Apex Markets is a major forex broker and has received a lot of praises from Intelligence Commissioner users. They have established themselves as an industry leader.

Apex Markets is a top forex broker known for its secure, dependable, and user-friendly trading platform. It is governed by top-tier authorities such as the FCA, CySEC, and DFSA, which ensures excellent security and transparency. It is a popular choice among traders due to its numerous trading instruments, excellent customer service, and affordable costs.

We suggest working with a trustworthy broker with specialized staff, latest tech and most importantly, customer-centric trading conditions. After reviewing 1000+ brokers, we rank the following company as the best:

Apex Markets has established itself as a major player in the currency trading market. As a broker, it has gained recognition and respect for its dedication to delivering a safe, dependable, and user-friendly trading environment. In this complete study, we will look at the different factors that distinguish Apex Markets, including its regulatory status, investor protection programs, customer assistance, trading instrument selection, and fee structure.

One of the most important considerations when selecting a forex broker is its regulatory status. Apex Markets is overseen by numerous top-tier financial regulators, including the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Dubai Financial Services Authority. This multijurisdictional regulation ensures that Apex Markets meets tough regulatory criteria, providing traders with a high level of security and dependability.

Regulation by such respected bodies gives traders piece of mind by ensuring that their monies are maintained in separate accounts and safeguarded by strong legal frameworks. These requirements also require Apex Markets to undergo regular audits and maintain transparent business processes, thereby increasing company trustworthiness. For example, the FCA is well-known for its stringent regulations, which require brokers to keep enough capital buffers and follow tight reporting criteria. This type of regulation is critical for ensuring that brokers operate fairly and transparently, protecting traders’ interests.

Furthermore, CySEC’s regulatory system includes membership in the Investor Compensation Fund, which offers consumers additional protection in the case of a broker’s collapse. This type of regulatory support is critical for preserving trust in the financial markets, particularly in an industry as fast-paced and volatile as forex trading.

In addition to its strong regulatory framework, Apex Markets provides investor protection schemes that shield traders’ funds in the unlikely case of the broker’s failure. These protection systems, such as the CySEC-regulated Investor Compensation Fund (ICF), ensure that consumers can recover cash up to a specific amount if the broker goes bankrupt.

Such systems are vital for establishing trust with traders because they add an extra layer of security. Traders may focus on their trading methods knowing that their money are protected, rather than worrying about losing capital due to broker insolvency. For example, the ICF compensates insured clients up to €20,000 in the event of a broker’s collapse, which can provide great comfort to small traders who may lack the resources to bear such losses.

Furthermore, Apex Markets’s adherence to European Securities and Markets Authority (ESMA) laws provides clients with increased protections, such as negative balance protection, which assures that traders do not lose more than their original investment. This is an important feature that shields traders from excessive market changes, which could otherwise result in significant losses.

Checking the regulatory status of a forex broker is essential. However, there are multiple tiers of regulation as well.

Some popular regulatory authorities include FCA and CFTC.

Whether its Apex Markets or another forex broker, it’s best to check if they are regulated by one (or more) of these authorities:

Commodity Futures Trading Commission (CFTC) – United States:

The CFTC is an independent agency of the U.S. government that regulates the futures and options markets. It also oversees the forex market, particularly ensuring the integrity of transactions and protection against fraud and manipulation.

National Futures Association (NFA) – United States:

The NFA is a self-regulatory organization for the U.S. derivatives industry, including on-exchange traded futures, retail off-exchange foreign currency, and OTC derivatives. It ensures that every firm or individual conducting futures and forex business with the public must be registered and must comply with strict standards.

Financial Conduct Authority (FCA) – United Kingdom:

The FCA is a financial regulatory body in the UK that oversees financial markets, including forex. It ensures that financial markets operate with integrity and that consumers are protected.

Australian Securities and Investments Commission (ASIC) – Australia:

ASIC is an independent Australian government body that acts as Australia’s corporate regulator. It oversees financial markets and services, ensuring that financial markets are fair and transparent, and it also regulates forex brokers.

Financial Services Authority (FSA) – Japan:

The FSA in Japan oversees banking, securities, and exchange, as well as insurance sectors to maintain the stability of Japan’s financial system. It regulates forex trading and brokers to ensure the protection of investors.

Swiss Financial Market Supervisory Authority (FINMA) – Switzerland:

FINMA is responsible for financial regulation in Switzerland. It oversees banks, insurance companies, and financial markets, including forex brokers, ensuring they operate within a secure and transparent framework.

Cyprus Securities and Exchange Commission (CySEC) – Cyprus:

CySEC is the financial regulatory authority of Cyprus, which is a popular jurisdiction for forex brokers. It supervises and controls the operation of the Cyprus Stock Exchange and regulates forex brokers to ensure compliance with international standards.

Investment Industry Regulatory Organization of Canada (IIROC) – Canada:

IIROC oversees all investment dealers and trading activities on debt and equity marketplaces in Canada, including the forex market, ensuring that firms adhere to high standards of conduct.

Monetary Authority of Singapore (MAS) – Singapore:

MAS is the central bank and financial regulatory authority of Singapore. It oversees various financial institutions and markets, including forex, ensuring they are well-regulated and stable.

Financial Sector Conduct Authority (FSCA) – South Africa:

The FSCA is responsible for market conduct regulation and supervision of financial institutions in South Africa, including forex brokers, to ensure fair treatment of customers and the integrity of financial markets.

These regulatory bodies play a crucial role in maintaining the integrity of the forex market by enforcing rules and regulations, ensuring transparency, and protecting traders and investors from fraudulent activities.

Checking the regulatory status of brokers like Apex Markets is quite beneficial. It inspires trust in the brand.

Apex Markets is well regarded as a legitimate and reliable forex broker. This certification is based on regulatory compliance and excellent assessments from legal and financial specialists. The broker’s legitimacy is further supported by its transparent business practices, which include public publication of financial accounts and regulatory audits.

Traders can be confident that Apex Markets is not a fraud, but rather a legitimate business that prioritizes the safety and security of its clients’ cash. This legitimacy is critical in a business where trust is essential, and many traders fall victim to unscrupulous brokers. For example, Apex Markets’s financial transparency and proactive attitude to resolving client difficulties help to solidify its reputation as a trustworthy broker.

Furthermore, Apex Markets’s commitment to ethical business practices is demonstrated by its open and honest contact with clients. The broker ensures that all marketing materials, including risk disclosures, are accurate and non-misleading. This kind of honesty and integrity is essential for developing long-term client relationships and instilling trust and reliability.

Easy Account Creation

Opening an account with Apex Markets is a simple and user-friendly process. The broker has simplified the account setup process, making it accessible even to beginner traders. This ease of use is especially useful for beginning traders who may find complex account configurations intimidating.

Apex Markets provides a variety of account kinds to meet different trading needs, including ordinary, premium, and professional accounts. Each account type has unique features and perks, allowing traders to select the one that best suits their trading style and experience level. For example, the standard account may be excellent for novices owing to its lower minimum deposit requirements and access to educational tools, whilst the professional account offers narrower spreads and larger leverage, making it more enticing to experienced traders.

The broker’s website and trading platforms are user-friendly, allowing even rookie traders to easily use the system. Account creation normally entails filling out a short online form, presenting required identification documents, and completing a verification process. This streamlined technique shortens the time and effort required to begin trading, allowing traders to concentrate on building their trading strategies.

A Wide Range of Trading Instruments

Apex Markets provides a wide variety of trading instruments, allowing investors to diversify their portfolios and explore new markets. These instruments include currency, equities, commodities, indices, and cryptocurrencies. This variety allows traders to access diverse marketplaces and capitalize on various trading opportunities.

The availability of multiple trading instruments enables traders to apply a variety of trading methods, whether they want to hedge their positions or speculate on price swings. Apex Markets’s extensive portfolio of products serves to both new and experienced traders, offering numerous prospects for growth and profit.

Forex traders, for example, can benefit from the broker’s competitive spreads and wide range of currency pairs, while commodity traders can trade popular products such as gold, silver, and oil. The introduction of cryptocurrencies broadens trading prospects, allowing traders to profit from the volatility and growth potential of digital assets.

Apex Markets’s trading platforms, which include MetaTrader 4 and MetaTrader 5, have extensive charting tools, technical indicators, and automated trading capabilities. These systems give traders the tools they need to understand markets, make transactions quickly, and manage their portfolios effectively. The broker also provides mobile trading apps, allowing traders to monitor and manage their holdings on the road.

Apex Markets’s pricing structure is designed to be open and competitive, appealing to both new and experienced traders. The broker provides various account kinds, each with its own pricing schedule that includes spreads, commissions, and swap rates.

The Amana Pro account charges a $3 commission per side on deals. This commission is cheap when compared to other brokers, making it appealing to high-frequency traders who profit from narrow spreads and low trading expenses. The Pro account is intended for professional traders that want advanced trading conditions and are ready to pay a commission for narrower spreads and faster execution times.

Commissions on equity

Equity trades with Apex Markets incur a 0.1% charge. This price is competitive and guarantees that traders have access to equity markets without suffering excessive fees. The broker’s equities trading platform offers a diverse range of worldwide stocks, allowing traders to diversify their portfolios and capitalize on market movements across industries and locations.

Apex Markets offers spreads starting as 0.0 pips, especially for key currency pairs. These tight spreads benefit traders who want to reduce their trading costs while increasing their earnings. The broker’s competitive spreads make it a tempting option for traders seeking low-cost trading circumstances. The narrow spreads are especially advantageous for scalpers and day traders who execute a high number of deals and rely on little price fluctuations to earn gains.

For bitcoin trading, Apex Markets provides a fee structure that is consistent with industry standards. The broker charges a maker fee of 0.02% and a taker fee of 0.05 percent. These fees are comparable to those of other cryptocurrency exchanges, making Apex Markets an affordable choice for exchanging digital assets. The cheap fees are especially tempting to crypto traders looking to decrease costs while increasing earnings in the highly unpredictable cryptocurrency markets.

You should always check the trading conditions of a forex broker.

That’s primarily because they have a direct impact on your potential returns. Moreover, each forex broker such as Apex Markets has distinct trading conditions.

A major part of checking the trading conditions of a broker is to verify their deposit and withdrawal methods.

In the case of Apex Markets withdrawal, you can see that there are multiple options available.

It makes them accessible to traders. Furthermore, it ensures that people can trade freely.

Some major aspects to keep in mind are:

1. Spreads:

- Fixed Spreads: These remain constant regardless of market conditions. They are generally higher than variable spreads but provide predictability in trading costs.

- Variable (Floating) Spreads: These fluctuate based on market volatility and liquidity. They can be lower than fixed spreads during normal market conditions but can widen significantly during high volatility.

2. Leverage:

- Leverage allows traders to control a larger position with a smaller amount of capital. It is expressed as a ratio (e.g., 100:1, 200:1). Higher leverage can amplify both potential profits and potential losses.

3. Margin Requirements:

- Margin is the amount of money required to open a leveraged position. Brokers set margin requirements based on the leverage ratio. For example, with 100:1 leverage, a $1,000 position would require a $10 margin.

4. Minimum Deposit:

- The minimum amount required to open an account varies by broker. Some brokers offer accounts with no minimum deposit, while others may require hundreds or thousands of dollars.

5. Trading Platforms:

- Brokers provide various trading platforms, such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and proprietary platforms. The choice of platform affects the tools, charts, and features available to traders.

6. Execution Methods:

- Market Execution: Orders are executed at the best available price in the market. There may be slippage, especially during high volatility.

- Instant Execution: Orders are executed at the price shown on the platform. If the price changes before execution, the order may be rejected (requote).

Keep in mind that shady forex brokers stop making payments and keep the money to themselves. Hence, you should always check the broker reviews to see if the broker’s payment methods work properly.

We recommend working with a reliable and trusted broker.

Apex Markets is known for providing exceptional customer care. The broker offers dedicated client service via a variety of methods, including live chat, email, and phone. This focus to customer service guarantees that traders may get assistance whenever they need it, thereby improving their overall trading experience.

Apex Markets’s support team is well-known for its professionalism and reactivity, resolving traders’ questions and problems quickly and effectively. This kind of support is critical in the fast-paced world of forex trading, where rapid assistance may mean a big difference. For example, during times of extreme market volatility, having access to dependable customer service can assist traders make more informed decisions and manage their positions more successfully.

In addition to standard service channels,Apex Markets provides a comprehensive knowledge base and instructional materials, including as webinars, tutorials, and market analysis. These tools are intended to assist traders improve their abilities and stay current on market trends. By providing complete support and educational tools, Apex Markets enables its clients to trade with confidence and achieve their financial objectives.

Good customer service is vital for any trader.

You should always check if a forex broker remains accessible to its customers and whether it offers multiple contact channels or not.

The most popular ways for recent customers are live chat and email.

While email is becoming a bit obsolete, it is still among the most common methods for a customer to contact the support staff of a broker.

In the case of Apex Markets, it’s clear that they offer proper customer support with a significant variety of ways to contact them.

According to multiple users, Apex Markets’s customer support is quite active and responds promptly to general queries and grievances.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

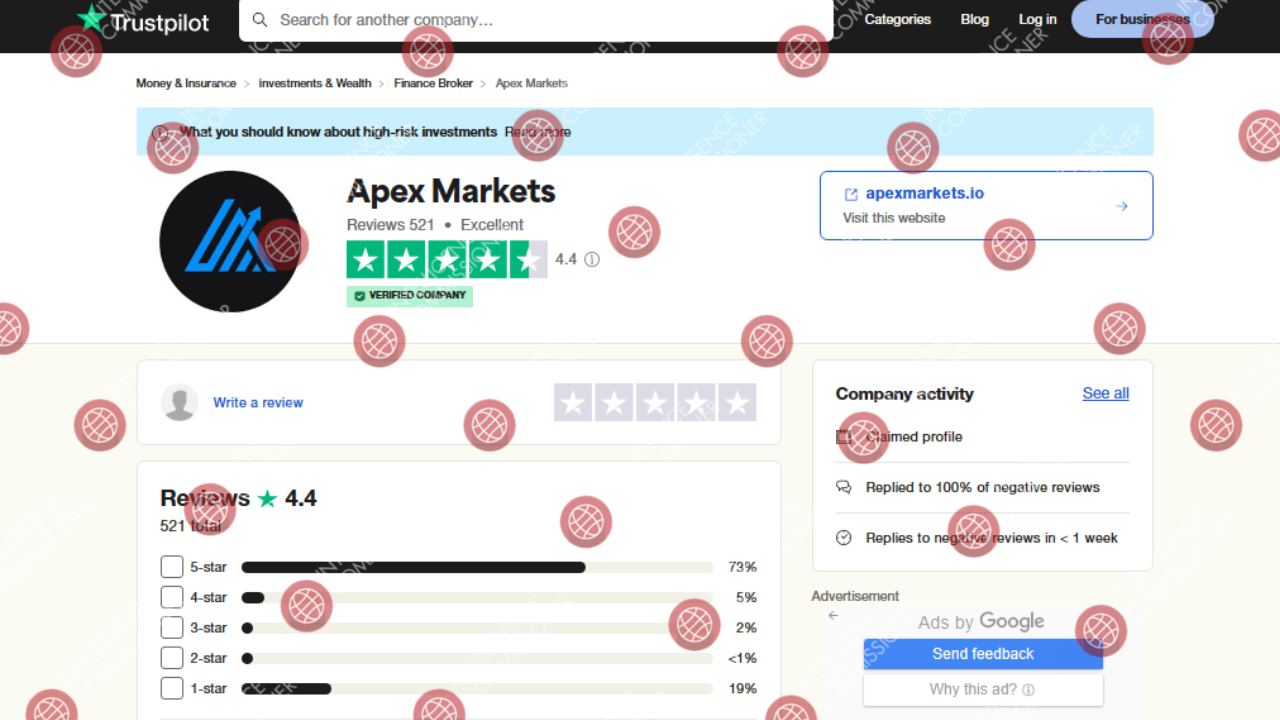

Based on user-submitted reports, most of the Apex Markets reviews are quite positive.

Customers praise the company for its prompt customer service and trader-friendly conditions.

However, it’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

While Apex Markets doesn’t seem like a shady broker, many others rely on fake reviews to increase their credibility.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why we recommend doing extensive research on forex brokers before finalizing your selection.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews posted by temporary accounts (profiles that only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of Apex Markets, however, we noticed that their reviews are legitimate.

Unlike their competitors, it seems Apex Markets has put in a lot of resources into providing its traders with specialized customer service. This way, their customers remain happy and satisfied with their experience.

Also, we didn’t notice many significant Apex Markets complaints. However, if you have any Apex Marketsreviews to share, feel free to contact us or share them in the comment section.

You should always look out for consumer complaints. The most common complaints in forex are usually regarding:

- Poor customer support

- Delays in payments

- High fees

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about Apex Markets? You can share your complaint in the comment section or submit an anonymous tip.

Apex Markets stands out as a trustworthy and user-friendly forex broker with strong regulatory backing, good customer service, and a wide selection of trading options. Its dedication to security, transparency, and client happiness makes it a popular choice among traders of all skill levels.

The broker’s top-tier regulation, investor protection initiatives, and competitive fee structure ensure a safe and cost-effective trading environment. Whether you are a rookie trader trying to enter the forex market or an experienced trader searching for a dependable broker, Apex Markets has the tools and support you need to succeed in your trading.

In essence, Apex Markets’s commitment to regulatory compliance, client service, and competitive trading conditions distinguishes it as a top choice in the forex trading business. Choosing Apex Markets provides traders with a secure, transparent, and supportive trading experience, allowing them to focus on accomplishing their trading objectives.

Additionally, Apex Markets’s continual dedication to innovation and technology keeps it at the forefront of the currency trading market. The broker is constantly updating its trading platforms and tools to match the changing needs of its clients, offering them with the most recent features and functionality. This forward-thinking approach assures traders have access to cutting-edge technology and can capitalize on the most recent market possibilities.

Apex Markets is a regulated entity. They are licensed and operate under the watch of a major financial regulator.

So, it’s clear that Apex Markets is a legit forex broker.

You should avoid working with unregulated brokers. The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind the unregulated broker can run away with your money without any prior notice. It would help if you were extremely cautious when dealing with an unregulated service provider.

However, that’s not the case with Apex Markets. It’s clear in our Apex Markets broker review that they are a legitimate entity and enjoy a positive reputation in the market.

Can You Trust Apex Markets?

All the evidence suggests that Apex Markets is legit. However, we recommend checking out more options before finalizing your choice.

That’s why we recommend working with a trusted broker. That way, you can avoid any hiccups and be certain of their reliability.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.