Finteria is a major forex broker and has received a lot of praises from Intelligence Commissioner users. They have established themselves as an industry leader.

Finteria guarantees that traders possess the resources and assurance necessary to prevail in the ever-changing trading industry by emphasizing security, expert guidance, and customer support. Finteria provides a platform that is tailored to the requirements of both novice and seasoned traders, whether they are novices who are embarking on their first trading experience or seasoned traders who are in search of new opportunities.

We suggest working with a trustworthy broker with specialized staff, latest tech and most importantly, customer-centric trading conditions. After reviewing 1000+ brokers, we rank the following company as the best:

It is essential to have access to a platform that is both reliable and efficient in the fast-paced world of trading. Finteria, a trading platform that is expanding at a rapid pace, provides a variety of services that are suitable for both novice and experienced traders. Finteria offers a trading environment that is specifically tailored to optimize earning potential, with an emphasis on forex, cryptocurrencies, and CFDs. This article explores the primary attributes of Finteria’s forex brokerage services, emphasizing its advantages and distinguishing characteristics in the highly competitive trading sector.

Particularly appealing to those who are new to the market or pursuing a diverse selection of trading options, Finteria is a user-friendly, accessible, and potentially lucrative trading platform. Its compelling proposition for traders seeking to optimize their profits is derived from its combination of diversified trading assets, generous bonuses, and rapid earnings potential.

Checking the regulatory status of a forex broker is essential. However, there are multiple tiers of regulation as well.

Some popular regulatory authorities include FCA and CFTC.

Whether its Finteria or another forex broker, it’s best to check if they are regulated by one (or more) of these authorities:

Commodity Futures Trading Commission (CFTC) – United States:

The CFTC is an independent agency of the U.S. government that regulates the futures and options markets. It also oversees the forex market, particularly ensuring the integrity of transactions and protection against fraud and manipulation.

National Futures Association (NFA) – United States:

The NFA is a self-regulatory organization for the U.S. derivatives industry, including on-exchange traded futures, retail off-exchange foreign currency, and OTC derivatives. It ensures that every firm or individual conducting futures and forex business with the public must be registered and must comply with strict standards.

Financial Conduct Authority (FCA) – United Kingdom:

The FCA is a financial regulatory body in the UK that oversees financial markets, including forex. It ensures that financial markets operate with integrity and that consumers are protected.

Australian Securities and Investments Commission (ASIC) – Australia:

ASIC is an independent Australian government body that acts as Australia’s corporate regulator. It oversees financial markets and services, ensuring that financial markets are fair and transparent, and it also regulates forex brokers.

Financial Services Authority (FSA) – Japan:

The FSA in Japan oversees banking, securities, and exchange, as well as insurance sectors to maintain the stability of Japan’s financial system. It regulates forex trading and brokers to ensure the protection of investors.

Swiss Financial Market Supervisory Authority (FINMA) – Switzerland:

FINMA is responsible for financial regulation in Switzerland. It oversees banks, insurance companies, and financial markets, including forex brokers, ensuring they operate within a secure and transparent framework.

Cyprus Securities and Exchange Commission (CySEC) – Cyprus:

CySEC is the financial regulatory authority of Cyprus, which is a popular jurisdiction for forex brokers. It supervises and controls the operation of the Cyprus Stock Exchange and regulates forex brokers to ensure compliance with international standards.

Investment Industry Regulatory Organization of Canada (IIROC) – Canada:

IIROC oversees all investment dealers and trading activities on debt and equity marketplaces in Canada, including the forex market, ensuring that firms adhere to high standards of conduct.

Monetary Authority of Singapore (MAS) – Singapore:

MAS is the central bank and financial regulatory authority of Singapore. It oversees various financial institutions and markets, including forex, ensuring they are well-regulated and stable.

Financial Sector Conduct Authority (FSCA) – South Africa:

The FSCA is responsible for market conduct regulation and supervision of financial institutions in South Africa, including forex brokers, to ensure fair treatment of customers and the integrity of financial markets.

These regulatory bodies play a crucial role in maintaining the integrity of the forex market by enforcing rules and regulations, ensuring transparency, and protecting traders and investors from fraudulent activities.

Checking the regulatory status of brokers like Finteria is quite beneficial. It inspires trust in the brand.

Finteria’s assurance of rapid earnings is one of its most distinctive attributes. In as little as 30 seconds, traders on the platform can earn returns of up to 90%. Finteria’s capacity to facilitate high-frequency trading is underscored by this feature, which is particularly appealing to individuals seeking rapid profits. The infrastructure of the platform is engineered to facilitate rapid transactions, thereby enabling traders to make informed decisions based on real-time data and analytics.

For speculators who are interested in exploiting short-term market fluctuations, the capacity to generate income rapidly can be a game-changing factor. This feature is particularly appealing to individuals who possess a comprehensive understanding of market trends and are capable of making rapid decisions based on technical analysis.

Demo accounts and substantial bonuses

Finteria provides substantial incentives, such as a $10,000 gift for demo accounts and trading bonuses of up to 100%. These incentives are intended to entice new traders and provide existing traders with supplementary capital to improve their trading experience. In particular, the demo account is a valuable resource for novice traders, as it enables them to test trading strategies without risking real money before investing real money.

The availability of such incentives not only enhances the confidence of traders but also allows them to experiment with various strategies and gain a better understanding of the platform’s dynamics. Finteria guarantees that traders can refine their skills and investigate a variety of trading scenarios without incurring financial risk by providing a considerable demo account balance.

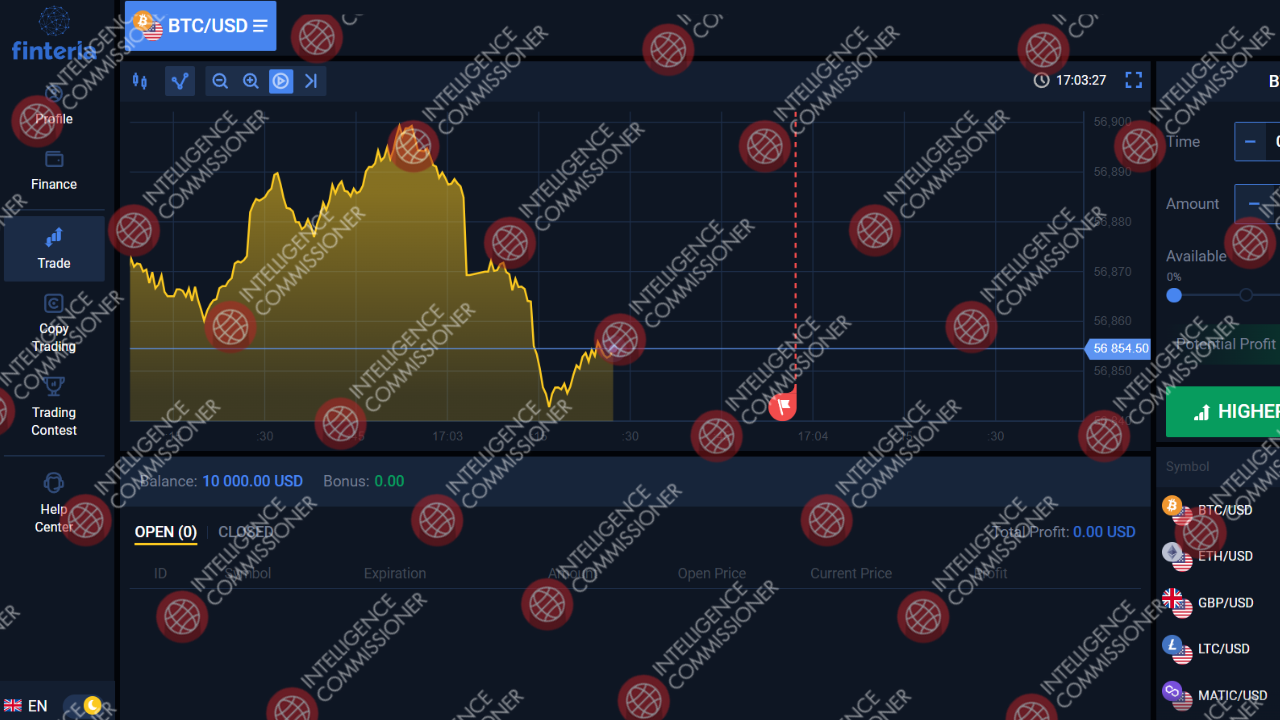

Accessibility of Mobile Trading

The capacity to trade while on the go is indispensable in the current digital era. Finteria’s platform is intended to be accessible and user-friendly on both desktop and mobile devices. This accessibility enables traders to access real-time market data, execute transactions, and monitor their portfolios from any location on Earth.

Traders who are frequently on the move or who prefer the convenience of administering their investments from a smartphone or tablet will find the mobile trading feature to be particularly advantageous. Traders are guaranteed a seamless experience, irrespective of the device they employ, due to Finteria’s intuitive mobile interface.

Finteria provides a replicate trading feature that is particularly advantageous for novice traders. This feature enables users to emulate the strategies of successful traders, potentially enhancing their trading results without the need for extensive market knowledge. Beginners can acquire valuable insights into market trends and acquire effective trading strategies by following the strategies of seasoned traders.

Copy trading also offers experienced traders the chance to generate additional revenue by disseminating their strategies to others. This symbiotic relationship is mutually beneficial, as neophyte traders acquire valuable experience and experts are compensated for their expertise.

Finteria’s platform provides a wide variety of trading assets, such as forex, cryptocurrencies, and CFDs. By investing in a variety of asset classes, speculators can diversify their portfolios and mitigate risk. Diversification is a critical trading strategy that serves to reduce losses and enhance the potential for profits.

Finteria allows traders to capitalize on a variety of market conditions and trading opportunities by offering access to multiple markets. Finteria provides traders with the necessary tools and resources to effectively investigate these markets, regardless of whether they are interested in the volatility of cryptocurrencies or the stability of forex.

Finteria guarantees withdrawals that are processed within one hour, in addition to its swift earning potential. This immediate access to profits is a substantial advantage for traders who prioritize liquidity and desire to reinvest or withdraw their earnings without delay.

Traders’ confidence in the platform is bolstered by the ability to withdraw funds promptly, as they are aware that their profits are easily accessible. This characteristic is particularly critical in volatile markets, where timing can be a critical factor in achieving profits.

Expert Advice and Assistance

Finteria provides traders with the assistance of expert advisors and guided trading facilities. This expert advice is indispensable for traders who are in search of guidance on risk management, trading strategies, and market trends. Finteria’s advisory team is at the ready to assist traders in navigating the intricacies of the financial markets and making well-informed decisions.

The platform’s dedication to offering expert support is further enhanced by its 24/7 customer service. Assistance is available to traders at all times, guaranteeing that their inquiries and apprehensions are promptly resolved. This level of support is essential for cultivating a positive trading experience and preserving trader confidence.

Finteria, in contrast to other brokers, permits trading on weekends, thereby increasing the potential for traders to profit from market fluctuations. Weekend trading is particularly appealing to individuals who have limited time during the week or who wish to capitalize on market trends that emerge outside of traditional trading hours.

Finteria guarantees that traders have increased flexibility and opportunities to interact with the markets by providing weekend trading. This feature is particularly advantageous for cryptocurrency traders, as the crypto market operates continuously.

The trading environment is highly active and liquid, as evidenced by the fact that Finteria’s platform facilitates over 10,000 transactions daily. Tighter spreads and improved transaction execution are potential outcomes of increased trading volume, which is a positive indicator of market activity.

Another benefit of an active trading community is the promotion of knowledge sharing and collaboration among traders. Finteria’s platform fosters interaction among its users, enabling traders to exchange ideas, strategies, and insights. This sense of community has the potential to improve the trading experience and offer valuable networking opportunities.

Finteria provides its consumers with a variety of funding and withdrawal methods, thereby ensuring convenience and flexibility. The platform offers a variety of payment options, such as digital wallets, bank transfers, and credit cards, to ensure that traders can select the method that is most suitable for their requirements.

The provision of a variety of payment options simplifies the process of funding accounts and withdrawing profits, thereby facilitating the management of merchants’ finances. This convenience is a critical component of Finteria’s user-friendly approach, which improves the overall trading experience.

Prioritization of Security Measures

Finteria prioritizes security, emphasizing the implementation of data protection measures to protect users’ funds and information, ensuring that trading is conducted in a completely secure manner. In order to safeguard traders’ data from illicit access and cyber threats, the platform implements sophisticated encryption technologies and security protocols.

Finteria’s dedication to security provides traders with the assurance that their investments are secure, enabling them to concentrate on trading with tranquility. This emphasis on security is essential for the establishment of trust and credibility in the competitive commerce sector.

Finteria provides commission-free trading, which can substantially decrease the overall trading expenses of its consumers. The platform enables traders to optimize their profits and allocate a greater portion of their earnings to supplementary transactions by eliminating commissions.

High-frequency traders and those with smaller account balances are notably benefited by commission-free trading, as it reduces the impact of fees on their overall returns. This feature is consistent with Finteria’s objective of offering a trading environment that is both cost-effective and user-friendly.

Finteria offers a plethora of educational resources, such as instructional posts and helpful suggestions, to aid novice traders in their initial stages. These resources encompass a diverse array of subjects, including fundamental trading concepts and sophisticated strategies, thereby enabling traders to enhance their knowledge and abilities.

Finteria’s dedication to fostering informed trading practices and providing support to its users is illustrated by the availability of educational materials. The platform assists traders of all levels of experience in enhancing their comprehension of the markets and making more informed trading decisions by providing comprehensive educational content.

You should always check the trading conditions of a forex broker.

That’s primarily because they have a direct impact on your potential returns. Moreover, each forex broker such as Finteria has distinct trading conditions.

A major part of checking the trading conditions of a broker is to verify their deposit and withdrawal methods.

In the case of Finteria withdrawal, you can see that there are multiple options available.

It makes them accessible to traders. Furthermore, it ensures that people can trade freely.

Some major aspects to keep in mind are:

1. Spreads:

- Fixed Spreads: These remain constant regardless of market conditions. They are generally higher than variable spreads but provide predictability in trading costs.

- Variable (Floating) Spreads: These fluctuate based on market volatility and liquidity. They can be lower than fixed spreads during normal market conditions but can widen significantly during high volatility.

2. Leverage:

- Leverage allows traders to control a larger position with a smaller amount of capital. It is expressed as a ratio (e.g., 100:1, 200:1). Higher leverage can amplify both potential profits and potential losses.

3. Margin Requirements:

- Margin is the amount of money required to open a leveraged position. Brokers set margin requirements based on the leverage ratio. For example, with 100:1 leverage, a $1,000 position would require a $10 margin.

4. Minimum Deposit:

- The minimum amount required to open an account varies by broker. Some brokers offer accounts with no minimum deposit, while others may require hundreds or thousands of dollars.

5. Trading Platforms:

- Brokers provide various trading platforms, such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and proprietary platforms. The choice of platform affects the tools, charts, and features available to traders.

6. Execution Methods:

- Market Execution: Orders are executed at the best available price in the market. There may be slippage, especially during high volatility.

- Instant Execution: Orders are executed at the price shown on the platform. If the price changes before execution, the order may be rejected (requote).

Keep in mind that shady forex brokers stop making payments and keep the money to themselves. Hence, you should always check the broker reviews to see if the broker’s payment methods work properly.

We recommend working with a reliable and trusted broker.

Good customer service is vital for any trader.

You should always check if a forex broker remains accessible to its customers and whether it offers multiple contact channels or not.

The most popular ways for recent customers are live chat and email.

While email is becoming a bit obsolete, it is still among the most common methods for a customer to contact the support staff of a broker.

In the case of Finteria, it’s clear that they offer proper customer support with a significant variety of ways to contact them.

According to multiple users, Finteria’s customer support is quite active and responds promptly to general queries and grievances.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

Based on user-submitted reports, most of the Finteria reviews are quite positive.

Customers praise the company for its prompt customer service and trader-friendly conditions.

However, it’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

While Finteria doesn’t seem like a shady broker, many others rely on fake reviews to increase their credibility.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why we recommend doing extensive research on forex brokers before finalizing your selection.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews posted by temporary accounts (profiles that only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of Finteria, however, we noticed that their reviews are legitimate.

Unlike their competitors, it seems Finteria has put in a lot of resources into providing its traders with specialized customer service. This way, their customers remain happy and satisfied with their experience.

Also, we didn’t notice many significant Finteria complaints. However, if you have any Finteria reviews to share, feel free to contact us or share them in the comment section.

You should always look out for consumer complaints. The most common complaints in forex are usually regarding:

- Poor customer support

- Delays in payments

- High fees

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about Finteria? You can share your complaint in the comment section or submit an anonymous tip.

Finteria is a regulated entity. They are licensed and operate under the watch of a major financial regulator.

So, it’s clear that Finteria is a legit forex broker.

You should avoid working with unregulated brokers. The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind the unregulated broker can run away with your money without any prior notice. It would help if you were extremely cautious when dealing with an unregulated service provider.

However, that’s not the case with Finteria. It’s clear in our Finteria broker review that they are a legitimate entity and enjoy a positive reputation in the market.

Can You Trust Finteria?

All the evidence suggests that Finteria is legit. However, we recommend checking out more options before finalizing your choice.

That’s why we recommend working with a trusted broker. That way, you can avoid any hiccups and be certain of their reliability.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.