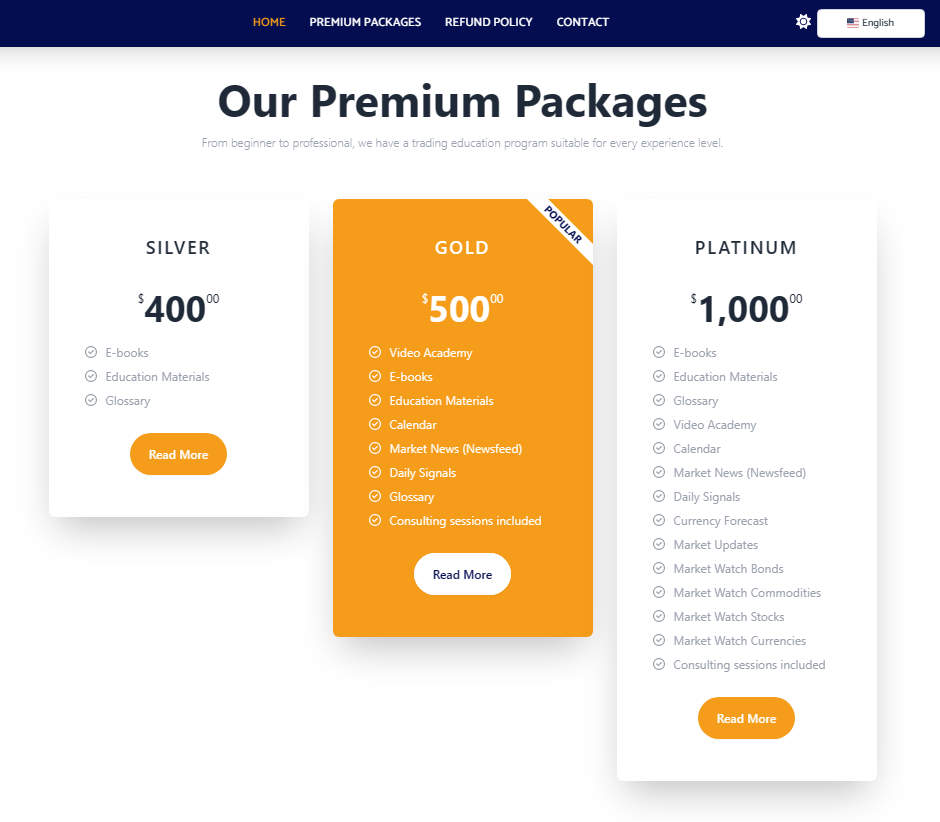

CapitalHall attracts traders with a variety of investment programs, each offering unique features, services, and possible earnings. Examining these plans offers valuable insights into the platform’s advertised features:

The cost of the Silver Plan is $400.00

The Silver Plan, priced at $400.00, is designed to cater to new traders who are entering the trading industry. Although there may be some variations, lower-tier plans generally provide restricted access to premium features and support services, serving as an introductory option for trading.

The cost of the Gold Plan is $500.00

The Gold Plan, priced at $500.00, is designed for traders who desire advanced features beyond the fundamental offerings. Positioned as an intermediate-level option, these plans frequently incorporate supplementary services such as consulting sessions and market analysis tools, to aid traders in making well-informed decisions.

The cost of the Platinum Plan is $1,000.00

The Platinum Plan is the most expensive option, costing $1,000.00. Designed for traders seeking a wide range of services, premium plans of this kind typically include comprehensive market analysis, forecasts, and extensive support services to assist traders in their pursuits.

Although trading offers the possibility of lucrative results, it is essential to recognize the underlying hazards that might result in significant financial losses. The details of each plan may differ, and the claims of profitability should be approached with caution.

Traders should carefully examine the specifics of these schemes, evaluate their trading objectives, and approach the potential benefits with a fair and objective viewpoint.

However, it’s worth noting that many scammers disable their payment channels before shutting down their operations.

They might give you multiple reasons including:

- A technical error

- A glitch in their system

- Banking issues

- A “hacking attack”

And many others.

But in 9/10 cases, the scammers actually stop making payments and keep the money to themselves. Hence, the payment methods we discussed here might not work.

If you want to get your money back from a scammer, you’d need to file a chargeback.

The consumer said that he established a trading account with a company called Capitalhall, with Ronald Lebowski serving as his account manager. He maintained regular communication with me using the phone number +493031879448. At first, the trade appeared to be profitable, which convinced me to augment my investment.

Nevertheless, following a period of unfavorable trading results, the balance of my account experienced a substantial decline. To correct this situation, Ronald strongly advised me to allocate new monies with the intention of “preserving” the money currently present in the account.

He perceived that my cash was being held as a form of coercion to compel me to deposit additional funds. He stressed the importance of injecting additional funds to restore the account balance to a positive state, warning that failure to do so would result in losing everything. Consequently, my overall investment increased to almost 100,000 EUR.

Ronald strongly advocated for Bitcoin transactions, stating that bank wire transfers would be excessively time-consuming and the fluctuating market conditions could lead to additional losses on my MT4 trading platform before the funds could be successfully deposited.

Following that, the Capitalhall website vanished inexplicably, and all communication with the company abruptly ceased emails were returned and phone calls were left unanswered. He has made an effort to initiate a fund withdrawal in compliance with their Terms and Conditions, but, my emails were consistently declined.

Plbox Ltd, a company based in Sofia, Bulgaria, is responsible for maintaining Capitalhall’s website and trading services, by its Terms and Conditions. The company is headed by Ms. Lyudmila Kadeleva.

When it comes to scammers, you should only measure the quality of their customer service if they respond to your complaint.

In the beginning, scammers tend to remain very accessible.

This means their representatives will keep calling you until you invest with them. Furthermore, they will act friendly and make it seem as if you’re one of their most valuable consumers.

However, they do all this just to win your trust.

Scammers understand that in order to convince someone to give them a large sum, they will need to seem like a friend.

Nevertheless, when you have invested a considerable amount of money and need to get it back, their customer support will become inaccessible.

All of a sudden, their numbers would either stop responding or become unavailable.

Still, they might remain accessible to convince you to invest further. Also, they might begin by making a few excuses regarding your payment.

However, in the end, the customer support won’t resolve your issues and become increasingly unavailable.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

It’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

Scammers like CapitalHall tend to purchase fake reviews for their online profiles to make themselves seem more credible.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why you shouldn’t trust CapitalHall reviews easily.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews that are posted by temporary accounts (profiles which only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of CapitalHall, chances are, you wouldn’t find many legitimate reviews.

Another prominent way scammers like CapitalHall enhance their credibility is by burying negative reviews and complaints under a lot of fake reviews.

This way, when you’ll look up “CapitalHall reviews”, you might not find many complaints. Or, you might find them buried within numerous reviews praising CapitalHall.

You should always look out for consumer complaints. In the case of CapitalHall, the most common complaints I found were about:

- Poor customer support

- Delays in payments

- High fees and charges

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about CapitalHall? You can share your complaint in the comment section or submit an anonymous tip.

Multiple indicators and evidence suggest potential concerns regarding the dependability of CapitalHall as a trading platform. Significant factors leading to these concerns encompass:

Lack of Regulatory Information

CapitalHall does not provide any information regarding its regulation by a financial body. Reputable trading platforms generally comply with regulatory criteria to protect users’ funds. The lack of regulatory specifics raises concerns over the platform’s security and transparency.

Unverified claims of financial gain

The platform advocates investment schemes with assurances of substantial returns that may seem too sanguine and implausible. The ambiguity surrounding the team or founders of CapitalHall exacerbates these worries. Transparent platforms typically disclose information regarding their leadership, and the absence of such particulars may suggest a deficiency in accountability.

Dubious Testimonials

The credibility of the testimonials on the website may be dubious, as they are susceptible to being readily falsified. Fraudulent platforms frequently employ fabricated testimonials to establish a false perception of achievement and trustworthiness.

Although the website acknowledges the existence of a refund policy, fraudulent individuals may manipulate these policies to lure unsuspecting customers and make the process of obtaining a refund more difficult. It is crucial to carefully examine the terms and circumstances of refunds.

Potential users are strongly recommended to exercise caution and undertake thorough research before participating with CapitalHall due to the lack of regulatory information, overly optimistic profit promises, and questionable testimonials.

Thoroughly examining the platform’s credibility, transparency of leadership, and regulations regarding refunds is essential for making well-informed choices and protecting oneself from possible risks.

CapitalHall is an unregulated entity. Although they might fall under the jurisdiction of a watchdog, they don’t have the license to offer financial services to consumers.

The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind CapitalHall can run away with your money without any prior notice. You should be extremely cautious when dealing with an unregulated service provider.

The absence of a watchdog also means you cannot report to them to anyone.

Also, due to the absence of specific regulations, there is no provision protecting you from the insolvency of this entity. If they go bankrupt, you won’t be able to do anything about it.

Despite careful consideration of all relevant facts, the trustworthiness of the CapitalHall trading platform remains uncertain. Hence, it is prudent to exercise caution and explore other choices that have a well-established track record of adhering to regulations and maintaining transparency. When making a decision, it is crucial to give priority to the security of the investments.

Can You Trust CapitalHall?

All the evidence suggests that CapitalHall is a scam. If you have lost money to them, there is still a chance you can get it back.

To recover your funds, you’d need to file a chargeback.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.