Amana Capital is a major forex broker and has received a lot of praises from Intelligence Commissioner users. They have established themselves as an industry leader.

Amana Capital stands out in the forex broker market for its excellent regulatory structure and wide products. It is regulated by prominent financial regulators such as the FCA, CySEC, and DFSA, ensuring tight control and security. Amana Capital offers a wide choice of trading instruments, including over 50 currency pairs, precious metals, energy assets, and global stock indices. The broker provides competitive spreads, a variety of account kinds, and high-end trading platforms such as MT4 and MT5. Furthermore, it prioritizes trader education and customer service, making it a dependable option for forex traders.

We suggest working with a trustworthy broker with specialized staff, latest tech and most importantly, customer-centric trading conditions. After reviewing 1000+ brokers, we rank the following company as the best:

Amana Capital distinguishes out in the crowded forex broker market due to its impressive portfolio of offerings and strong regulatory framework. Amana Capital, an established broker, has earned a reputation for dependability, comprehensive asset coverage, and customer-centric service. This article digs deeply into Amana Capital’s features, benefits, and regulatory standing, providing a comprehensive knowledge of why it may be a favored alternative for forex traders.

One of the most important considerations when selecting a forex broker is its regulatory standing. Amana Capital excels in this area, as it is regulated by several top-tier financial authorities, including the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Dubai Financial Services Authority (DFSA), Labuan Financial Services Authority (LFSA), and the Financial Services Commission.

This multi-jurisdictional regulation demonstrates a high level of control and security, guaranteeing that client assets are safeguarded and that the broker follows strict operational guidelines. These regulatory authorities are well-known for their stringent regulations, which include frequent audits, the separation of client funds, and adherence to anti-money laundering rules. This compliance structure provides traders with piece of mind, ensuring that their assets are safe.

Checking the regulatory status of a forex broker is essential. However, there are multiple tiers of regulation as well.

Some popular regulatory authorities include FCA and CFTC.

Whether its Amana Capital or another forex broker, it’s best to check if they are regulated by one (or more) of these authorities:

Commodity Futures Trading Commission (CFTC) – United States:

The CFTC is an independent agency of the U.S. government that regulates the futures and options markets. It also oversees the forex market, particularly ensuring the integrity of transactions and protection against fraud and manipulation.

National Futures Association (NFA) – United States:

The NFA is a self-regulatory organization for the U.S. derivatives industry, including on-exchange traded futures, retail off-exchange foreign currency, and OTC derivatives. It ensures that every firm or individual conducting futures and forex business with the public must be registered and must comply with strict standards.

Financial Conduct Authority (FCA) – United Kingdom:

The FCA is a financial regulatory body in the UK that oversees financial markets, including forex. It ensures that financial markets operate with integrity and that consumers are protected.

Australian Securities and Investments Commission (ASIC) – Australia:

ASIC is an independent Australian government body that acts as Australia’s corporate regulator. It oversees financial markets and services, ensuring that financial markets are fair and transparent, and it also regulates forex brokers.

Financial Services Authority (FSA) – Japan:

The FSA in Japan oversees banking, securities, and exchange, as well as insurance sectors to maintain the stability of Japan’s financial system. It regulates forex trading and brokers to ensure the protection of investors.

Swiss Financial Market Supervisory Authority (FINMA) – Switzerland:

FINMA is responsible for financial regulation in Switzerland. It oversees banks, insurance companies, and financial markets, including forex brokers, ensuring they operate within a secure and transparent framework.

Cyprus Securities and Exchange Commission (CySEC) – Cyprus:

CySEC is the financial regulatory authority of Cyprus, which is a popular jurisdiction for forex brokers. It supervises and controls the operation of the Cyprus Stock Exchange and regulates forex brokers to ensure compliance with international standards.

Investment Industry Regulatory Organization of Canada (IIROC) – Canada:

IIROC oversees all investment dealers and trading activities on debt and equity marketplaces in Canada, including the forex market, ensuring that firms adhere to high standards of conduct.

Monetary Authority of Singapore (MAS) – Singapore:

MAS is the central bank and financial regulatory authority of Singapore. It oversees various financial institutions and markets, including forex, ensuring they are well-regulated and stable.

Financial Sector Conduct Authority (FSCA) – South Africa:

The FSCA is responsible for market conduct regulation and supervision of financial institutions in South Africa, including forex brokers, to ensure fair treatment of customers and the integrity of financial markets.

These regulatory bodies play a crucial role in maintaining the integrity of the forex market by enforcing rules and regulations, ensuring transparency, and protecting traders and investors from fraudulent activities.

Checking the regulatory status of brokers like Amana Capital is quite beneficial. It inspires trust in the brand.

Amana Capital provides an excellent selection of tradable instruments that cater to a wide range of trading preferences and tactics. The broker offers access to over 50 currency pairs, including major, minor, and exotic pairs, giving traders sufficient possibilities to profit from global forex market moves. In addition to FX, Amana Capital trades precious metals such as gold and silver, which serve as a hedge against inflation and economic instability. The broker also offers energy assets like crude oil, allowing traders to diversify their portfolios through commodities.

Major global stock indices are available for those who want to speculate on the performance of big market areas. Over 280 US firm shares are available through share CFDs, allowing traders to trade on the price swings of big American corporations without actually owning the stocks. Traders interested in trading actual items and investigating the turbulent but possibly lucrative digital asset market can also choose from a selection of commodity and cryptocurrency CFDs. This wide choice of assets allows traders to diversify their trading activity and successfully manage risk.

Amana Capital’s wide portfolio of tradable instruments distinguishes it from many of its competitors. For forex traders, having access to over 50 currency pairings is a huge advantage. This diverse range includes main pairings such as EUR/USD and GBP/USD, minor pairs such as EUR/GBP, and exotic pairs, which provide unique trading opportunities because to their higher volatility and less frequent trading. The inclusion of precious metals such as gold and silver allows traders to hedge against economic instability and inflation, whilst energy items such as crude oil let traders to position themselves based on global economic conditions and geopolitical events.

The availability of major global stock indexes allows traders to speculate on the overall performance of stock markets around the world, allowing opportunities to profit from market moves without having to select specific stocks. Amana Capital’s offer of over 280 US firm shares via CFDs is particularly notable. This enables traders to engage in stock trading without the difficulties and costs that come with owning the underlying assets. Traders can take long or short positions, profiting from rising and declining markets.

Furthermore, the introduction of commodities and cryptocurrency expands the range of trading opportunities. Commodities such as agricultural items, metals, and energy sources offer diversification opportunities, whereas cryptocurrencies enable access to one of the most dynamic and frequently changing markets. With such a diverse range of tradable assets, traders with varied interests and tactics can discover suitable instruments on Amana Capital’s platform.

Amana Capital offers both the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are well-known for their powerful charting tools, extensive technical analysis capabilities, and user-friendly interfaces. MT4 is particularly popular for FX trading, while MT5 has more advanced capabilities such as a wider choice of asset classes and better execution options. Both platforms provide automated trading via Expert Advisors (EAs), which enables traders to rapidly implement and backtest their methods.

MT4 remains the preferred platform for many forex traders due to its simplicity, dependability, and extensive feature set. It offers powerful charting capabilities, a wide range of technical indicators, and support for automated trading systems. In contrast, MT5 enhances these features. It provides greater periods, a bigger selection of technical indicators, and the opportunity to trade multiple asset classes with a single account. The addition of an economic calendar and extra order types makes MT5 a valuable tool for sophisticated traders.

The versatility and extensive features of MT4 and MT5 ensure that both new and seasoned traders can select a platform that meets their requirements. The ability to deploy automated trading techniques using Expert Advisors (EAs) is very useful because it allows traders to implement their ideas without constant monitoring. This can result in more consistent trading performance and the opportunity to take advantage of market opportunities around the clock.

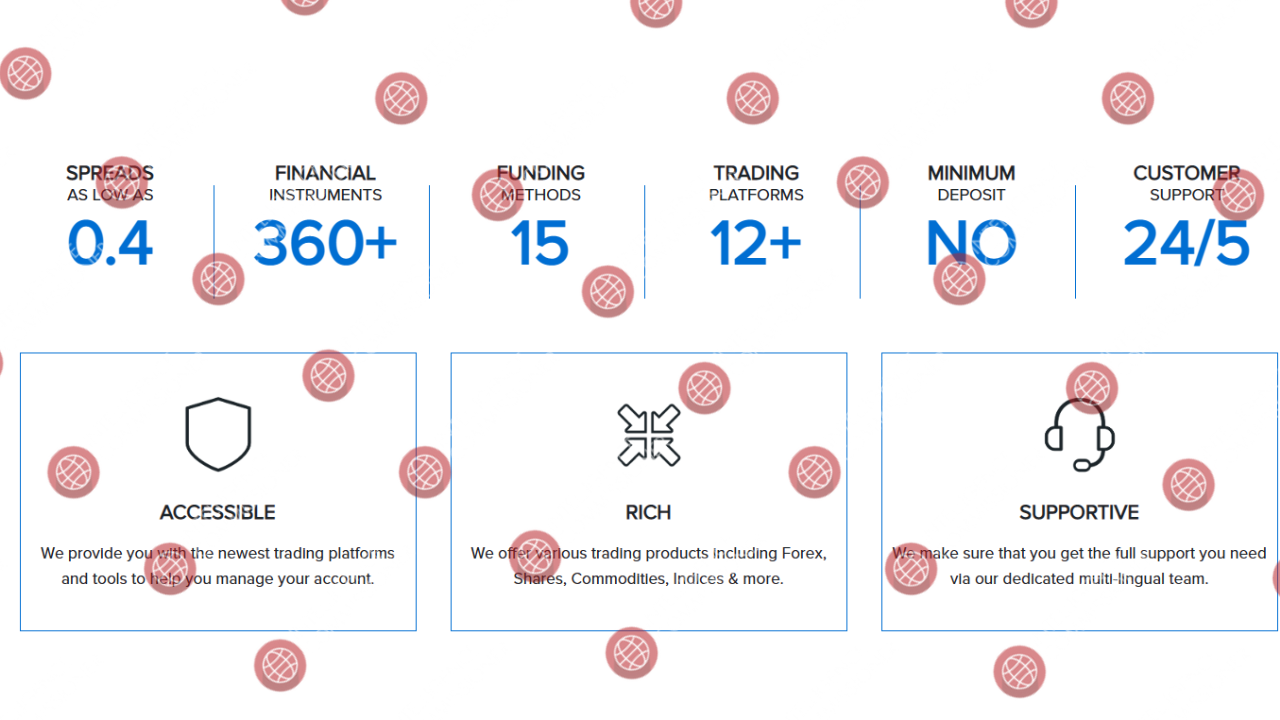

Amana Capital offers competitive trading conditions, with spreads as low as 0.4 pips on some account types. This low-cost trading environment can considerably boost profits, particularly for high-frequency traders. Furthermore, the broker provides a choice of account kinds to meet different trading requirements.

The Amana Classic Account is ideal for retail traders and requires a minimum deposit of $50. The Amana Active Account, geared toward high-volume traders, has a minimum deposit of $25,000. The Amana Shares Account focuses on stock CFD trading and has no minimum deposit. The Amana Elite Account is meant for high-net-worth people and has a minimum deposit of $250,000. The Demo Account allows traders to practice trading without risking their money by using virtual funds.

Amana Capital’s competitive spreads make it an appealing choice for traders trying to reduce trading costs. Tight spreads are especially critical for day traders and scalpers, who rely on little price fluctuations to benefit. Lower trading costs can significantly improve overall profitability, particularly for individuals who trade frequently.

Amana Capital’s diverse account types ensure that traders of all levels can select an account that matches their requirements. The Amana Classic Account is intended for new and retail traders, with a low minimum deposit and attractive trading conditions. The Amana Active Account is ideal for high-volume traders, with tighter spreads and additional capabilities to enable advanced trading methods. The Amana Shares Account is for people interested in trading stock CFDs, whereas the Amana Elite Account offers premium services and the greatest trading conditions for high-net-worth individuals.

The availability of a Demo Account is also a key benefit. This allows new traders to test their skills and become acquainted with the platform without risking real money. It also allows experienced traders to test new methods and improve their trading techniques.

Amana Capital places a high emphasis on trader education, providing numerous resources to help traders enhance their abilities and expertise. These include video lessons with step-by-step instructions on a variety of trading themes, booklets covering fundamental and technical analysis, trading methods, and market insights, and extensive trading manuals to assist traders in navigating all areas of the trading environment. In addition to educational materials, Amana Capital offers trading signals, detailed market data, and an economic calendar. These tools are crucial for making sound trading decisions and keeping up with market developments.

Amana Capital’s educational offerings are intended to support traders of all skill levels. Video tutorials provide visual and interactive learning experiences, making complicated subjects more understandable. Ebooks contain detailed information on various elements of trading, allowing traders to learn at their own pace. Trading guidelines provide practical guidance and insights to help traders establish and improve their trading methods.

Access to trading signals and market analytics offers traders with crucial information that can help them make sound trading decisions. Trading signals can indicate prospective trading opportunities, whilst market analytics provide information on market patterns and conditions. The economic calendar keeps traders up to date on major economic events and announcements that may affect the markets.

Flexible deposit and withdrawal options

Amana Capital accepts a range of deposit and withdrawal methods, such as bank transfers, credit/debit cards, and e-wallets. This flexibility allows traders to choose the most comfortable choice for them. The broker’s low minimum deposit of $50 for ordinary accounts makes it accessible to a diverse range of traders, from novices to pros.

Amana Capital’s range of deposit and withdrawal options guarantees that traders can conveniently fund their accounts and access their funds when necessary. Bank transfers provide a secure and dependable approach for larger transactions, but credit/debit cards are a quick and simple option for lesser amounts. E-wallets offer additional flexibility and are especially handy for international dealers.

Amana Capital’s low minimum deposit of $50 for ordinary accounts makes it accessible to a diverse spectrum of traders. This is especially critical for novices who may not have a lot of money to start with. The opportunity to begin trading with a little investment enables inexperienced traders to gain expertise and confidence without risking a large sum of money.

You should always check the trading conditions of a forex broker.

That’s primarily because they have a direct impact on your potential returns. Moreover, each forex broker such as Amana Capital has distinct trading conditions.

A major part of checking the trading conditions of a broker is to verify their deposit and withdrawal methods.

In the case of Amana Capital withdrawal, you can see that there are multiple options available.

It makes them accessible to traders. Furthermore, it ensures that people can trade freely.

Some major aspects to keep in mind are:

1. Spreads:

- Fixed Spreads: These remain constant regardless of market conditions. They are generally higher than variable spreads but provide predictability in trading costs.

- Variable (Floating) Spreads: These fluctuate based on market volatility and liquidity. They can be lower than fixed spreads during normal market conditions but can widen significantly during high volatility.

2. Leverage:

- Leverage allows traders to control a larger position with a smaller amount of capital. It is expressed as a ratio (e.g., 100:1, 200:1). Higher leverage can amplify both potential profits and potential losses.

3. Margin Requirements:

- Margin is the amount of money required to open a leveraged position. Brokers set margin requirements based on the leverage ratio. For example, with 100:1 leverage, a $1,000 position would require a $10 margin.

4. Minimum Deposit:

- The minimum amount required to open an account varies by broker. Some brokers offer accounts with no minimum deposit, while others may require hundreds or thousands of dollars.

5. Trading Platforms:

- Brokers provide various trading platforms, such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and proprietary platforms. The choice of platform affects the tools, charts, and features available to traders.

6. Execution Methods:

- Market Execution: Orders are executed at the best available price in the market. There may be slippage, especially during high volatility.

- Instant Execution: Orders are executed at the price shown on the platform. If the price changes before execution, the order may be rejected (requote).

Keep in mind that shady forex brokers stop making payments and keep the money to themselves. Hence, you should always check the broker reviews to see if the broker’s payment methods work properly.

We recommend working with a reliable and trusted broker.

Customer service is an important aspect of a reputable forex broker, and Amana Capital excels in this area. The broker provides client help around the clock by email, live chat, and phone. This ensures that traders receive prompt assistance with any concerns or inquiries. The presence of multilingual help improves accessibility for traders from various regions.

The quality and availability of customer service can significantly impact a trader’s experience. Amana Capital’s 24-hour support ensures that traders can obtain help when they need it, whether they have technical issues, account-related queries, or require assistance with their trades. The availability of several support channels, including email, live chat, and phone, allows traders to select the most convenient form of communication.

Multilingual support is also a key advantage because it allows traders from various regions to receive advice in their preferred language. This improves the entire customer experience and allows traders to efficiently engage with the support team.

Good customer service is vital for any trader.

You should always check if a forex broker remains accessible to its customers and whether it offers multiple contact channels or not.

The most popular ways for recent customers are live chat and email.

While email is becoming a bit obsolete, it is still among the most common methods for a customer to contact the support staff of a broker.

In the case of Amana Capital, it’s clear that they offer proper customer support with a significant variety of ways to contact them.

According to multiple users, Amana Capital’s customer support is quite active and responds promptly to general queries and grievances.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

Based on user-submitted reports, most of the Amana Capital reviews are quite positive.

Customers praise the company for its prompt customer service and trader-friendly conditions.

However, it’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

While Amana Capital doesn’t seem like a shady broker, many others rely on fake reviews to increase their credibility.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why we recommend doing extensive research on forex brokers before finalizing your selection.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews posted by temporary accounts (profiles that only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of Amana Capital, however, we noticed that their reviews are legitimate.

Unlike their competitors, it seems Amana Capital has put in a lot of resources into providing its traders with specialized customer service. This way, their customers remain happy and satisfied with their experience.

Also, we didn’t notice many significant Amana Capital complaints. However, if you have any Amana Capitalreviews to share, feel free to contact us or share them in the comment section.

You should always look out for consumer complaints. The most common complaints in forex are usually regarding:

- Poor customer support

- Delays in payments

- High fees

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about Amana Capital? You can share your complaint in the comment section or submit an anonymous tip.

Amana Capital has established itself as a dependable and versatile forex broker, providing a wide selection of tradable assets, innovative trading platforms, competitive spreads, and strong regulatory monitoring. The broker’s dedication to offering educational tools and great client service strengthens its appeal.

Whether you are a newbie wishing to start your trading career or an experienced trader looking for advanced tools and ideal trading conditions, Amana Capital provides a well-rounded package that meets a variety of trading needs.

However, as with any financial decision, traders should conduct their own research and evaluate their specific financial condition and trading objectives before selecting a broker. While Amana Capital has several advantages, individual preferences and needs can differ. A successful trading experience requires a broker that understands your trading strategy and risk tolerance.

Amana Capital is a regulated entity. They are licensed and operate under the watch of a major financial regulator.

So, it’s clear that Amana Capital is a legit forex broker.

You should avoid working with unregulated brokers. The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind the unregulated broker can run away with your money without any prior notice. It would help if you were extremely cautious when dealing with an unregulated service provider.

However, that’s not the case with Amana Capital. It’s clear in our Amana Capital broker review that they are a legitimate entity and enjoy a positive reputation in the market.

Can You Trust Amana Capital?

All the evidence suggests that Amana Capital is legit. However, we recommend checking out more options before finalizing your choice.

That’s why we recommend working with a trusted broker. That way, you can avoid any hiccups and be certain of their reliability.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.