Etal Dunet has been identified as a risky opportunity by Intelligence Commissioner users. It is similar to Tradeontop. We’ve received over 7 complaints against Etal Dunet.

Etal Dunet promotes as a forex broker but raises several red flags, including a lack of transparency, an unregulated position, and bad client service. The website lacks important information and just accepts cryptocurrency payments. Regulatory noncompliance and associated hidden costs indicate a high risk of scam. Investors should use regulated, transparent brokers to protect their funds.

We suggest working with a trustworthy broker with specialized staff, latest tech and most importantly, customer-centric trading conditions. After reviewing 1000+ brokers, we rank the following company as the best:

Etal Dunet advertises itself as a forex broker, but closer analysis reveals multiple red flags that should alert any potential investor. This review examines many features of Etal Dunet in order to highlight the platform’s possible hazards.

The Etal Dunet website takes visitors directly to a login or registration form, which is rare for a professional broker. A trustworthy broker’s website usually includes thorough information about the organization, its location, and regulatory compliance. However, Etal Dunet lacked transparency. The registration process includes consenting to a User Agreement and Refund Policy, which turn out to be generic agreements that make no mention of the company’s name or jurisdiction, raising suspicions about their legitimacy.

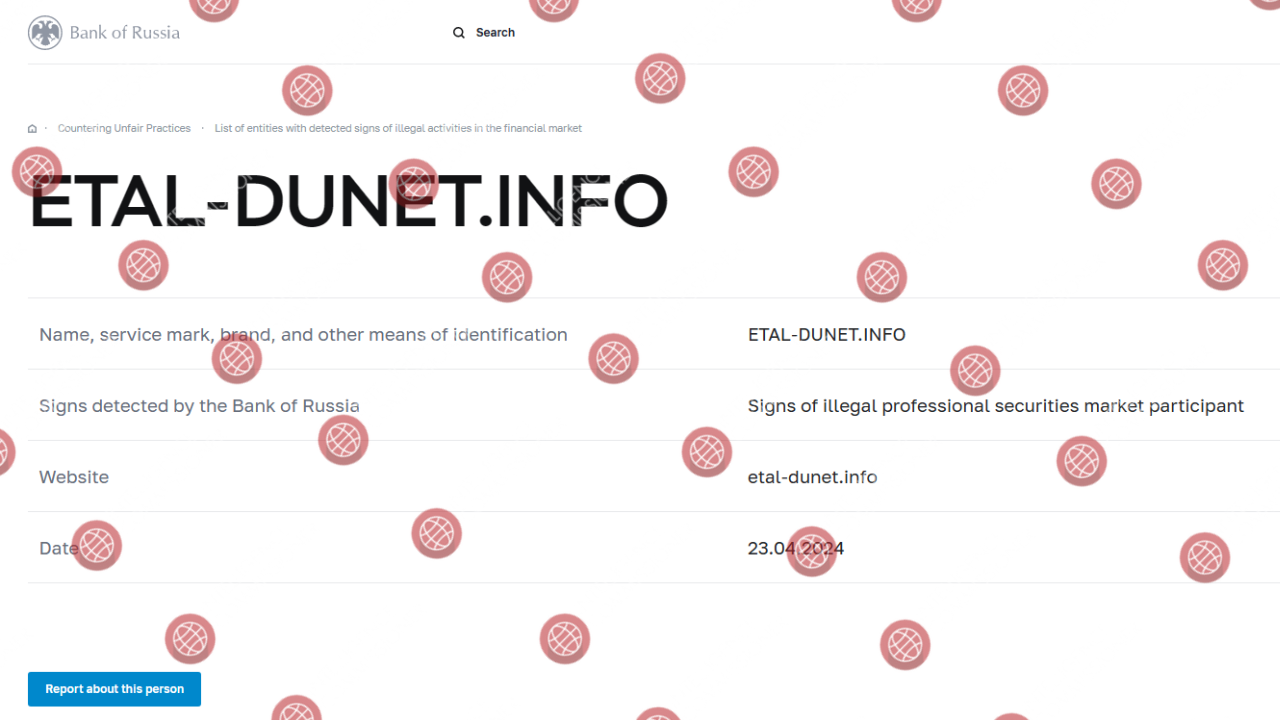

When choosing a forex broker, regulatory compliance is critical. Licensed brokers must follow tight laws and produce legal paperwork to safeguard investors. Unfortunately, Etal Dunet does not match these requirements.

The website is mostly in Russian, and a check with the Bank of Russia shows that Etal Dunet is not a licensed broker. In contrast, brokers authorized by authorities such as the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Commodity Futures Trading Commission (CFTC) in the United States provide strong investor protections.

The lack of regulation or the presence of poor regulation is a huge red flag. It means Etal Dunet might be a scam or most likely, an illegal operation.

Companies offering investment services or opportunities without having a license can vanish without leaving a trace. Furthermore, the lack of a regulatory license allows them to get away with it and face no legal consequences.

That’s why it’s vital for you to always check a company’s regulation status as well as its license information. The presence of a license allows consumers to reach out to an authority if something goes wrong.

In the case of Etal Dunet, victims have nowhere to go due to the absence of a watchdog or license.

You should ask yourself the following questions when you come across a new investment firm or opportunity:

- Does the investment provider maintain transparency about its CEO?

- Do they have a license from a renowned regulatory authority?

- If the need arises, can I reach out to an authority to report this company as a scam?

Etal Dunet provides a standard-looking web trading platform that lacks advanced customisation and capability. This platform is identical to those used by other fraudulent brokers, and it is frequently designed to trick people into believing their money are growing. In contrast, respectable brokers offer a variety of comprehensive trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are noted for their vast features, customization options, and support for automated trading.

The fact that Etal Dunet only accepts cryptocurrency payments raises serious concerns. While cryptocurrencies have several advantages, they are frequently preferred by scammers because to their anonymity and irreversible nature. Legitimate brokers often provide a number of transparent payment methods, such as bank transfers, credit/debit cards, and well-known e-wallets such as PayPal, Skrill, and Neteller, resulting in more safe and traceable transactions.

Etal Dunet claims to trade a variety of items, including currencies, equities, indexes, cryptocurrency, and commodities. However, the broker’s overall lack of transparency and regulatory compliance raises concerns about the legitimacy of these trading possibilities. Established brokers who offer actual access to a wide range of financial instruments benefit investors better.

Etal Dunet promises extremely low spreads, such as 0.1 pips on popular currency pairs, which generally include additional hidden expenses or commissions. Without specific information on trading costs, it is difficult to determine the exact cost of trading on this platform. Furthermore, Etal Dunet provides high leverage of 1:100 across numerous assets, which is substantially larger than what licensed brokers allow for regular clients due to the risk of substantial losses associated with high leverage.

Etal Dunet’s legal documentation does not include explicit withdrawal requirements or restrictions. This lack of transparency is common among fraudulent brokers, who frequently charge high fees and unreasonable trading volume requirements to restrict withdrawals. In contrast, regulated brokers have less restricted withdrawal regulations and offer clear, fair terms.

However, it’s worth noting that many forex scams disable their payment channels before shutting down their operations.

They might give you multiple reasons including:

- A technical error

- A glitch in their system

- Banking issues

- A “hacking attack”

And many others.

But in 9/10 cases, shady forex brokers stop making payments and keep the money to themselves. Hence, the payment methods we discussed here might not work.

To avoid such scenarios, it’s best to work with a reliable and trusted broker.

When it comes to forex brokers, you should only measure the quality of their customer service if they respond to your complaint.

In the beginning, shady brokers tend to remain very accessible.

This means their representatives will keep calling you until you invest with them. Furthermore, they will act friendly and make it seem as if you’re one of their most valuable consumers.

However, they do all this just to win your trust.

Shady brokers understand that to convince someone to give them a large sum, they will need to seem like a friend.

Nevertheless, when you have invested a considerable amount of money and need to get it back, their customer support will become inaccessible.

All of a sudden, their numbers would either stop responding or become unavailable.

Still, they might remain accessible to convince you to invest further. Also, they might begin by making a few excuses regarding your payment.

However, in the end, customer support won’t resolve your issues and become increasingly unavailable.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

It’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

Even if Etal Dunet might not be a scam, brokers like them rely on fake reviews to increase their credibility.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why you shouldn’t trust the online Etal Dunet reviews easily.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews posted by temporary accounts (profiles that only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of Etal Dunet, chances are, you wouldn’t find many legitimate reviews.

Another prominent way brokers like Etal Dunet enhance their credibility is by burying negative reviews and complaints under a lot of fake reviews.

This way, when you’ll look up “Etal Dunet reviews”, you might not find many complaints. Or, you might find them buried within numerous reviews praising Etal Dunet.

You should always look out for consumer complaints. In the case of Etal Dunet, the most common complaints I found were about:

- Poor customer support

- Delays in payments

- High fees

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about Etal Dunet? You can share your complaint in the comment section or submit an anonymous tip.

Etal Dunet touts itself as a forex broker, however several red flags indicate that it is not a trustworthy platform. Potential investors should choose registered brokers who provide transparency, strong investor protections, and consistent trading circumstances.

Etal Dunet is an unregulated entity. Although they might fall under the jurisdiction of a watchdog, they don’t have the license to offer financial services to consumers.

The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind Etal Dunet can run away with your money without any prior notice. It would help if you were extremely cautious when dealing with an unregulated service provider.

The absence of a watchdog also means you cannot report to them to anyone.

Also, due to the absence of specific regulations, there is no provision protecting you from the insolvency of this entity. If they go bankrupt, you won’t be able to do anything about it.

Can You Trust Etal Dunet?

All the evidence suggests that Etal Dunet might be a scam. You shouldn’t risk your funds with a broker you don’t fully trust.

That’s why we recommend working with a trusted broker. That way, you can avoid any hiccups and be certain of

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.