Coins Capital has been identified as a risky opportunity by Intelligence Commissioner users. It is similar to Immediate Momentum. We’ve received over 3 complaints against Coins Capital.

Due to inadequate regulation, St. Vincent & Grenadines-based offshore broker Coins Capital has been criticized for investing dangers. Investor risk is increased by the platform’s lack of guaranteed money, segregated accounts, and negative balance protection. Basic accounts start at $5,000, which is greater than many respectable brokers. The lack of additional functionality on their trading platform limits trading effectiveness compared to MetaTrader and cTrader. The unclear price structure, especially for withdrawals, raises concerns about hidden fees. Given these red signs, investors should be cautious and investigate more transparent and regulated trading options.

Get Your Money Back From These Scammers!

[mychargeback-form]

Coins Capital has garnered attention and scrutiny from members of the currency brokerage community, leading investors to raise concerns regarding the legitimacy and security of their investments on the platform. The objective of this evaluation is to analyze the key elements of Coins Capital, emphasizing noteworthy apprehensions that prospective investors ought to take into account.

Prior to proceeding, it is critical to comprehend that Coins Capital functions as an offshore broker, operating from its headquarters in the jurisdiction of St. Vincent and Grenadines (SVG), which is renowned for its lenient regulatory framework. Due to the minimal oversight such brokers are subject to, this arrangement raises a red flag for investors and substantially increases the risk to their funds.

The lack of regulation or the presence of poor regulation is a huge red flag. It means Coins Capital is a scam and most likely, an illegal operation.

Companies offering investment services or opportunities without having a license can vanish without leaving a trace. Furthermore, the lack of a regulatory license allows them to get away with it and face no legal consequences.

That’s why it’s vital for you to always check a company’s regulation status as well as its license information. The presence of a license allows consumers to reach out to an authority if something goes wrong.

In the case of Coins Capital, victims have nowhere to go due to the absence of a watchdog or license.

You should ask yourself the following questions when you come across a new investment firm or opportunity:

- Does the investment provider maintain transparency about its CEO?

- Do they have a license from a renowned regulatory authority?

- If the need arises, can I reach out to an authority to report this company as a scam?

The trading platform of Coins Capital allegedly lacks a number of sophisticated features that are customary for reputable brokers. Mobile versions, auto trading, and custom indicators are not supported by the platform, which restricts the flexibility and effectiveness of traders.

In contrast to Coins Capital’s platform, MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader provide an extensive array of indicators and functionalities, such as mobile support and automated trading.

Financial and Account Requirements

Coins Capital has an industry-beating minimum deposit requirement of $5,000 for a basic account and as high as $500,000 for a platinum account, which is considerably higher than the norm. This barrier is not justified by the services provided and is impracticable for the average investor.

Coins Capital provides a range of deposit methods, each with its own set of processing times. Deposits made via bank wire are estimated to take 2 to 5 business days, while withdrawals may take up to 5 business days, with no fees stated. Credit card deposits are handled promptly, however withdrawals, like bank wires, might take up to 5 business days and incur undefined fees.

Deposits made using cryptocurrencies are completed within 24 hours, and withdrawals take the same time as other methods, up to 5 business days, with no specific cost information supplied. The lack of clear information about withdrawal costs across all of these ways raises worries about potential hidden charges for investors.

Trading Instruments and Spreads

The broker claims to offer access to a diverse set of trading products. The lack of cryptocurrency trading, paired with undefined spreads for major pairs, raises concerns about the competitiveness and transparency of their offers.

Leverage Options

Coins Capital offers currency leverage of up to 200:1, exceeding the restrictions set by regulators in major financial markets. Such large leverage can considerably raise the danger of loss, underscoring the importance of caution.

However, it’s worth noting that many scammers disable their payment channels before shutting down their operations.

They might give you multiple reasons including:

- A technical error

- A glitch in their system

- Banking issues

- A “hacking attack”

And many others.

But in 9/10 cases, the scammers actually stop making payments and keep the money to themselves. Hence, the payment methods we discussed here might not work.

If you want to get your money back from a scammer, you’d need to file a chargeback.

When it comes to scammers, you should only measure the quality of their customer service if they respond to your complaint.

In the beginning, scammers tend to remain very accessible.

This means their representatives will keep calling you until you invest with them. Furthermore, they will act friendly and make it seem as if you’re one of their most valuable consumers.

However, they do all this just to win your trust.

Scammers understand that in order to convince someone to give them a large sum, they will need to seem like a friend.

Nevertheless, when you have invested a considerable amount of money and need to get it back, their customer support will become inaccessible.

All of a sudden, their numbers would either stop responding or become unavailable.

Still, they might remain accessible to convince you to invest further. Also, they might begin by making a few excuses regarding your payment.

However, in the end, the customer support won’t resolve your issues and become increasingly unavailable.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

It’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

Scammers like Coins Capital tend to purchase fake reviews for their online profiles to make themselves seem more credible.

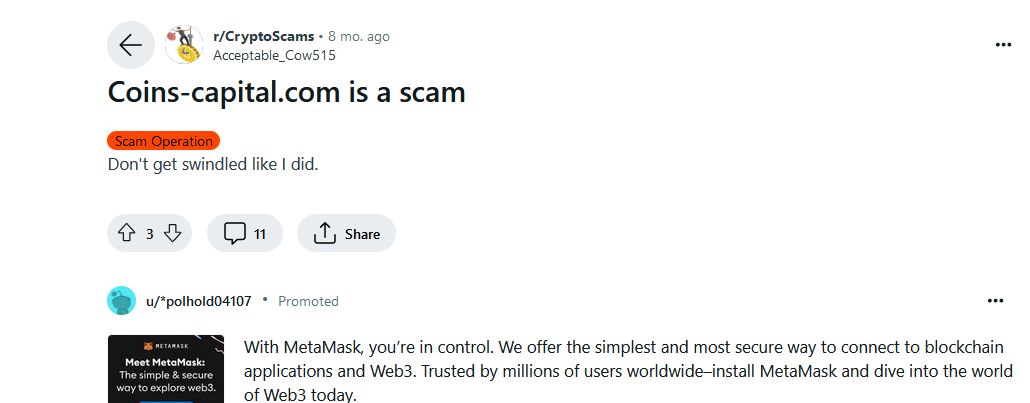

It is claimed in a discussion on Reddit located within a subreddit devoted to cryptocurrency schemes that “CoinsCapital.com is scam.” This discourse likely comprises a multitude of testimonies and evidence from individuals who are certain CoinsCapital.com has engaged in fraudulent or deceitful practices.

These narratives may bring attention to challenges such as withdrawal difficulties, deceptive investment promises, unresponsive customer support in resolving disputes, and recommendations from peers to refrain from investing via the platform.

These collective experiences function as anecdotes that underscore the criticality of conducting thorough research and exercising due diligence prior to making any investment commitments, particularly on platforms such as CoinsCapital.com.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why you shouldn’t trust Coins Capital reviews easily.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews that are posted by temporary accounts (profiles which only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of Coins Capital, chances are, you wouldn’t find many legitimate reviews.

Another prominent way scammers like Coins Capital enhance their credibility is by burying negative reviews and complaints under a lot of fake reviews.

This way, when you’ll look up “Coins Capital reviews”, you might not find many complaints. Or, you might find them buried within numerous reviews praising Coins Capital.

You should always look out for consumer complaints. In the case of Coins Capital, the most common complaints I found were about:

- Poor customer support

- Delays in payments

- High fees and charges

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about Coins Capital? You can share your complaint in the comment section or submit an anonymous tip.

Coins Capital raises multiple red signals that should not be missed by sensible investors. The lack of regulatory control, significant financial barriers, restricted trading platform capabilities, and opaque operating methods all highlight the hazards of investing through the platform.

It is strongly encouraged to use registered and recognized brokers to protect the safety and security of your money.

Coins Capital is an unregulated entity. Although they might fall under the jurisdiction of a watchdog, they don’t have the license to offer financial services to consumers.

The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind Coins Capital can run away with your money without any prior notice. You should be extremely cautious when dealing with an unregulated service provider.

The absence of a watchdog also means you cannot report to them to anyone.

Also, due to the absence of specific regulations, there is no provision protecting you from the insolvency of this entity. If they go bankrupt, you won’t be able to do anything about it.

Can You Trust Coins Capital?

All the evidence suggests that Coins Capital is a scam. If you have lost money to them, there is still a chance you can get it back.

To recover your funds, you’d need to file a chargeback.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.