Funding Pips has been identified as a risky opportunity by Intelligence Commissioner users. It is similar to Tori.fi. We’ve received over 4 complaints against Funding Pips.

Funding Pips, a proprietary trading firm, is currently under investigation for its financial stability, management, and payout processes. CEO Khaled Ayesh is accused of manipulating Trustpilot reviews and intimidating employees. Additionally, regulatory concerns and platform stability are obstacles that the organization encounters. Skepticism regarding its transparency and integrity persists, despite endeavors to enhance operations. It is imperative to confirm the regulatory status of a company prior to making an investment.

Get Your Money Back From These Scammers!

[mychargeback-form]

Funding Pips, a proprietary trading firm, has been embroiled in controversy over its payout processes and overall operations. A company that is grappling with financial stability, transparency, and management practices has emerged, as evidenced by the emergence of numerous critical issues.

The organization’s difficulties are further compounded by allegations against CEO Khaled Ayesh. It has been reported that Ayesh has employed aggressive strategies to suppress negative information about the company, such as intimidating employees with legal action. These allegations of CEO misconduct further damage the company’s reputation by implying a noxious work environment and questionable leadership practices.

Critics have also criticized the organization’s stringent policy regarding payment disputes. Traders who contest payments are at risk of having their accounts suspended and losing eligibility for future accounts with the organization. This rigid posture on disputes has been perceived as an effort to suppress dissatisfied traders and evade the resolution of legitimate concerns.

Additionally, there are apprehensions regarding the financial stability of Funding Pips. The company’s potential financial issues are suggested by reports of unexpected account terminations and delays in payments. The financial concerns, in conjunction with the other controversies, suggest that the firm may be experiencing difficulty in maintaining its operational and financial health.

The lack of regulation or the presence of poor regulation is a huge red flag. It means Funding Pips is a scam and most likely, an illegal operation.

Companies offering investment services or opportunities without having a license can vanish without leaving a trace. Furthermore, the lack of a regulatory license allows them to get away with it and face no legal consequences.

That’s why it’s vital for you to always check a company’s regulation status as well as its license information. The presence of a license allows consumers to reach out to an authority if something goes wrong.

In the case of Funding Pips, victims have nowhere to go due to the absence of a watchdog or license.

You should ask yourself the following questions when you come across a new investment firm or opportunity:

- Does the investment provider maintain transparency about its CEO?

- Do they have a license from a renowned regulatory authority?

- If the need arises, can I reach out to an authority to report this company as a scam?

Traders who have Funding Pips have reported substantial delays in receiving their payouts, which are accompanied by restrictive regulations that appear to be intended to restrict the size of distributions.

Skepticism has been expressed in response to complaints regarding slippage and the firm’s explanation that slippage is caused by “matching orders” and higher batch sizes.

Many traders have been dissatisfied by the payout delays and restrictive conditions, which have raised questions about the company’s dedication to providing fair and expeditious compensation.

In an effort to resolve these concerns, Funding Pips implemented Rise as a new payout processor with the objective of enhancing efficiency.

In this system, transactions that are less than $500 are processed using cryptocurrency, while those that are more than $500 are processed using the Rise platform, which supports both bank transfers and cryptocurrency transactions. The compensation issues persist, despite these efforts, which raises concerns about the efficacy of these modifications.

The developer of the MT4 and MT5 trading platforms, suspended services to Funding Pips as a result of the firm’s active U.S. accounts, resulting in a significant operational disruption. This resulted in the temporary cessation of services and the termination of their partnership with BlackBull Markets.

In order to alleviate the effect, Funding Pips has transitioned to the Match-Trader platform and is currently in the process of integrating additional platforms, including TradeLocker and cTrader.

Nevertheless, the transition to TradeLocker was further disrupted by a DDoS attack. The firm’s vulnerability to operational setbacks and its ongoing struggles with platform stability were underscored by the incident, even though Funding Pips claimed culpability for the situation and promised to rectify the impacted accounts.

However, it’s worth noting that many scammers disable their payment channels before shutting down their operations.

They might give you multiple reasons including:

- A technical error

- A glitch in their system

- Banking issues

- A “hacking attack”

And many others.

But in 9/10 cases, the scammers stop making payments and keep the money to themselves. Hence, the payment methods we discussed here might not work.

If you want to get your money back from a scammer, you’d need to file a chargeback.

When it comes to scammers, you should only measure the quality of their customer service if they respond to your complaint.

In the beginning, scammers tend to remain very accessible.

This means their representatives will keep calling you until you invest with them. Furthermore, they will act friendly and make it seem as if you’re one of their most valuable consumers.

However, they do all this just to win your trust.

Scammers understand that to convince someone to give them a large sum, they will need to seem like a friend.

Nevertheless, when you have invested a considerable amount of money and need to get it back, their customer support will become inaccessible.

All of a sudden, their numbers would either stop responding or become unavailable.

Still, they might remain accessible to convince you to invest further. Also, they might begin by making a few excuses regarding your payment.

However, in the end, customer support won’t resolve your issues and become increasingly unavailable.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

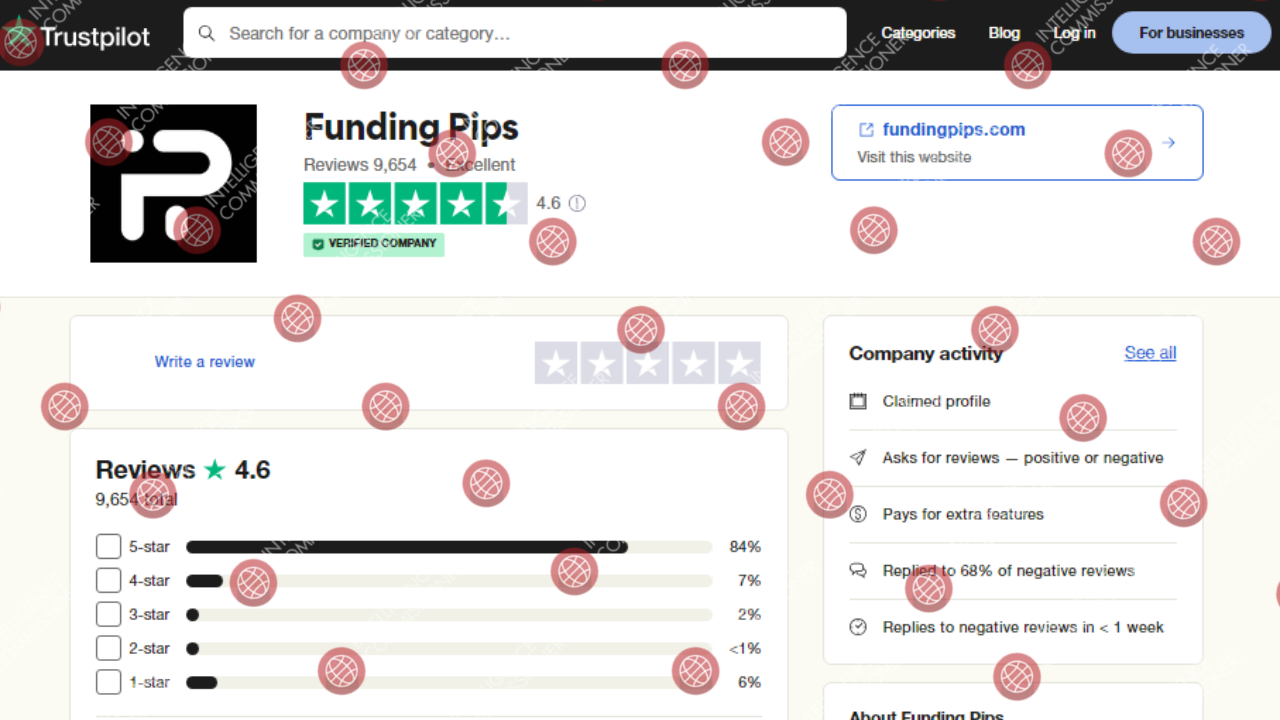

It’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

The allegation of manipulating Trustpilot evaluations is one of the significant controversies surrounding Funding Pips. The firm has been accused of posting fabricated five-star evaluations in order to obscure negative feedback. The unexpected influx of positive reviews has sparked concerns regarding the authenticity of the reviews, implying a coordinated effort to deceive potential customers.

Scammers like Funding Pips tend to purchase fake reviews for their online profiles to make themselves seem more credible.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why you shouldn’t trust Funding Pips reviews easily.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews posted by temporary accounts (profiles that only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of Funding Pips, chances are, you wouldn’t find many legitimate reviews.

Another prominent way scammers like Funding Pips enhance their credibility is by burying negative reviews and complaints under a lot of fake reviews.

This way, when you’ll look up “Funding Pips reviews”, you might not find many complaints. Or, you might find them buried within numerous reviews praising Funding Pips.

You should always look out for consumer complaints. In the case of Funding Pips, the most common complaints I found were about:

- Poor customer support

- Delays in payments

- High fees

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about Funding Pips? You can share your complaint in the comment section or submit an anonymous tip.

The controversies surrounding Funding Pips shed light on substantial deficiencies in its operational stability, management practices, and payout processes. The firm’s reputation was tarnished by allegations of CEO misconduct and phony reviews, as well as payout delays and financial instability. Despite Funding Pips’ efforts to resolve some of these issues, including the integration of new payout systems and the migration to alternative trading platforms, the efficacy of these measures is uncertain.

Funding Pips is an unregulated entity. Although they might fall under the jurisdiction of a watchdog, they don’t have the license to offer financial services to consumers.

The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind Funding Pips can run away with your money without any prior notice. It would help if you were extremely cautious when dealing with an unregulated service provider.

The absence of a watchdog also means you cannot report to them to anyone.

Also, due to the absence of specific regulations, there is no provision protecting you from the insolvency of this entity. If they go bankrupt, you won’t be able to do anything about it.

Can You Trust Funding Pips?

All the evidence suggests that Funding Pips is a scam. If you have lost money to them, there is still a chance you can get it back.

To recover your funds, you’d need to file a chargeback.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.