Fidelcrest Prop Firm has been identified as a risky opportunity by Intelligence Commissioner users. It is similar to Puldex.com. We’ve received over 5 complaints against Fidelcrest Prop Firm.

Fidelcrest Prop Firm, an unregulated internet trading platform situated in Saint Vincent and the Grenadines, provides trading services in a variety of asset classes, including FX, commodities, equities, and more. Despite being operational for 2-5 years, its lack of regulatory monitoring raises serious concerns regarding potential fraudulent activity and the security of trader capital. Traders should choose regulated alternatives for improved safety and accountability.

Get Your Money Back From These Scammers!

[mychargeback-form]

Fidelcrest Prop Firm Ltd is an online trading platform that provides trading services for a wide range of asset classes, including forex, commodities, equities, indices, cryptocurrencies, and metals.

The platform, which is based in Saint Vincent and the Grenadines, has been functioning for around 2-5 years. This extensive overview will go over the platform’s services, regulatory concerns, account kinds, trading tools, and more to provide traders a complete picture of what Fidelcrest Prop Firm has to offer.

Fidelcrest Prop Firm is renowned for operating without valid regulation, raising serious issues about its adherence to established industry standards and laws. The lack of regulation might expose traders to potential risks such as fraudulent activity and unethical behaviour.

Prospective traders should exercise cautious and investigate other registered brokers that offer a higher level of security and accountability.

The lack of regulation or the presence of poor regulation is a huge red flag. It means Fidelcrest Prop Firm is a scam and most likely, an illegal operation.

Companies offering investment services or opportunities without having a license can vanish without leaving a trace. Furthermore, the lack of a regulatory license allows them to get away with it and face no legal consequences.

That’s why it’s vital for you to always check a company’s regulation status as well as its license information. The presence of a license allows consumers to reach out to an authority if something goes wrong.

In the case of Fidelcrest Prop Firm, victims have nowhere to go due to the absence of a watchdog or license.

You should ask yourself the following questions when you come across a new investment firm or opportunity:

- Does the investment provider maintain transparency about its CEO?

- Do they have a license from a renowned regulatory authority?

- If the need arises, can I reach out to an authority to report this company as a scam?

Fidelcrest Prop Firm caters to a variety of trader demographics by providing two major account types: MicroFX+ and ProFX+, both available in Normal and Aggressive settings. MicroFX+ accounts are targeted for beginners, with smaller account sizes and a more conservative trading strategy. ProFX+ accounts, on the other hand, are geared toward experienced traders, with larger account sizes and risk tolerances.

- MicroFX+ Account: Ideal for beginners, with account sizes ranging from $5,000 to $20,000. Traders can select either the Normal or Aggressive account type, which affects the profit-sharing ratio and risk thresholds.

- PROFX+ Account: Designed for experienced traders, these accounts range in size from $50,000 to $400,000 and are offered in Normal or Aggressive strategies, which influence profit targets and loss criteria.

Both accounts highlight the necessity of risk management and strategic trading in order to obtain consistent profits.

Fidelcrest Prop Firm supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two renowned platforms known for their extensive trading features, technical analysis tools, and automated trading options. Traders can use these platforms to get real-time market data, execute transactions, and use a variety of trading methods.

Leverage and Trading Conditions

- Maximum Leverage: 1:100 enables traders to greatly increase their purchasing power.

- Spreads and commissions: Trades are commission-free and have competitive spreads starting at 0 pips.

However, it’s worth noting that many scammers disable their payment channels before shutting down their operations.

They might give you multiple reasons including:

- A technical error

- A glitch in their system

- Banking issues

- A “hacking attack”

And many others.

But in 9/10 cases, the scammers stop making payments and keep the money to themselves. Hence, the payment methods we discussed here might not work.

If you want to get your money back from a scammer, you’d need to file a chargeback.

When it comes to scammers, you should only measure the quality of their customer service if they respond to your complaint.

In the beginning, scammers tend to remain very accessible.

This means their representatives will keep calling you until you invest with them. Furthermore, they will act friendly and make it seem as if you’re one of their most valuable consumers.

However, they do all this just to win your trust.

Scammers understand that to convince someone to give them a large sum, they will need to seem like a friend.

Nevertheless, when you have invested a considerable amount of money and need to get it back, their customer support will become inaccessible.

All of a sudden, their numbers would either stop responding or become unavailable.

Still, they might remain accessible to convince you to invest further. Also, they might begin by making a few excuses regarding your payment.

However, in the end, customer support won’t resolve your issues and become increasingly unavailable.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

It’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

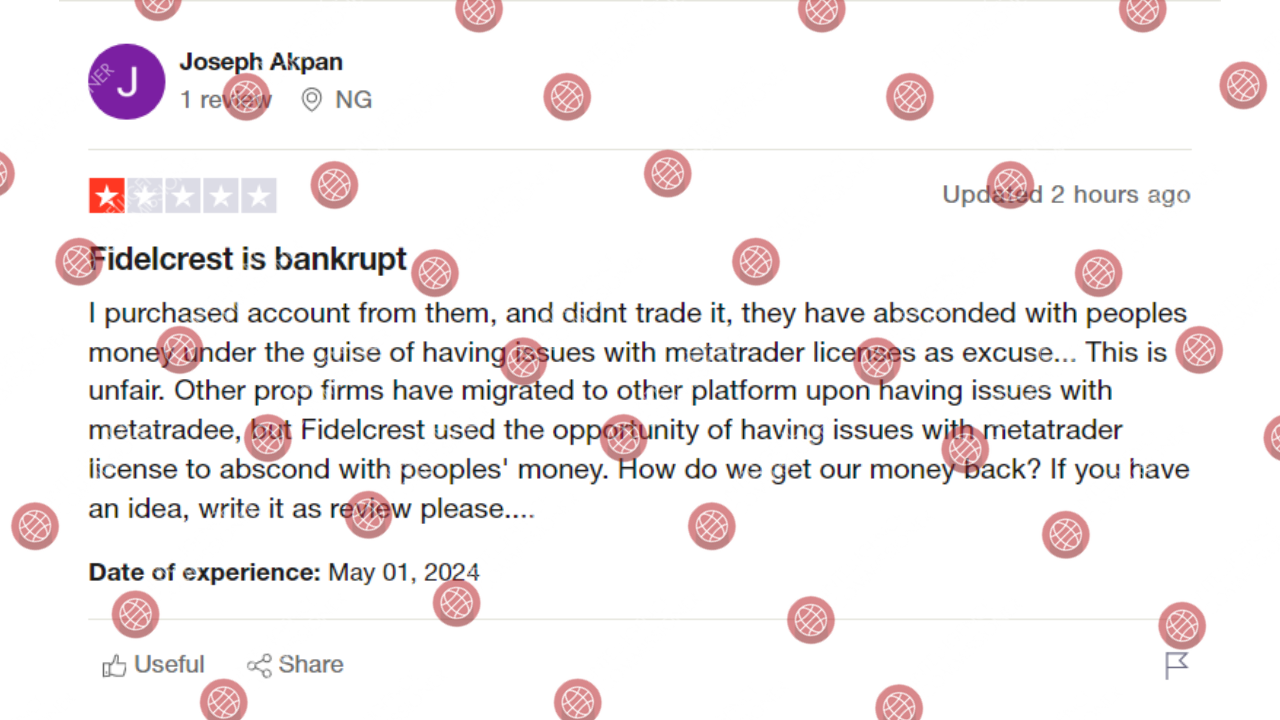

Joseph Akpan’s Trustpilot review conveys his disappointment and concern regarding Fidelcrest. Joseph claims that he bought an account from Fidelcrest but did not trade in it. He accuses the corporation of “absconding with people’s money,” claiming that they cited licensing concerns with Metatrader as a pretext to shut down or become unresponsive.

He contrasts Fidelcrest’s behavior with that of other proprietary enterprises, noting that when confronted with comparable challenges, they have shifted to new platforms rather than ceasing operations.

Joseph’s assessment underlines a sense of unfairness and deception, implying that Fidelcrest took advantage of the circumstance to wrongfully hold onto client monies.

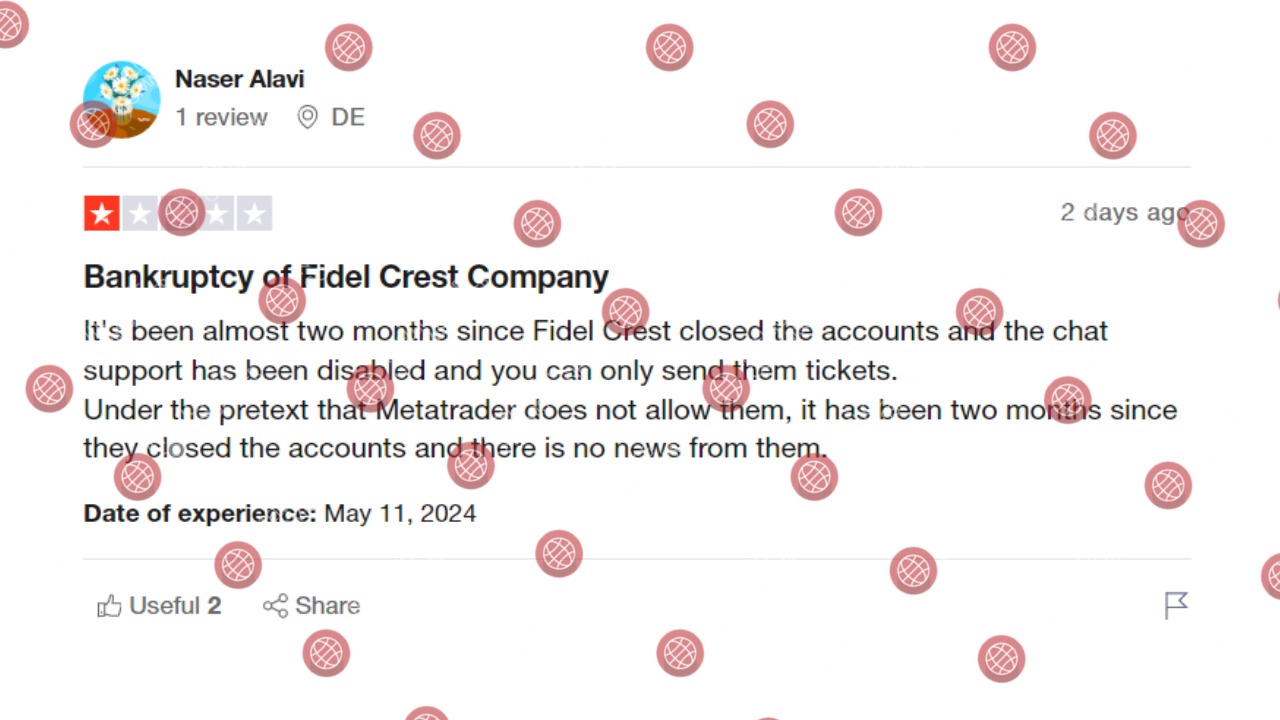

Like the review by Joseph Akpan before it, Naser Alavi’s review on Trustpilot talks about problems with the Fidel Crest Company. Naser says it’s been almost two months since Fidel Crest deleted its users’ accounts and turned off chat, so the only way to talk to them is through support tickets.

The company closed the accounts by saying that MetaTrader does not allow them to do business, which he says is not true. Naser points out that the company hasn’t talked to him or her since the accounts were stopped. He says that they haven’t sent any news or updates in two months.

This review shows that the person writing it is very unhappy with how FidelCrest has handled the situation, especially when it comes to communicating with and being honest with its clients. The reviewer is worried about how quick the company is and how vague its explanations are for what it does.

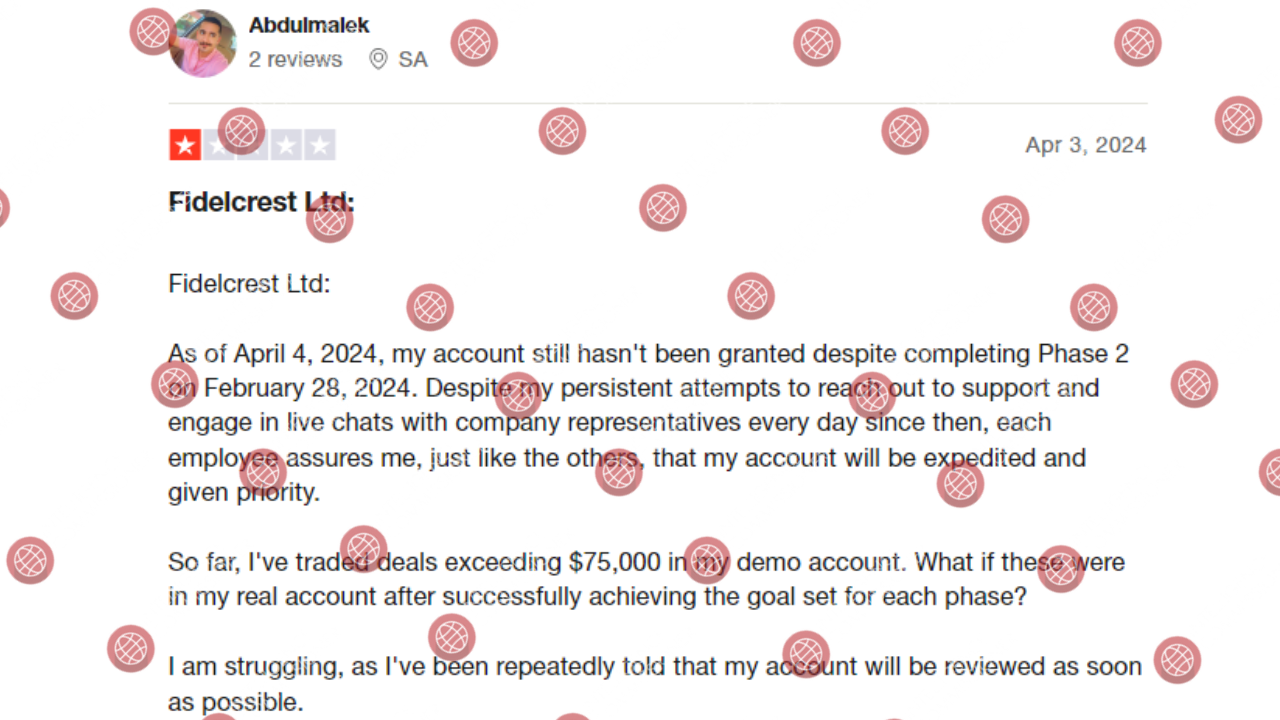

In his Trustpilot review, Abdulmalek talks about his difficult experience with Fidelcrest Ltd. He talks about problems he had getting his account upgraded even though he met certain requirements. Abu Malek says that his account still hasn’t been updated as of April 4, 2024, even though he finished Phase 2 of the process by February 28, 2024. He says he tried to get in touch with the company’s support team every day and had live chats with several people who all told him that his account would be handled quickly and with the utmost care.

Abdulmalek also talks about his trading accomplishments, saying that he has made trades worth more than $75,000 in his demo account. This is important because it shows that he has been successful in trading and met all of his goals for each step. His main worry seems to be the constant delays and lack of a clear date for when the company said his account would be reviewed and possibly upgraded.

His review shows a mix of frustration and sadness that Fidelcrest Ltd. failed to keep their promises. It also shows worry about what might happen to his finances if the success he had on his demo account turned out to be true on his real account.

Jammal Sayahi’s Trustpilot review describes a terrible encounter with Fidelcrest, a proprietary trading firm. Jammal, who describes himself as an honest trader who has had success on previous trading platforms such as FTMO and Funding Pips, opted to test Fidelcrest. He reports successfully completing Phases 1 and 2 of Fidelcrest’s evaluation procedure, with an 80.83% victory percentage and all of his identification documents validated.

However, his experience took a sour turn following the five-day evaluation period. According to Jammal, Fidelcrest failed him by accusing him of breaking their trading regulations and employing an illegal approach. When he asked for more information and clarity on the alleged violations, he was disregarded.

Jammal’s review serves as a cautionary tale, alerting people about his perceived lack of transparency and justice in Fidelcrest’s assessment and decision-making process, and advising potential customers to avoid the company. His experience displays annoyance and discontent, particularly with the lack of communication and rationale supplied by the corporation for their choice.

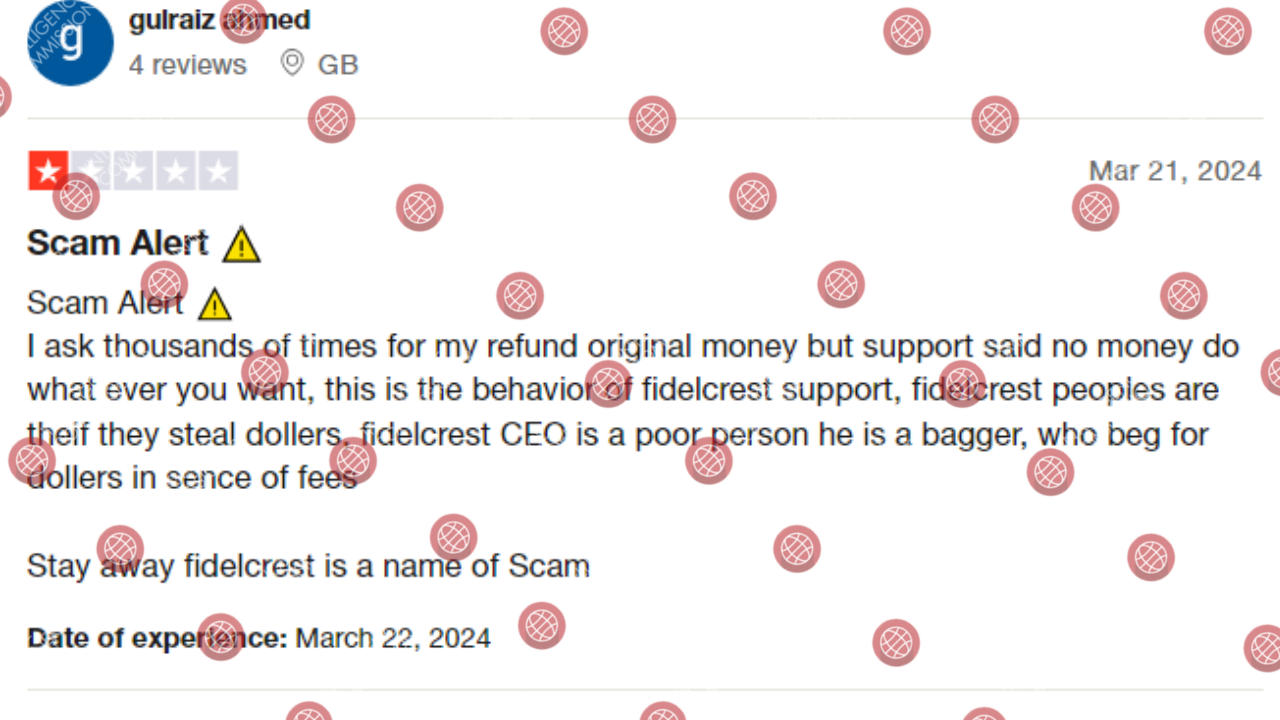

Gulraiz Ahmed’s review on Trustpilot vehemently accuses Fidelcrest of being a scam. He expresses extreme dissatisfaction with the company’s customer support, citing multiple unsuccessful attempts to get a refund of his original investment. According to Gulraiz, the support team repeatedly denied his requests by stating they have no money to refund.

Gulraiz criticizes the overall behavior of the Fidelcrest team, accusing them of theft by calling them “thieves” who “steal dollars.” He also disparages the CEO of Fidelcrest, describing him as someone who “beggars for dollars in sense of fees,” implying that the CEO is dishonestly or desperately soliciting money under the guise of various fees.

His review concludes with a stark warning to others, describing Fidelcrest as synonymous with a scam. Gulraiz’s language and tone reflect significant frustration and anger, underlining a deeply negative experience with the company.

Scammers like Fidelcrest Prop Firm tend to purchase fake reviews for their online profiles to make themselves seem more credible.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why you shouldn’t trust Fidelcrest Prop Firm reviews easily.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews posted by temporary accounts (profiles that only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of Fidelcrest Prop Firm, chances are, you wouldn’t find many legitimate reviews.

Another prominent way scammers like Fidelcrest Prop Firm enhance their credibility is by burying negative reviews and complaints under a lot of fake reviews.

This way, when you’ll look up “Fidelcrest Prop Firm reviews”, you might not find many complaints. Or, you might find them buried within numerous reviews praising Fidelcrest Prop Firm.

You should always look out for consumer complaints. In the case of Fidelcrest Prop Firm, the most common complaints I found were about:

- Poor customer support

- Delays in payments

- High fees

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about Fidelcrest Prop Firm? You can share your complaint in the comment section or submit an anonymous tip.

Fidelcrest Prop Firm provides a platform with a number of trading options and tools, the lack of regulation considerably outweighs these benefits. Traders interested in using Fidelcrest Prop Firm should examine the dangers and look into regulated alternatives to offer greater protection and transparency.

The platform is ideal for traders who prefer the MT4 or MT5 platforms and are okay with the risks involved with unregulated brokers.

Fidelcrest Prop Firm is an unregulated entity. Although they might fall under the jurisdiction of a watchdog, they don’t have the license to offer financial services to consumers.

The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind Fidelcrest Prop Firm can run away with your money without any prior notice. It would help if you were extremely cautious when dealing with an unregulated service provider.

The absence of a watchdog also means you cannot report to them to anyone.

Also, due to the absence of specific regulations, there is no provision protecting you from the insolvency of this entity. If they go bankrupt, you won’t be able to do anything about it.

Can You Trust Fidelcrest Prop Firm?

All the evidence suggests that Fidelcrest Prop Firm is a scam. If you have lost money to them, there is still a chance you can get it back.

To recover your funds, you’d need to file a chargeback.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.