ABC Holdings has been identified as a risky opportunity by Intelligence Commissioner users. It is similar to Nordea Partners. We’ve received over 6 complaints against ABC Holdings.

ABC Holdings shows warning signals of a potential scam, including a lack of critical ownership information and the use of many domain names. The affiliation with the dubious Arkbit Capital Holdings, which has previously been tied to a Ponzi scheme, raises worries. Victims have difficulty reporting or retrieving monies because they lack regulatory authorization. The lack of retailable merchandise, poor customer service, and frequent complaints highlight the importance of vigilance. Before engaging, potential investors should consider the company’s openness, regulatory status, and customer ratings. ABC Holdings may follow the Ponzi scheme model, crumbling when new investments decline. If you have been the victim of a scam, file a chargeback to recover your funds.

Get Your Money Back From These Scammers!

[mychargeback-form]

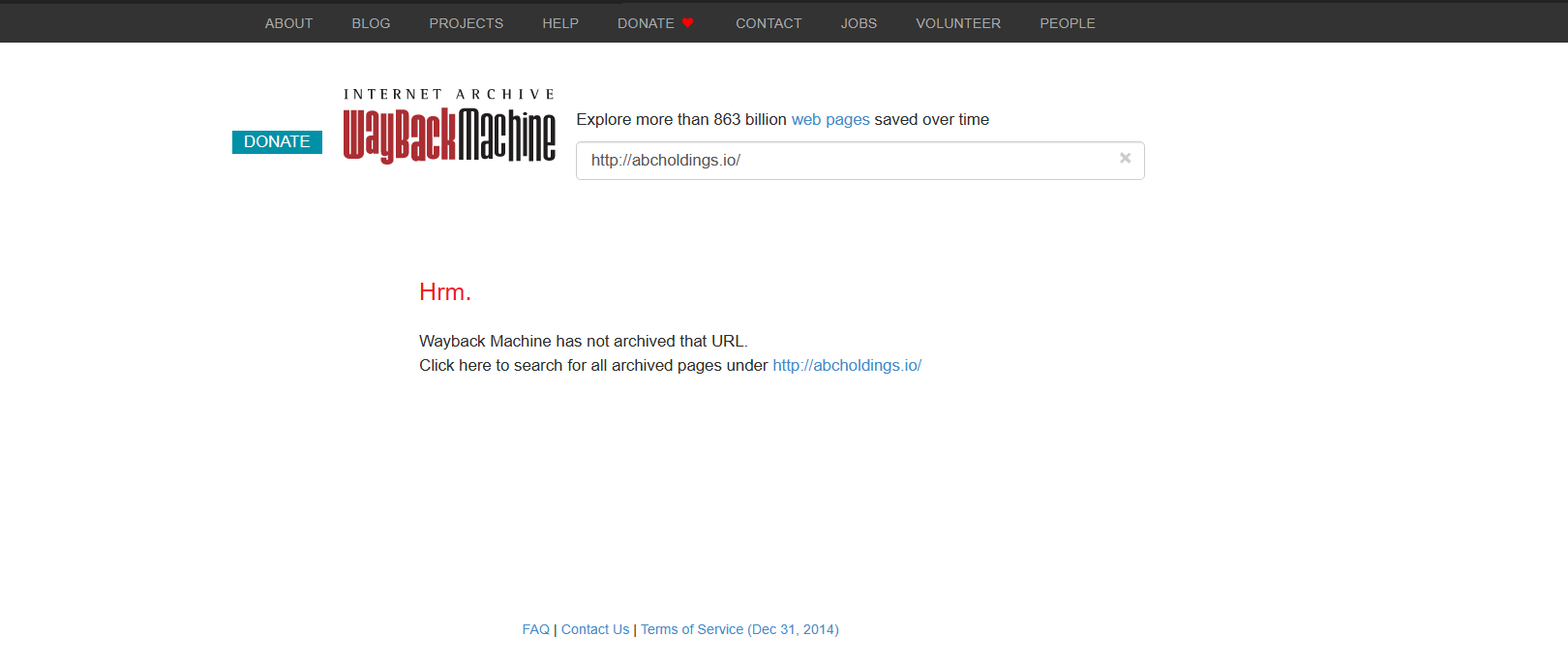

ABC Holdings’ official website is missing important information about ownership and executive positions. The corporation uses two domain names: abcholdings.io, which was privately registered on September 28th, 2023, abcmining.me, which was registered on October 27th, 2023, and abcai.me, which was registered on October 29th, 2023. Notably, both websites mention “Arkbit Capital Holdings.”

Arkbit Capital, a multi-level marketing (MLM) crypto Ponzi scheme started in late 2022, was run by Boris CEO “Thomas Brewer.” Interestingly, Brewer was portrayed by US actor Mike Wolfe, whose image is prominently displayed on ABC Holdings’ website, “abcmining.me.” Despite this, Wolfe’s role in ABC Holdings’ promotion beyond the posted photo remains unknown.

The lack of regulation or the presence of poor regulation is a huge red flag. It means ABC Holdings is a scam and most likely, an illegal operation.

Companies offering investment services or opportunities without having a license can vanish without leaving a trace. Furthermore, the lack of a regulatory license allows them to get away with it and face no legal consequences.

That’s why it’s vital for you to always check a company’s regulation status as well as its license information. The presence of a license allows consumers to reach out to an authority if something goes wrong.

In the case of ABC Holdings, victims have nowhere to go due to the absence of a watchdog or license.

You should ask yourself the following questions when you come across a new investment firm or opportunity:

- Does the investment provider maintain transparency about its CEO?

- Do they have a license from a renowned regulatory authority?

- If the need arises, can I reach out to an authority to report this company as a scam?

ABC Holdings stands apart due to its lack of retailable items or services. Affiliates are restricted to marketing the company’s affiliate membership as their sole marketable product.

ABC Holdings’ compensation scheme incorporates affiliates investing in cryptocurrencies. The promise of a passive return is organized as follows:

| Plan | Investment Range | Daily Return |

|---|---|---|

| Novice | $50 to $4,999 | 1.6% |

| Plus | $5,000 to $9,999 | 1.9% |

| Proficient | $10,000 to $24,999 | 2.2% |

| Supreme | $25,000 to $49,999 | 2.5% |

ABC Holdings provides a 6% commission on bitcoin investments made by personally recruited affiliates.

Residual commissions are distributed via a binary compensation mechanism. Affiliates are located at the top of a binary team, which is separated into two sides (left and right). The binary team progresses through levels, with each level accommodating twice as many roles as the preceding level. Affiliates receive 10% of the new investment volume from their weaker binary team.

Becoming an ABC Holdings affiliate is free, but active involvement in the earning opportunity requires a minimum commitment of $50.

However, it’s worth noting that many scammers disable their payment channels before shutting down their operations.

They might give you multiple reasons including:

- A technical error

- A glitch in their system

- Banking issues

- A “hacking attack”

And many others.

But in 9/10 cases, the scammers actually stop making payments and keep the money to themselves. Hence, the payment methods we discussed here might not work.

If you want to get your money back from a scammer, you’d need to file a chargeback.

When it comes to scammers, you should only measure the quality of their customer service if they respond to your complaint.

In the beginning, scammers tend to remain very accessible.

This means their representatives will keep calling you until you invest with them. Furthermore, they will act friendly and make it seem as if you’re one of their most valuable consumers.

However, they do all this just to win your trust.

Scammers understand that in order to convince someone to give them a large sum, they will need to seem like a friend.

Nevertheless, when you have invested a considerable amount of money and need to get it back, their customer support will become inaccessible.

All of a sudden, their numbers would either stop responding or become unavailable.

Still, they might remain accessible to convince you to invest further. Also, they might begin by making a few excuses regarding your payment.

However, in the end, the customer support won’t resolve your issues and become increasingly unavailable.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

It’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

Scammers like ABC Holdings tend to purchase fake reviews for their online profiles to make themselves seem more credible.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why you shouldn’t trust ABC Holdings reviews easily.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews that are posted by temporary accounts (profiles which only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of ABC Holdings, chances are, you wouldn’t find many legitimate reviews.

Another prominent way scammers like ABC Holdings enhance their credibility is by burying negative reviews and complaints under a lot of fake reviews.

This way, when you’ll look up “ABC Holdings reviews”, you might not find many complaints. Or, you might find them buried within numerous reviews praising ABC Holdings.

You should always look out for consumer complaints. In the case of ABC Holdings, the most common complaints I found were about:

- Poor customer support

- Delays in payments

- High fees and charges

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about ABC Holdings? You can share your complaint in the comment section or submit an anonymous tip.

While Arkbit Capital’s Ponzi scam involved manufactured bitcoin mining businesses in Arkansas, the ASD (probably a regulatory authority) dismissed these charges as unfounded.

ABC Holdings appears to be perpetuating a similar Ponzi fraud by claiming to offer fictional energy to Arkbit Capital’s non-existent mining activities via “ARK Energies.” Despite ASD’s debunking of Arkbit Capital’s lack of operations in Arkansas, ABC Holdings continues the ruse.

Without proven commercial operations that generate external revenue, ABC Holdings appears to rely on recycling freshly invested cash to compensate existing investors. As with all MLM Ponzi schemes, new investments will dry up as affiliate recruitment declines. This loss of capital will inevitably result in a collapse when ABC Holdings is unable to sustain returns on investment, repeating the destiny of similar schemes.

ABC Holdings is an unregulated entity. Although they might fall under the jurisdiction of a watchdog, they don’t have the license to offer financial services to consumers.

The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind ABC Holdings can run away with your money without any prior notice. You should be extremely cautious when dealing with an unregulated service provider.

The absence of a watchdog also means you cannot report to them to anyone.

Also, due to the absence of specific regulations, there is no provision protecting you from the insolvency of this entity. If they go bankrupt, you won’t be able to do anything about it.

Can You Trust ABC Holdings?

All the evidence suggests that ABC Holdings is a scam. If you have lost money to them, there is still a chance you can get it back.

To recover your funds, you’d need to file a chargeback.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.