SurgeTrader has been identified as a risky opportunity by Intelligence Commissioner users. It is similar to Traderseed.io. We’ve received over 4 complaints against SurgeTrader.

SurgeTrader, a proprietary trading firm, has stopped down due to a series of challenges. Match-Trade Technologies’ license termination, SEC fraud charges against the founder’s husband, financial and operational challenges, and poor client communication all contributed to the company’s failure. These controversies have caused many traders to seek clarity and restitution in the midst of severe financial anxiety.

Get Your Money Back From These Scammers!

[mychargeback-form]

SurgeTrader, a proprietary trading firm notorious for allowing traders to trade with the firm’s capital, has recently shut down following a slew of issues. The closure has left many traders and investors in turmoil, with unresolved questions and financial uncertainty. Here’s a detailed look at the major issues that contributed to SurgeTrader’s failure.

Match-Trade Technologies’ revocation of SurgeTrader’s license was a major factor in the company’s unexpected demise. This decisive action resulted from SurgeTrader’s “failure to meet the formal requirements outlined in our agreement,” as well as legitimate compliance concerns.

Match-Trade Technologies withdrew the license on June 30, 2024, but the notice came sooner, causing severe interruption to SurgeTrader’s business. This early announcement produced panic and confusion among traders who relied on SurgeTrader’s platform, and it greatly harmed the company’s ability to conduct business as usual.

The U.S. Securities and Exchange Commission (SEC) charged the spouse of SurgeTrader’s founder with fraud, exacerbating the company’s problems. He was accused of running a $35 million Ponzi scheme that targeted church members, casting a lasting shadow over SurgeTrader’s legitimacy. The SEC punished both the founder and her husband, raising concerns about the firm’s authenticity and financial operations. This controversy not only harmed the firm’s reputation, but also caused anxiety and confusion among its clients about the safety of their assets.

The lack of regulation or the presence of poor regulation is a huge red flag. It means SurgeTrader is a scam and most likely, an illegal operation.

Companies offering investment services or opportunities without having a license can vanish without leaving a trace. Furthermore, the lack of a regulatory license allows them to get away with it and face no legal consequences.

That’s why it’s vital for you to always check a company’s regulation status as well as its license information. The presence of a license allows consumers to reach out to an authority if something goes wrong.

In the case of SurgeTrader, victims have nowhere to go due to the absence of a watchdog or license.

You should ask yourself the following questions when you come across a new investment firm or opportunity:

- Does the investment provider maintain transparency about its CEO?

- Do they have a license from a renowned regulatory authority?

- If the need arises, can I reach out to an authority to report this company as a scam?

SurgeTrader’s challenges were not limited to licensing issues. The company had numerous financial and operational issues, further eroding its users’ faith. One of the most serious worries was about profit withdrawals. Many users experienced serious issues withdrawing their money, with some even claiming that their accounts were terminated without previous communication or resolution from the company. These charges caused considerable unhappiness and distrust among traders, who believed their investments were at risk.

Furthermore, technical failures plagued the platform, compounding users’ frustrations. SurgeTrader’s customer support services were frequently criticized as unresponsive and ineffective, leaving many users without assistance during vital times. This lack of dependable customer assistance exacerbated the operational challenges and seriously harmed SurgeTrader’s reputation.

However, it’s worth noting that many scammers disable their payment channels before shutting down their operations.

They might give you multiple reasons including:

- A technical error

- A glitch in their system

- Banking issues

- A “hacking attack”

And many others.

But in 9/10 cases, the scammers stop making payments and keep the money to themselves. Hence, the payment methods we discussed here might not work.

If you want to get your money back from a scammer, you’d need to file a chargeback.

The announcement of SurgeTrader’s suspension prompted a surge in consumer complaints and refund requests. Many traders who had invested in SurgeTrader’s trading challenges found themselves in a perilous position, unsure whether they would ever see their money again. Some users noticed a complete lack of communication from the company about the progress of their refunds or the overall state of their accounts. This communication blackout created more unhappiness and suspicion among SurgeTrader’s customers.

During this turbulent moment, SurgeTrader’s management failed to communicate effectively. Users across several platforms, including Discord and social media, complained about the lack of information or comments from corporate representatives. This silence kept many traders in the dark, compounding the confusion and concern about SurgeTrader’s operations. The lack of transparency and timely communication exacerbated the firm’s users’ feelings of desertion.

When it comes to scammers, you should only measure the quality of their customer service if they respond to your complaint.

In the beginning, scammers tend to remain very accessible.

This means their representatives will keep calling you until you invest with them. Furthermore, they will act friendly and make it seem as if you’re one of their most valuable consumers.

However, they do all this just to win your trust.

Scammers understand that to convince someone to give them a large sum, they will need to seem like a friend.

Nevertheless, when you have invested a considerable amount of money and need to get it back, their customer support will become inaccessible.

All of a sudden, their numbers would either stop responding or become unavailable.

Still, they might remain accessible to convince you to invest further. Also, they might begin by making a few excuses regarding your payment.

However, in the end, customer support won’t resolve your issues and become increasingly unavailable.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

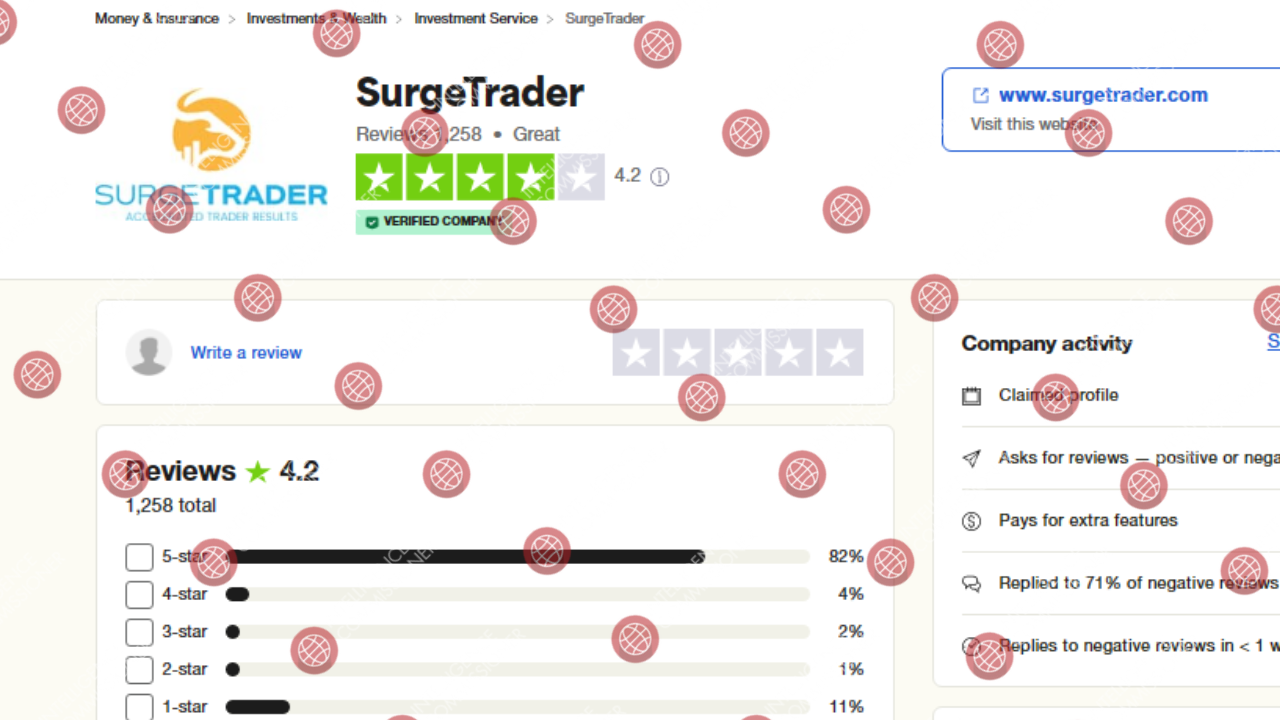

It’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

Scammers like SurgeTrader tend to purchase fake reviews for their online profiles to make themselves seem more credible.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why you shouldn’t trust SurgeTrader reviews easily.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews posted by temporary accounts (profiles that only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

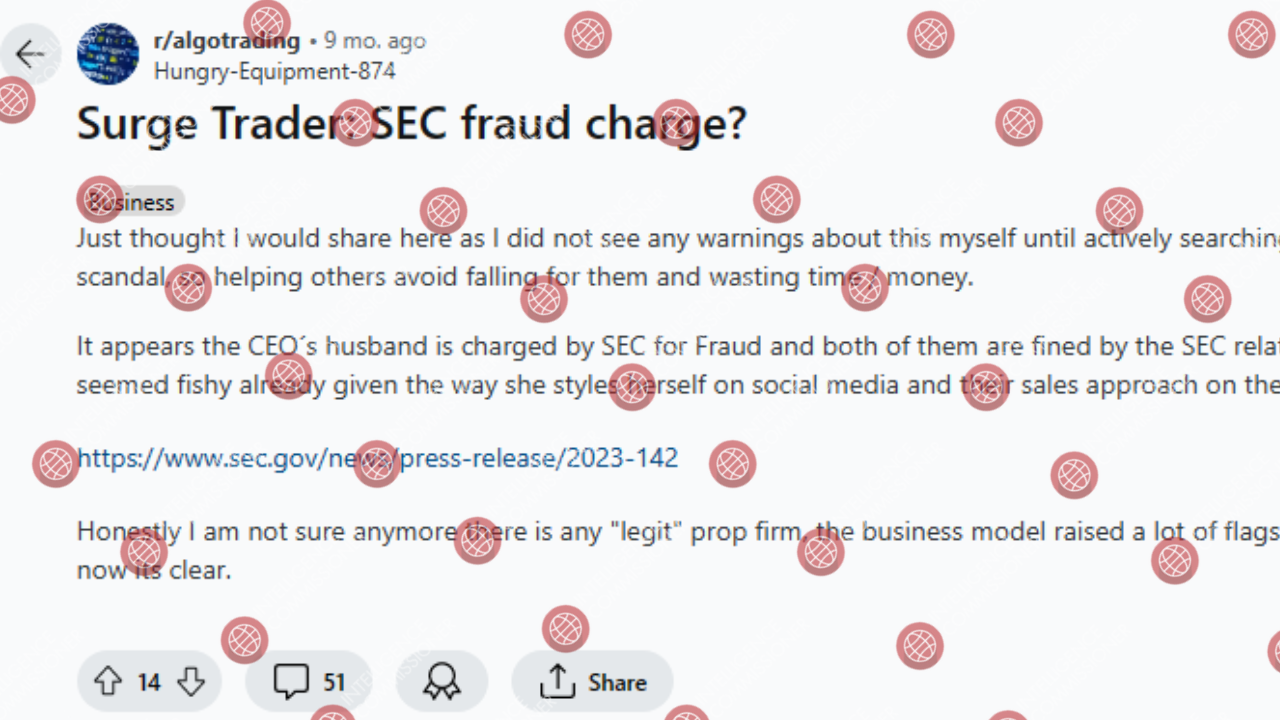

A Reddit post from the r/algotrading subreddit posted about 9 months ago by a user named “Hungry-Equipment-874”. The piece, headlined “Surge Trader: SEC fraud charge?” addresses concerns regarding SurgeTrader, a proprietary trading firm.

The poster claims that they had not seen any warnings concerning SurgeTrader until they began actively searching after the MFF (My Forex Funds) scandal. They state that the CEO’s spouse was charged with fraud by the SEC (United States Securities and Exchange Commission), and that both the CEO and her husband were penalized. The post includes a link to an SEC press release for more information.

The user questions SurgeTrader’s validity, saying that the CEO’s social media presence and sales strategy on the site were dubious. The user finishes by questioning the legality of any proprietary trading company, claiming that the business concept itself raised numerous red flags for them.

The post has generated some participation, as evidenced by 14 upvotes and 51 comments, demonstrating community members’ interest and concern about the topic.

In the case of SurgeTrader, chances are, you wouldn’t find many legitimate reviews.

Another prominent way scammers like SurgeTrader enhance their credibility is by burying negative reviews and complaints under a lot of fake reviews.

This way, when you’ll look up “SurgeTrader reviews”, you might not find many complaints. Or, you might find them buried within numerous reviews praising SurgeTrader.

You should always look out for consumer complaints. In the case of SurgeTrader, the most common complaints I found were about:

- Poor customer support

- Delays in payments

- High fees

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about SurgeTrader? You can share your complaint in the comment section or submit an anonymous tip.

SurgeTrader is an unregulated entity. Although they might fall under the jurisdiction of a watchdog, they don’t have the license to offer financial services to consumers.

The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind SurgeTrader can run away with your money without any prior notice. It would help if you were extremely cautious when dealing with an unregulated service provider.

The absence of a watchdog also means you cannot report to them to anyone.

Also, due to the absence of specific regulations, there is no provision protecting you from the insolvency of this entity. If they go bankrupt, you won’t be able to do anything about it.

Can You Trust SurgeTrader?

SurgeTrader’s demise is the result of a complicated web of regulatory violations, financial wrongdoing, operational difficulties, and poor client service. Match-Trade Technologies’ revocation of its license, combined with the SEC’s fraud allegations against the founder’s husband, severely harmed the firm’s reputation. Furthermore, recurrent financial and operational challenges, as well as a complete breakdown in communication, alienated the company’s users.

These multifarious controversies combined to bring SurgeTrader down, leaving many traders seeking explanation, resolution, and reparation. The aftermath of this shutdown emphasizes the significance of regulatory compliance, financial transparency, and strong customer service in preserving trust and credibility in the trading sector.

All the evidence suggests that SurgeTrader is a scam. If you have lost money to them, there is still a chance you can get it back.

To recover your funds, you’d need to file a chargeback.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.