ARG Personal Loans has been identified as a risky opportunity by Intelligence Commissioner users. It is similar to ARG Finance. We’ve received over 6 complaints against ARG Personal Loans.

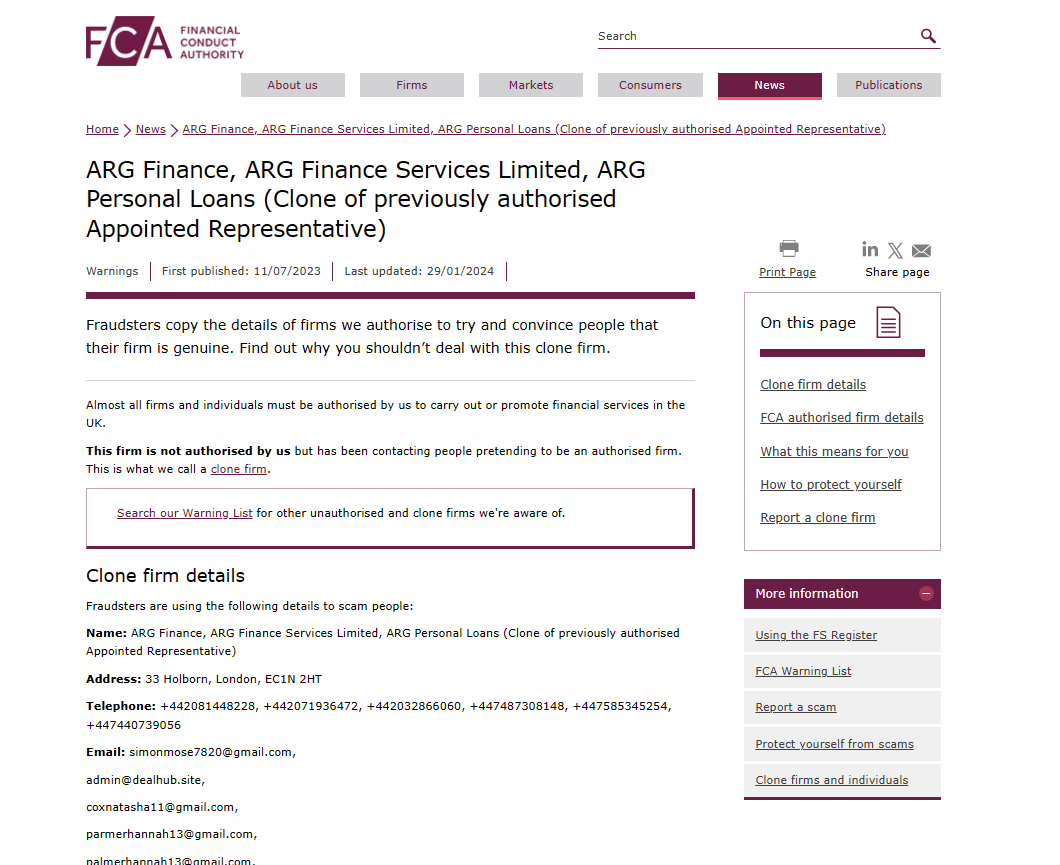

The Financial Conduct Authority in the UK has issued a warning about ARG Personal Loans, citing fraudulent practices and inadequate regulation, classifying it as a high-risk scam. Investors should confirm a company’s regulatory status and licensing to protect themselves from deceptive entities. ARG Personal Loans’ lack of regulation has left individuals with no means of seeking redress, underscoring the significance of conducting thorough research before engaging in financial transactions.

Get Your Money Back From These Scammers!

[mychargeback-form]

The Financial Conduct Authority of the United Kingdom has issued a warning against ARG Personal Loans. The subject of the warning is:

Regarding fraudulent or manipulative practices (insider dealing, market manipulation, misrepresentation of material information, etc.)

The lack of regulation or the presence of poor regulation is a huge red flag. It means ARG Personal Loans is a scam and most likely, an illegal operation.

Companies offering investment services or opportunities without having a license can vanish without leaving a trace. Furthermore, the lack of a regulatory license allows them to get away with it and face no legal consequences.

That’s why it’s vital for you to always check a company’s regulation status as well as its license information. The presence of a license allows consumers to reach out to an authority if something goes wrong.

In the case of ARG Personal Loans, victims have nowhere to go due to the absence of a watchdog or license.

You should ask yourself the following questions when you come across a new investment firm or opportunity:

- Does the investment provider maintain transparency about its CEO?

- Do they have a license from a renowned regulatory authority?

- If the need arises, can I reach out to an authority to report this company as a scam?

However, it’s worth noting that many scammers disable their payment channels before shutting down their operations.

They might give you multiple reasons including:

- A technical error

- A glitch in their system

- Banking issues

- A “hacking attack”

And many others.

But in 9/10 cases, the scammers actually stop making payments and keep the money to themselves. Hence, the payment methods we discussed here might not work.

If you want to get your money back from a scammer, you’d need to file a chargeback.

When it comes to scammers, you should only measure the quality of their customer service if they respond to your complaint.

In the beginning, scammers tend to remain very accessible.

This means their representatives will keep calling you until you invest with them. Furthermore, they will act friendly and make it seem as if you’re one of their most valuable consumers.

However, they do all this just to win your trust.

Scammers understand that in order to convince someone to give them a large sum, they will need to seem like a friend.

Nevertheless, when you have invested a considerable amount of money and need to get it back, their customer support will become inaccessible.

All of a sudden, their numbers would either stop responding or become unavailable.

Still, they might remain accessible to convince you to invest further. Also, they might begin by making a few excuses regarding your payment.

However, in the end, the customer support won’t resolve your issues and become increasingly unavailable.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

It’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

Scammers like ARG Personal Loans tend to purchase fake reviews for their online profiles to make themselves seem more credible.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why you shouldn’t trust ARG Personal Loans reviews easily.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews that are posted by temporary accounts (profiles which only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of ARG Personal Loans, chances are, you wouldn’t find many legitimate reviews.

Another prominent way scammers like ARG Personal Loans enhance their credibility is by burying negative reviews and complaints under a lot of fake reviews.

This way, when you’ll look up “ARG Personal Loans reviews”, you might not find many complaints. Or, you might find them buried within numerous reviews praising ARG Personal Loans.

You should always look out for consumer complaints. In the case of ARG Personal Loans, the most common complaints I found were about:

- Poor customer support

- Delays in payments

- High fees and charges

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about ARG Personal Loans? You can share your complaint in the comment section or submit an anonymous tip.

ARG Personal Loans is an unregulated entity. Although they might fall under the jurisdiction of a watchdog, they don’t have the license to offer financial services to consumers.

The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind ARG Personal Loans can run away with your money without any prior notice. You should be extremely cautious when dealing with an unregulated service provider.

The absence of a watchdog also means you cannot report to them to anyone.

Also, due to the absence of specific regulations, there is no provision protecting you from the insolvency of this entity. If they go bankrupt, you won’t be able to do anything about it.

Can You Trust ARG Personal Loans?

All the evidence suggests that ARG Personal Loans is a scam. If you have lost money to them, there is still a chance you can get it back.

To recover your funds, you’d need to file a chargeback.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.