STYX Trade has been identified as a risky opportunity by Intelligence Commissioner users. It is similar to Skilled Funded. We’ve received over 3 complaints against STYX Trade.

STYX Trade fraudulently asserts regulation by the Cyprus Securities and Exchange Commission, which is a significant red flag for Forex traders, according to investigations. STYX Trade fails to obtain a valid forex license, thereby jeopardizing the funds of its investors. Furthermore, cautionary statements issued by esteemed financial institutions such as BaFin and the FCA underscore its illicit operations. STYX Trade’s absence of safeguards such as negative balance protection and segregated accounts, which are provided by regulated brokers, substantially amplifies the potential for financial loss. This underscores the criticality of exercising prudence when selecting a broker in the Forex market.

Get Your Money Back From These Scammers!

[mychargeback-form]

The investigation of STYX Trade’s regulatory status finds a serious discrepancy, despite its claims to be regulated by the Cyprus Securities and Exchange Commission (CySEC), a credential that typically inspires trust in the Forex community. The lack of a proper forex license indicates a significant control gap, leaving its operations unregulated and putting traders’ capital at danger.

Further investigation reveals alarming warnings from two key financial regulatory bodies: the Federal Financial Supervisory Authority (BaFin) in Germany and the Financial Conduct Authority (FCA) in the UK. These warnings highlight major flaws with STYX Trade’s procedures, such as unlawful actions and noncompliance with regulatory frameworks, casting doubt on the broker’s credibility and the protection of investor funds.

In contrast, brokers licensed in jurisdictions such as the United Kingdom, the European Union, Australia, and the United States provide increased investor protection through measures such as guaranteed funds, segregated accounts, and, in some cases, negative balance protection. However, STYX Trade’s failure to offer these key safety nets raises the chance of financial loss for traders and underscores the risks of entrusting funds to such firms.

The lack of regulation or the presence of poor regulation is a huge red flag. It means STYX Trade is a scam and most likely, an illegal operation.

Companies offering investment services or opportunities without having a license can vanish without leaving a trace. Furthermore, the lack of a regulatory license allows them to get away with it and face no legal consequences.

That’s why it’s vital for you to always check a company’s regulation status as well as its license information. The presence of a license allows consumers to reach out to an authority if something goes wrong.

In the case of STYX Trade, victims have nowhere to go due to the absence of a watchdog or license.

You should ask yourself the following questions when you come across a new investment firm or opportunity:

- Does the investment provider maintain transparency about its CEO?

- Do they have a license from a renowned regulatory authority?

- If the need arises, can I reach out to an authority to report this company as a scam?

STYX Trade touts a proprietary trading platform that claims to have cutting-edge capabilities. However, the platform’s lack of reliability and sophistication, combined with the absence of essential trading tools and indicators found on industry-standard platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), further reduces its appeal and casts doubt on its efficacy and the broker’s credibility.

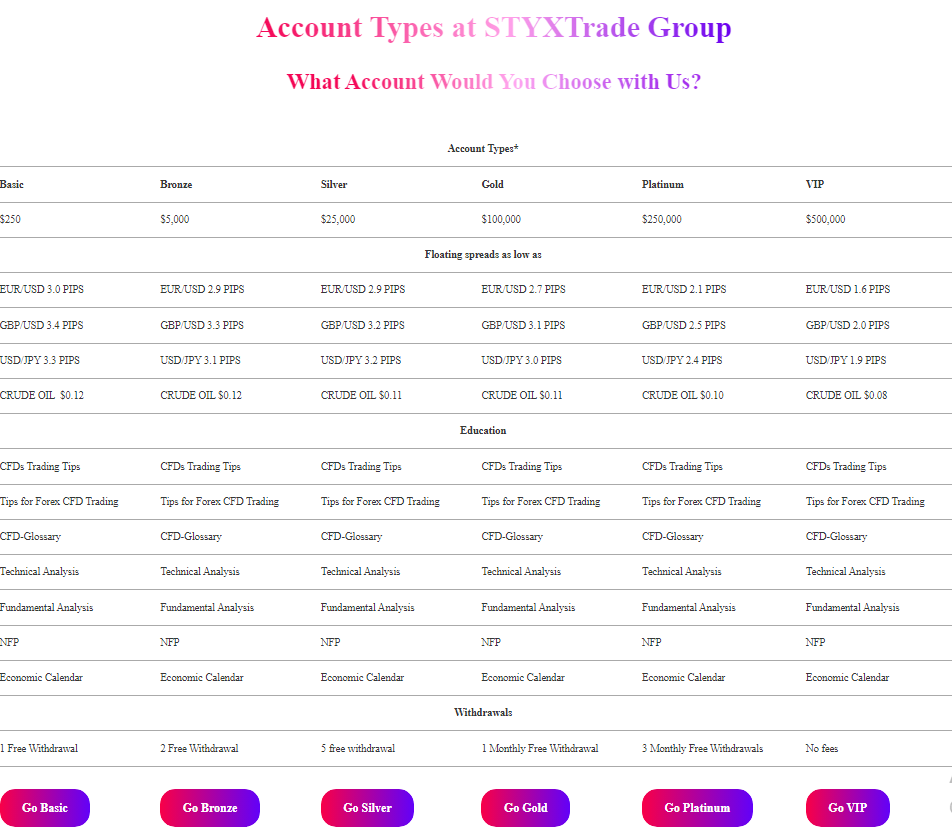

The broker’s minimum deposit requirement and range of trading instruments should be carefully considered. While STYX Trade offers a variety of account types with varying minimum deposits, the lack of regulatory control and imprecise trading rules suggest that even the most basic investment may be at danger.

However, it’s worth noting that many scammers disable their payment channels before shutting down their operations.

They might give you multiple reasons including:

- A technical error

- A glitch in their system

- Banking issues

- A “hacking attack”

And many others.

But in 9/10 cases, the scammers actually stop making payments and keep the money to themselves. Hence, the payment methods we discussed here might not work.

If you want to get your money back from a scammer, you’d need to file a chargeback.

STYX Trade, a Forex broker under criticism for a lack of regulatory control and operational transparency, raises serious concerns about the effectiveness of its customer care, particularly in processing complaints.

The lack of a genuine license, warnings from reputable financial regulatory authorities, and the absence of critical client money protections such as guaranteed funds and segregated accounts are all huge red flags. These flaws not only call into doubt the broker’s credibility, but also suggest potential shortcomings in properly addressing customer complaints.

Traders should exercise caution and look for brokers with strong regulatory compliance and a track record of quick and fair customer service to ensure a secure and transparent trading experience.

When it comes to scammers, you should only measure the quality of their customer service if they respond to your complaint.

In the beginning, scammers tend to remain very accessible.

This means their representatives will keep calling you until you invest with them. Furthermore, they will act friendly and make it seem as if you’re one of their most valuable consumers.

However, they do all this just to win your trust.

Scammers understand that in order to convince someone to give them a large sum, they will need to seem like a friend.

Nevertheless, when you have invested a considerable amount of money and need to get it back, their customer support will become inaccessible.

All of a sudden, their numbers would either stop responding or become unavailable.

Still, they might remain accessible to convince you to invest further. Also, they might begin by making a few excuses regarding your payment.

However, in the end, the customer support won’t resolve your issues and become increasingly unavailable.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

Forex trading is complex, therefore picking a regulated and trustworthy broker is crucial for investment security and fair trading. Based on years of industry experience and regulatory requirements, a thorough assessment of STYX Trade shows many concerning aspects that prospective clients must carefully consider. STYX Trade lacks a genuine forex license from the Cyprus Securities and Exchange Commission (CySEC), despite representations to the contrary.

Financial regulators including BaFin in Germany and the FCA in the UK have warned about the broker’s unlawful activity in their jurisdictions.

It’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

Scammers like STYX Trade tend to purchase fake reviews for their online profiles to make themselves seem more credible.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why you shouldn’t trust STYX Trade reviews easily.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews that are posted by temporary accounts (profiles which only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of STYX Trade, chances are, you wouldn’t find many legitimate reviews.

Another prominent way scammers like STYX Trade enhance their credibility is by burying negative reviews and complaints under a lot of fake reviews.

This way, when you’ll look up “STYX Trade reviews”, you might not find many complaints. Or, you might find them buried within numerous reviews praising STYX Trade.

You should always look out for consumer complaints. In the case of STYX Trade, the most common complaints I found were about:

- Poor customer support

- Delays in payments

- High fees and charges

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about STYX Trade? You can share your complaint in the comment section or submit an anonymous tip.

It is strongly advised to exercise caution due to the mentioned concerns, including inadequate regulatory oversight, warnings from reputable financial authorities, insufficient safeguards for client funds, questionable platform reliability, and unclear trade conditions. Investors seeking a secure and transparent trading environment should prioritize brokers that have undergone thorough scrutiny by reputable regulatory bodies.

These brokers ensure a secure and pleasant trading experience by prioritizing the protection of client funds, providing advanced trading systems equipped with a diverse set of tools, and maintaining transparency regarding the rules of the trade.

Working with a middleman such as STYX Trade may not be advisable due to their lack of transparency and disregard for regulations. The potential impact on one’s finances could be significant. The foreign exchange market has a lot of potential, but it also faces some challenges. Choosing a broker that adheres to industry regulations and best practices is crucial for safeguarding your investments and achieving favorable trading outcomes.

STYX Trade is an unregulated entity. Although they might fall under the jurisdiction of a watchdog, they don’t have the license to offer financial services to consumers.

The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind STYX Trade can run away with your money without any prior notice. You should be extremely cautious when dealing with an unregulated service provider.

The absence of a watchdog also means you cannot report to them to anyone.

Also, due to the absence of specific regulations, there is no provision protecting you from the insolvency of this entity. If they go bankrupt, you won’t be able to do anything about it.

Can You Trust STYX Trade?

All the evidence suggests that STYX Trade is a scam. If you have lost money to them, there is still a chance you can get it back.

To recover your funds, you’d need to file a chargeback.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.