Coinfield has been identified as a risky opportunity by Intelligence Commissioner users. It is similar to MTFE. We’ve received over 7 complaints against Coinfield.

The CoinField fraud, a Canadian cryptocurrency exchange that began in January 2018, caused considerable investor losses owing to deceptive activities and regulatory violations. CoinField operated without legal registration, lacked sufficient crypto assets, and deceived investors about withdrawal times. Regulatory organizations such as the Ontario Securities Commission have taken action, yet many users are still unable to reclaim their payments.

Get Your Money Back From These Scammers!

[mychargeback-form]

The CoinField scam, which involved a number of deceptive practices and regulatory infractions, resulted in considerable financial losses for investors. CoinField was a Canadian cryptocurrency exchange that began in January 2018. It positioned itself as a secure and user-friendly platform for exchanging multiple cryptocurrencies. Despite its initial promise, the platform has faced several charges of fraud and regulatory noncompliance.

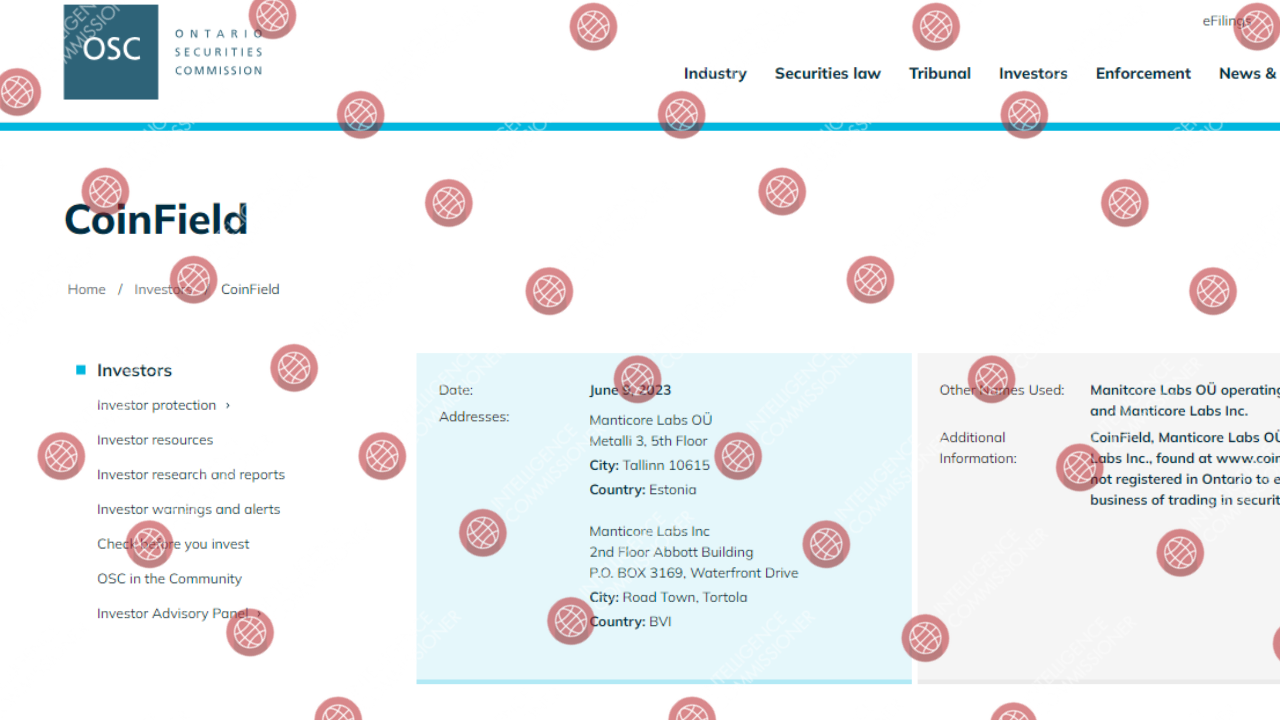

The Ontario Securities Commission (OSC) claimed that CoinField operated without legal registration and failed to follow securities rules. The platform did not have enough crypto assets to meet withdrawal requests, misled investors about the causes for the delays by claiming ongoing audits rather than admitting asset shortages.

Many users experienced substantial delays and outright refusals to execute withdrawal requests. CoinField’s support crew frequently supplied incorrect explanations, citing technical difficulties or withholding periods to hide asset shortages.

CoinField has been accused of participating in a variety of fraudulent actions, including as freezing cash, changing withdrawal restrictions without warning, and offering no customer support. These activities resulted in users being unable to retrieve their payments, with some labeling the situation as a “exit scam”.

The lack of regulation or the presence of poor regulation is a huge red flag. It means Coinfield is a scam and most likely, an illegal operation.

Companies offering investment services or opportunities without having a license can vanish without leaving a trace. Furthermore, the lack of a regulatory license allows them to get away with it and face no legal consequences.

That’s why it’s vital for you to always check a company’s regulation status as well as its license information. The presence of a license allows consumers to reach out to an authority if something goes wrong.

In the case of Coinfield, victims have nowhere to go due to the absence of a watchdog or license.

You should ask yourself the following questions when you come across a new investment firm or opportunity:

- Does the investment provider maintain transparency about its CEO?

- Do they have a license from a renowned regulatory authority?

- If the need arises, can I reach out to an authority to report this company as a scam?

The platform used a variety of fraudulent strategies to entice and deceive investors. These included deceptive promises of high returns, pressure to attract new investors, and the use of forged support emails to steal account information.

The Financial Services Commission of Mauritius issued an investment advisory, stating that CoinField was not licensed to operate and posed a serious danger to customers. Other regulatory organizations have issued similar warnings and recommendations, underlining the platform’s potential risk to investors.

Many customer evaluations and comments describe personal losses and frustrations with CoinField. Users have claimed misplaced cash, poor customer service, and unexpected account suspensions. Some consumers have been able to recover their monies using third-party recovery services, but others have not been so fortunate.

However, it’s worth noting that many scammers disable their payment channels before shutting down their operations.

They might give you multiple reasons including:

- A technical error

- A glitch in their system

- Banking issues

- A “hacking attack”

And many others.

But in 9/10 cases, the scammers stop making payments and keep the money to themselves. Hence, the payment methods we discussed here might not work.

If you want to get your money back from a scammer, you’d need to file a chargeback.

When it comes to scammers, you should only measure the quality of their customer service if they respond to your complaint.

In the beginning, scammers tend to remain very accessible.

This means their representatives will keep calling you until you invest with them. Furthermore, they will act friendly and make it seem as if you’re one of their most valuable consumers.

However, they do all this just to win your trust.

Scammers understand that to convince someone to give them a large sum, they will need to seem like a friend.

Nevertheless, when you have invested a considerable amount of money and need to get it back, their customer support will become inaccessible.

All of a sudden, their numbers would either stop responding or become unavailable.

Still, they might remain accessible to convince you to invest further. Also, they might begin by making a few excuses regarding your payment.

However, in the end, customer support won’t resolve your issues and become increasingly unavailable.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

It’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

Scammers like Coinfield tend to purchase fake reviews for their online profiles to make themselves seem more credible.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why you shouldn’t trust Coinfield reviews easily.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews posted by temporary accounts (profiles that only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of Coinfield, chances are, you wouldn’t find many legitimate reviews.

Another prominent way scammers like Coinfield enhance their credibility is by burying negative reviews and complaints under a lot of fake reviews.

This way, when you’ll look up “Coinfield reviews”, you might not find many complaints. Or, you might find them buried within numerous reviews praising Coinfield.

You should always look out for consumer complaints. In the case of Coinfield, the most common complaints I found were about:

- Poor customer support

- Delays in payments

- High fees

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about Coinfield? You can share your complaint in the comment section or submit an anonymous tip.

The CoinField scam is distinguished by a combination of regulatory noncompliance, fraudulent operations, and deceptive methods that have caused significant financial losses for investors. Regulatory organizations have taken action against the platform, yet many users are still unable to retrieve their money. The CoinField case is a cautionary tale about the dangers of unregulated cryptocurrency exchanges and the significance of conducting due diligence before investing in digital assets.

Coinfield is an unregulated entity. Although they might fall under the jurisdiction of a watchdog, they don’t have the license to offer financial services to consumers.

The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind Coinfield can run away with your money without any prior notice. It would help if you were extremely cautious when dealing with an unregulated service provider.

The absence of a watchdog also means you cannot report to them to anyone.

Also, due to the absence of specific regulations, there is no provision protecting you from the insolvency of this entity. If they go bankrupt, you won’t be able to do anything about it.

Can You Trust Coinfield?

All the evidence suggests that Coinfield is a scam. If you have lost money to them, there is still a chance you can get it back.

To recover your funds, you’d need to file a chargeback.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.