Birch Gold Group is a significant gold dealer and has received a lot of praises from Intelligence Commissioner users. They have established themselves as an industry leader.

The Birch Gold Group has become a respected leader in investing in precious metals. They provide many goods and services that can help people protect their future finances. Birch Gold Group helps people who want to diversify their retirement portfolios by giving Precious Metals IRAs, a wide range of products, and a strong dedication to customer education.

We suggest working with a trustworthy broker with specialized staff, latest tech and most importantly, customer-centric trading conditions. After reviewing 1000+ brokers, we rank the following company as the best:

Traditional investment portfolios often fail because of financial uncertainty and market volatility. People are looking for steadiness, which has led many to consider other types of investments. Precious metals are one of these that has always been a good way to keep your money safe. Birch Gold Group, which has been around since 2003, has become a star in this field by helping people invest in gold, silver, platinum, and palladium to diversify their retirement savings. This article goes into detail about Birch Gold Group’s services and products, looking at their core values, customer service, and educational goal to give a full picture of how they are changing the future of retirement planning.

Birch Gold Group was started with a clear goal: to give people the tools they need to secure their financial futures by investing in valuable metals. Since its start in 2003, the company has become a trusted name in its field, known for putting the needs of its customers first and being open and honest. Birch Gold Group has been in business for more than 20 years and is known for helping customers understand the ins and outs of investing in precious metals, especially when planning for retirement.

Precious metals are appealing as a part of retirement planning because of their value and ability to last for a long time. Stocks, bonds, and mutual funds can lose or gain a lot of value over time. Precious metals, on the other hand, are real assets that have kept their value for thousands of years. This security is especially appealing to people who are getting close to retirement because it protects them from inflation and economic downturns.

What Birch Gold Group Does and What It Offers

Birch Gold Group’s products are designed to meet the needs of people who want to diversify their retirement investments. The business offers many goods and services that make investing in rare metals easy and available to everyone.

One of the best things that Birch Gold Group has to offer is the Precious Metals IRA, which lets people save for retirement by investing in real precious metals. This new way of doing things is different from standard IRAs, which are usually made up of stocks, bonds, and mutual funds. A Precious Metals IRA can be more stable if it includes physical assets, since these metals often do not follow the rules of standard financial markets.

Setting up a Precious Metals IRA with Birch Gold Group is meant to be easy and smooth for the customer. The business helps people move their old retirement savings into a self-directed IRA that can hold gold, silver, platinum, and palladium in physical form. Birch Gold Group also gives clients ongoing support and advice to make sure they are making smart choices that will help them reach their financial goals.

As long as the economy is uncertain, rare metals will likely become more popular as a safe and stable investment. Investors who want to protect their money with valuable metals will continue to trust Birch Gold Group because they are committed to openness, doing business in an honest way, and providing personalized customer service. Birch Gold Group has the tools, advice, and support you need to make smart financial choices, no matter how much experience you have as an investor or how new you are to precious metals.

These regulatory bodies play a crucial role in maintaining the integrity of the forex market by enforcing rules and regulations, ensuring transparency, and protecting traders and investors from fraudulent activities.

Checking the regulatory status of brokers like Birch Gold Group is quite beneficial. It inspires trust in the brand.

There are fees associated with investing in a Precious Metals IRA through Birch Gold Group. These fees are made clear and are thought to be fair in the industry. There are fees like $50 to open an account and $30 for wire payments. The physical assets are also kept safe and managed by paying yearly fees. These include a $100 fee for storage and insurance and a $125 management fee, for a total of $225 per year.

Notably, this yearly fee stays the same no matter how big or small the account is. This lets clients budget with confidence and avoid costs they didn’t expect. Birch Gold Group also offers to pay the first year’s custodial fees for accounts moved from another standard IRA worth more than $50,000. This is an extra reason for clients to use this way to spread out their assets. Birch Gold Group also sells a lot of different valuable metals, such as gold, silver, platinum, and palladium coins, bars, and rounds, so investors and collectors can find what they’re looking for.

For Birch Gold Group, gold is still the most important thing they sell. The business offers a wide range of gold products, each carefully chosen to meet the specific wants of their customers. These gold coins are some of the most well-known:

- Bullion coins made of American gold eagle

- The American Buffalo Gold Coin

- The gold Maple Leaf coin from Canada

- The Krugerrand is made of gold, and the Florin is made of gold.

- British Gold Coins

Birch Gold Group offers a range of gold bars and rounds, valued primarily based on their melt value. These products come in various sizes, from one ounce to one kilogram, allowing investors to select the format that best aligns with their investment strategy.

Silver is another key offering from Birch Gold Group, known for its affordability and versatility as an investment. The company provides a variety of silver coins and bars, including:

- American Silver Eagle Coins

- British Silver Coins

- Silver Bars and Rounds

With silver products available in multiple forms, they cater to a wide spectrum of investors, whether they are making small investments or looking to diversify a larger portfolio.

For those interested in further diversifying their precious metals portfolio, Birch Gold Group also offers products made from platinum and palladium. Although less common than gold and silver, these metals are valued for their rarity and industrial demand. Some of the available products include:

- U.S. Platinum Eagle Coin

- Australian 1/4-oz Platinum Florin

- Canadian Palm Leaf Coins

- Palladium Rounds and Bars

Similar to gold and silver, these platinum and palladium products come in various sizes, allowing investors to tailor their purchases to their specific needs.

These are the core beliefs that Birch Gold Group lives by and use to make all of their decisions and interactions. Some of these values are empowering customers, educating them, showing understanding, being honest, being ethical, and being efficient.

Birch Gold Group thinks that educating its customers gives them power. The business gives clients a lot of information to help them understand the pros and cons of investing in rare metals. This goal to teach is shown in their personalized consultations, where clients get one-on-one help from committed precious metals experts. These experts aren’t just sellers; they’re also teachers who want to help their clients make smart choices about their financial future.

The company’s website also has many guides and other useful information, such as information about the background of precious metals, how to set up a Precious Metals IRA, and how to avoid common investment scams. Birch Gold Group makes sure that their customers are well-informed and confident in their investment choices by giving them this information.

Birch Gold Group’s way of doing business is based on ethics and empathy. The business knows that investing in rare metals is a big choice for many people, especially those who are getting close to retirement. Their goal is to build long-term relationships with their clients built on trust and respect. Birch Gold Group is known as a reliable partner in the financial services industry because it is dedicated to doing business in an honest way.

Another important thing to Birch Gold Group is being open and honest. The business is honest about how much their services cost, so customers are never caught off guard by secret fees or extra charges. They are also open about how they invest; clients are kept up to date on the state of their accounts and the performance of their investments on a regular basis.

Birch Gold Group also cares a lot about being efficient. To make setting up and keeping a Precious Metals IRA as easy and stress-free as possible, the company has streamlined the process. From the first meeting to managing the account on a regular basis, Birch Gold Group is dedicated to making the whole process easy and quick for their clients.

Goal of Birch Gold Group

One of the main goals of Birch Gold Group is to promote education. The business thinks that clients who are well-informed can make better investment choices, so they go to great steps to give their clients the information and help they need.

Through their website, Birch Gold Group provides many learning tools, such as papers, guides, and videos. These sites talk about a lot of different aspects of investing in precious metals, from the basics of gold and silver to more complex ways to spread out your investments. The company also gives clients monthly updates on changes in the economy and market trends. This helps them stay up to date on things that could affect their investments.

Birch Gold Group has tools on their website, but they also offer one-on-one consultations with their precious metals experts. Clients can ask questions, talk about their financial goals, and get personalized help during these consultations. The experts at Birch Gold Group know all about the complicated ways to deal in precious metals and are dedicated to helping clients find their way through the market.

Adding precious metals to your retirement portfolio can be very helpful, especially when the economy is unclear.

One of the main reasons people buy in precious metals is that they can protect you from inflation. While paper money can lose value over time due to inflation, valuable metals tend to keep their value over time. Because of this, they are a good choice for people who want to keep their money safe over the long run.

Investing in rare metals can also protect you from market volatility, which is another benefit. While the prices of stocks and bonds can change a lot, the prices of rare metals tend to stay the same. This stability can help to balance out the risk in a retirement fund, protecting it from big drops in the stock market.

Precious metals are also worth a lot just because they are precious. Stocks and bonds are claims on future cash flows, but rare metals are real things that have been valued for hundreds of years. Investors feel safe when they buy precious metals because they can be seen and touched. They know that their money is backed by a real object.

How to Invest in Precious Metals in the Future with Birch Gold Group

It is possible that the demand for precious metals as an investment will rise as long as we have economic uncertainty. Birch Gold Group has a wide range of goods and services that can help customers understand how to invest in precious metals, so they are well-equipped to meet this demand.

One of the most important things that Birch Gold Group does to be successful is teach their customers. It will become more and more important to have clear, accurate information as more people look to add valuable metals to their retirement portfolios. Birch Gold Group is ready to stay at the top of this field by giving clients the tools and advice they need to make smart financial choices.

Birch Gold Group may keep adding new and different ways to invest in precious metals to their present products like the ones they already have. This could mean adding new coins, bars, and rounds, as well as other items that meet their customers’ changed wants. By keeping an eye on customer tastes and market trends, Birch Gold Group can make sure they stay ahead of the competition.

The financial markets are always changing, and Birch Gold Group will need to be able to adapt to these changes in order to stay successful. Because Birch Gold Group is flexible and quick to adapt to new rules in the financial industry and changes in the prices of gold and silver, they will be able to keep giving their customers the best service possible.

You should always check the fee structure of a gold dealer.

That’s primarily because they have a direct impact on your potential returns. Moreover, each gold dealer such as Birch Gold Group has distinct trading conditions.

A major part of checking the trading conditions of a broker is to verify their available payment methods.

In the case of Birch Gold Group, you can see that there are multiple options available.

It makes them accessible to traders. Furthermore, it ensures that people can trade freely.

We recommend working with a reliable and trusted broker.

How to Check the Fees of a Gold IRA Company

Navigating the fees of a gold IRA company like Birch Gold Group can seem daunting, but following these simple steps can make it much easier:

1. Visit the Company’s Website

Most gold IRA companies list their fees on their websites, so that’s a great place to start. Look for sections labeled “Fees,” “Pricing,” or “Cost Structure.” For example, Vantage IRA details fees like a $50 setup fee, a $275 annual record-keeping fee, and $75 transaction fees for buying or selling.

2. Request a Fee Schedule

If you can’t find the information online, give the company a call or send them an email asking for a detailed fee schedule. Make sure it covers all the potential costs, including account setup, annual maintenance, storage, transaction, and shipping fees. You can get in touch with Birch Gold Group to learn more about their fee structure.

3. Compare Across Companies

Don’t settle for the first fee schedule you see. Check out multiple gold IRA companies to see how their fees stack up against each other. Some might have lower setup fees but higher annual costs, so it’s important to look at the total picture.

4. Read Customer Reviews

Customer reviews can offer valuable insights into how fair and transparent a company’s fees are. Look for testimonials that specifically mention fees to see what others are saying about their experiences. Checking out Birch Gold Group reviews can be quite helpful. That’s a major reason why we prepared this Birch Gold Group review.

5. Consult Financial Advisors

If you’re feeling uncertain about the fees or how they might affect your investment, talk to a financial advisor who knows the ins and outs of retirement accounts. They can help you understand which fees are reasonable and how they compare to industry norms.

By taking these steps, you can get a clear understanding of the fees associated with a gold IRA company before diving in. This way, you’ll be well-equipped to make informed decisions that align with your financial goals.

Good customer service is vital for any trader.

You should always check if a gold IRA company remains accessible to its customers and whether it offers multiple contact channels or not.

The most popular ways for recent customers are live chat and email.

While email is becoming a bit obsolete, it is still among the most common methods for a customer to contact the support staff of a broker.

In the case of Birch Gold Group, it’s clear that they offer proper customer support with a significant variety of ways to contact them.

According to multiple users, Birch Gold Group’s customer support is quite active and responds promptly to general queries and grievances.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

Birch Gold Group puts a lot of effort into making sure each customer has a unique experience. Each client is paired with a precious metals expert who will be their main point of contact during the whole investment process. This expert works closely with the client to learn about their financial goals and how much risk they are willing to take before giving them personalized help and suggestions.

Birch Gold Group’s one-on-one care is meant to help them build long-term relationships with their customers. The company wants to build trust and make sure customers feel supported throughout their investment journey by giving them personalized service. Many clients like this method, and they like how Birch Gold Group gives them personalized care and expert advice.

The way the valuable metals are handled is an important part of the Birch Gold Group customer experience. The business works with reputable custodians to make sure that clients’ money is kept safely in depositories that are allowed by the IRS. Because these depositories are fully covered, clients can rest easy knowing that their money is safe.

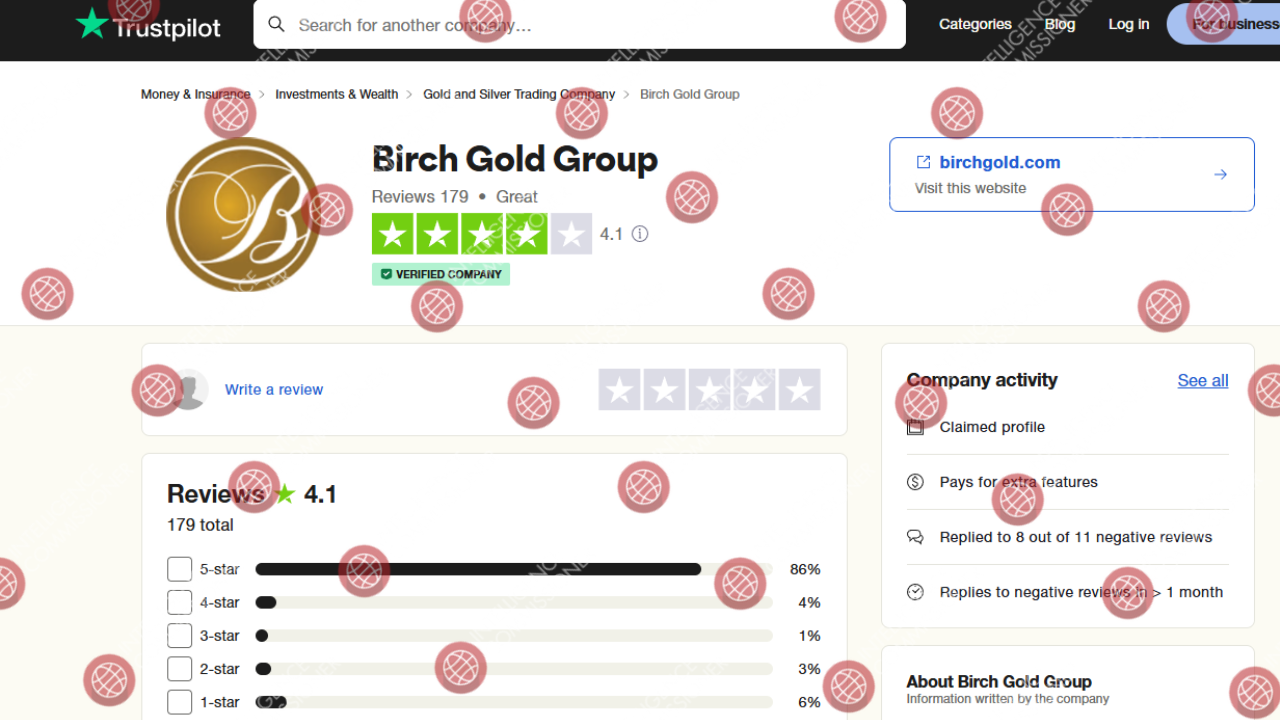

Based on user-submitted reports, most of the Birch Gold Group reviews are quite positive.

Customers praise the company for its prompt customer service and trader-friendly conditions.

However, it’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

While Birch Gold Group doesn’t seem like a shady broker, many others rely on fake reviews to increase their credibility.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why we recommend doing extensive research on forex brokers before finalizing your selection.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews posted by temporary accounts (profiles that only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of Birch Gold Group, however, we noticed that their reviews are legitimate.

Unlike their competitors, it seems Birch Gold Group has put in a lot of resources into providing its traders with specialized customer service. This way, their customers remain happy and satisfied with their experience.

Also, we didn’t notice many significant Birch Gold Group complaints. However, if you have any Birch Gold Group reviews to share, feel free to contact us or share them in the comment section.

You should always look out for consumer complaints. The most common complaints in forex are usually regarding:

- Poor customer support

- Delays in payments

- High fees

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about Birch Gold Group? You can share your complaint in the comment section or submit an anonymous tip.

Birch Gold Group is a regulated entity. They are licensed and operate under the watch of a major financial regulator.

So, it’s clear that Birch Gold Group is a legit gold broker.

You should avoid working with unregulated brokers. The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind the unregulated broker can run away with your money without any prior notice. It would help if you were extremely cautious when dealing with an unregulated service provider.

However, that’s not the case with Birch Gold Group. It’s clear in our Birch Gold Group broker review that they are a legitimate entity and enjoy a positive reputation in the market.

Can You Trust Birch Gold Group?

All the evidence suggests that Birch Gold Group is legit. However, we recommend checking out more options before finalizing your choice.

That’s why we recommend working with a trusted broker. That way, you can avoid any hiccups and be certain of their reliability.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.