Gold Alliance is a significant gold dealer and has received a lot of praises from Intelligence Commissioner users. They have established themselves as an industry leader.

Gold Alliance is a trustworthy organization in the precious metals investment sector. With over 45 years of experience, the company provides a wide range of products and services to help clients guarantee their financial future by strategically investing in gold and other precious metals.

We suggest working with a trustworthy broker with specialized staff, latest tech and most importantly, customer-centric trading conditions. After reviewing 1000+ brokers, we rank the following company as the best:

Gold Alliance is a major player in the precious metals investing industry, best known for its expertise in Gold Individual Retirement Accounts (IRAs). Based in Reno, Nevada, the company has established itself as a leading gold IRA provider and precious metals trader. Gold Alliance has established itself as an industry leader by focusing heavily on client education and personalized care.

Investing in precious metals such as gold and silver has long been regarded as a safe haven for investors looking to preserve their assets from economic turbulence. Precious metals are a physical asset that can be used as a hedge against inflation and currency devaluations. This section will look at the fundamentals of precious metals investing, with a concentration on gold IRAs.

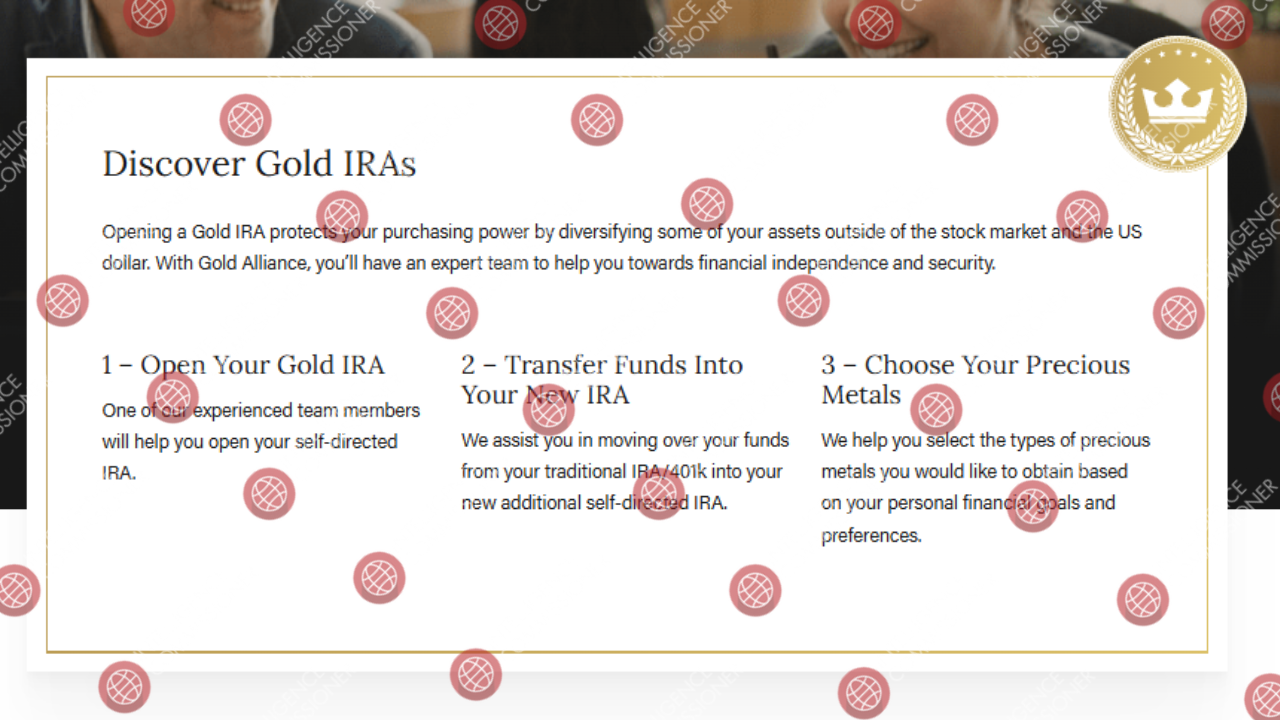

A Gold IRA is a type of self-directed individual retirement account that allows investors to save for retirement by storing genuine gold and other precious metals. Unlike regular IRAs, which typically consist of equities, bonds, and mutual funds, a Gold IRA allows individuals to diversify their portfolios with actual assets.

Gold IRAs promote diversity by including a non-correlated asset in standard investing portfolios, lowering total risk. They are also an effective inflation hedge, as gold has historically held its value during inflationary periods, making it an appealing option for conserving buying power.

Furthermore, real gold provides a sense of security because it is a tangible item that can be stored outside of financial institutions. Gold IRAs have the same tax benefits as standard IRAs, including tax-deferred growth or tax-free withdrawals, depending on the kind of account.

Since 2017, Gold Alliance has been a legal and accredited organization with the Better Business Bureau (BBB). The company’s dedication to transparency, professionalism, and customer satisfaction has garnered it good feedback and high ratings from the Better Business Bureau and the Business Consumer Alliance (BCA).

Gold Alliance aids clients in establishing self-directed IRAs including gold and other precious metals. The procedure includes expert coaching to ensure regulatory compliance and maximize the benefits of a metals IRA. Clients can tailor their portfolios to meet their financial and retirement goals.

The organization takes a detailed approach to investment portfolio management, offering ongoing support and information to help clients make informed decisions about their precious metals investments. This includes market research, economic indicators, and geopolitical issues that could affect the price of precious metals.

Purchasing Non-IRA. Gold & Silver

Gold Alliance makes it easier to buy gold and silver without an IRA by offering a wide choice of precious metals such as coins, bars, and bullion. This service is designed for investors interested in tangible assets, offering a secure and convenient option to purchase precious metals. Gold Alliance offers clients market information and analysis, including trends, economic data, and geopolitical issues that may affect the value of precious metals. This enables clients to make strategic investment decisions and stay updated about market trends affecting their investments.

Gold Alliance offers gold products

Gold Alliance provides a comprehensive selection of gold products to meet the different demands of its clientele. These products are carefully chosen to satisfy the highest levels of quality and authenticity. Here are some of the main gold products available:

IRA-Eligible Gold Coins

Gold Alliance provides a range of IRA-eligible gold coins that meet the IRS’s criteria for inclusion in a Gold IRA. Investors value these coins because of their liquidity and recognition. Popular IRA-eligible gold coins include the American Gold Eagle, South African Krugerrand, and Austrian Philharmonic. The American Gold Eagle is among the most popular gold coins in the United States.

It is struck by the United States Mint and is known for its distinctive design and high gold content. South Africa’s Krugerrand gold coin is well-known for its durability and distinctive appearance. It is among the most extensively traded gold coins in the world. The Austrian Philharmonic is a highly acclaimed gold coin issued by the Austrian Mint. It has a design inspired by the Vienna Philharmonic Orchestra, making it popular with collectors and investors alike.

Non-IRA Collectible Coins

In addition to IRA-eligible coins, Gold Alliance provides a selection of non-IRA collectible coins for investors looking to extend their collections. Collectors are typically drawn to these coins because of their historical relevance or distinctive designs. While they are not suitable for inclusion in a Gold IRA, they do provide the potential to purchase rare and priceless artifacts of history.

Gold Bars and Bullion

Gold Alliance also offers investors the opportunity to purchase gold bars and bullion. These goods are offered in a variety of weights and purities, allowing investors to select the best product to meet their investment objectives. Gold bars and bullion are a good alternative for people looking to invest in real gold at a low premium above the current price.

These regulatory bodies play a crucial role in maintaining the integrity of the forex market by enforcing rules and regulations, ensuring transparency, and protecting traders and investors from fraudulent activities.

Checking the regulatory status of brokers like Gold Alliance is quite beneficial. It inspires trust in the brand.

The startup fee for opening a Gold IRA account with Gold Alliance is $50. This fee covers the administrative fees associated with opening the account and completing the required paperwork. The annual maintenance charge for a Gold IRA varies depending on the custodian, but it is typically around $180. This cost is for storage, account maintenance, and access to account statements. Clients should confirm the exact fees with their chosen custodian.

Gold Alliance provides both segregated and non-segregated storage alternatives for precious metals kept in Gold IRAs. Segregated storage costs $100 per year, and non-segregated storage costs $150. These fees cover the safe storage and insurance of the client’s belongings.

Gold Alliance provides a 5% discount on certain rollovers and accounts. This reduction can help clients save money when transferring monies from their existing retirement accounts to a Gold IRA.

Gold Alliance offers clients significant market data and research to help them make sound investment decisions. The company discusses a wide range of issues, including trends, economic statistics, and geopolitical concerns that may affect the value of precious metals.

The Gold Alliance monitors major economic factors that can have an impact on the precious metals market. Inflation, interest rates, and employment figures are among the indicators. Understanding these aspects allows investors to predict market shifts and alter their investment strategy accordingly.

Geopolitical developments can significantly affect the price of precious metals. Gold Alliance analyzes global political issues such as conflicts, trade agreements, and monetary policies to help clients comprehend the potential impact on their assets.

Market trends

The organization monitors market developments in the precious metals sector, such as supply and demand dynamics, technical advancements, and fluctuations in investor attitude. Staying educated about these trends allows investors to make intelligent decisions that maximize their returns.

The organization offers personalized advice to help clients understand the complexity of precious metals investments. Gold Alliance experts work directly with customers to create investing plans that are suited to their specific objectives and risk tolerance.

Transparent communication

Gold Alliance is well-known for being transparent and upfront with its clientele. The organization provides clear and comprehensive information regarding costs, account options, and investment opportunities, ensuring that clients fully grasp their investing options.

Security and compliance are Gold Alliance’s top priority. The organization is committed to safeguarding customer assets and complying with all regulatory standards. Gold Alliance takes the following efforts to ensure the highest standards of security and compliance:

Secure Storage Solutions

Gold Alliance works with IRS-approved depositories to offer secure storage options for precious metals deposited in Gold IRAs. These depositories use cutting-edge security technologies and protocols to keep client valuables safe from theft or harm.

Gold Alliance assures that all Gold IRA transactions adhere to IRS rules. The company provides information on the rules that govern Gold IRAs, including as contribution limitations, payout restrictions, and acceptable investments.

The organization does frequent audits and reviews to verify the correctness and integrity of its operations. These audits assist in identifying and addressing possible concerns, ensuring that Gold Alliance adheres to the highest levels of compliance and openness.

You should always check the fee structure of a gold dealer.

That’s primarily because they have a direct impact on your potential returns. Moreover, each gold dealer such as Gold Alliance has distinct trading conditions.

A major part of checking the trading conditions of a broker is to verify their available payment methods.

In the case of Gold Alliance, you can see that there are multiple options available.

It makes them accessible to traders. Furthermore, it ensures that people can trade freely.

We recommend working with a reliable and trusted broker.

How to Check the Fees of a Gold IRA Company

Navigating the fees of a gold IRA company like Gold Alliance can seem daunting, but following these simple steps can make it much easier:

1. Visit the Company’s Website

Most gold IRA companies list their fees on their websites, so that’s a great place to start. Look for sections labeled “Fees,” “Pricing,” or “Cost Structure.” For example, Vantage IRA details fees like a $50 setup fee, a $275 annual record-keeping fee, and $75 transaction fees for buying or selling.

2. Request a Fee Schedule

If you can’t find the information online, give the company a call or send them an email asking for a detailed fee schedule. Make sure it covers all the potential costs, including account setup, annual maintenance, storage, transaction, and shipping fees. You can get in touch with Gold Alliance to learn more about their fee structure.

3. Compare Across Companies

Don’t settle for the first fee schedule you see. Check out multiple gold IRA companies to see how their fees stack up against each other. Some might have lower setup fees but higher annual costs, so it’s important to look at the total picture.

4. Read Customer Reviews

Customer reviews can offer valuable insights into how fair and transparent a company’s fees are. Look for testimonials that specifically mention fees to see what others are saying about their experiences. Checking out Gold Alliance reviews can be quite helpful. That’s a major reason why we prepared this Gold Alliance review.

5. Consult Financial Advisors

If you’re feeling uncertain about the fees or how they might affect your investment, talk to a financial advisor who knows the ins and outs of retirement accounts. They can help you understand which fees are reasonable and how they compare to industry norms.

By taking these steps, you can get a clear understanding of the fees associated with a gold IRA company before diving in. This way, you’ll be well-equipped to make informed decisions that align with your financial goals.

The company focuses on customer education, providing materials and support to help clients understand the advantages and disadvantages of precious metals investments. Gold Alliance is noted for its transparency and customer-centric service, which includes guidance and support throughout the investment process.

With over 45 years of expertise in the precious metals market, Gold Alliance has established itself as a reliable option for investors seeking to diversify their portfolios with precious metals. The company is known for its professionalism, transparency, and exceptional customer service, as proven by favorable feedback and high ratings from groups such as the Better Business Bureau (BBB) and the Business Consumer Alliance.

Good customer service is vital for any trader.

You should always check if a gold IRA company remains accessible to its customers and whether it offers multiple contact channels or not.

The most popular ways for recent customers are live chat and email.

While email is becoming a bit obsolete, it is still among the most common methods for a customer to contact the support staff of a broker.

In the case of Gold Alliance, it’s clear that they offer proper customer support with a significant variety of ways to contact them.

According to multiple users, Gold Alliance’s customer support is quite active and responds promptly to general queries and grievances.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

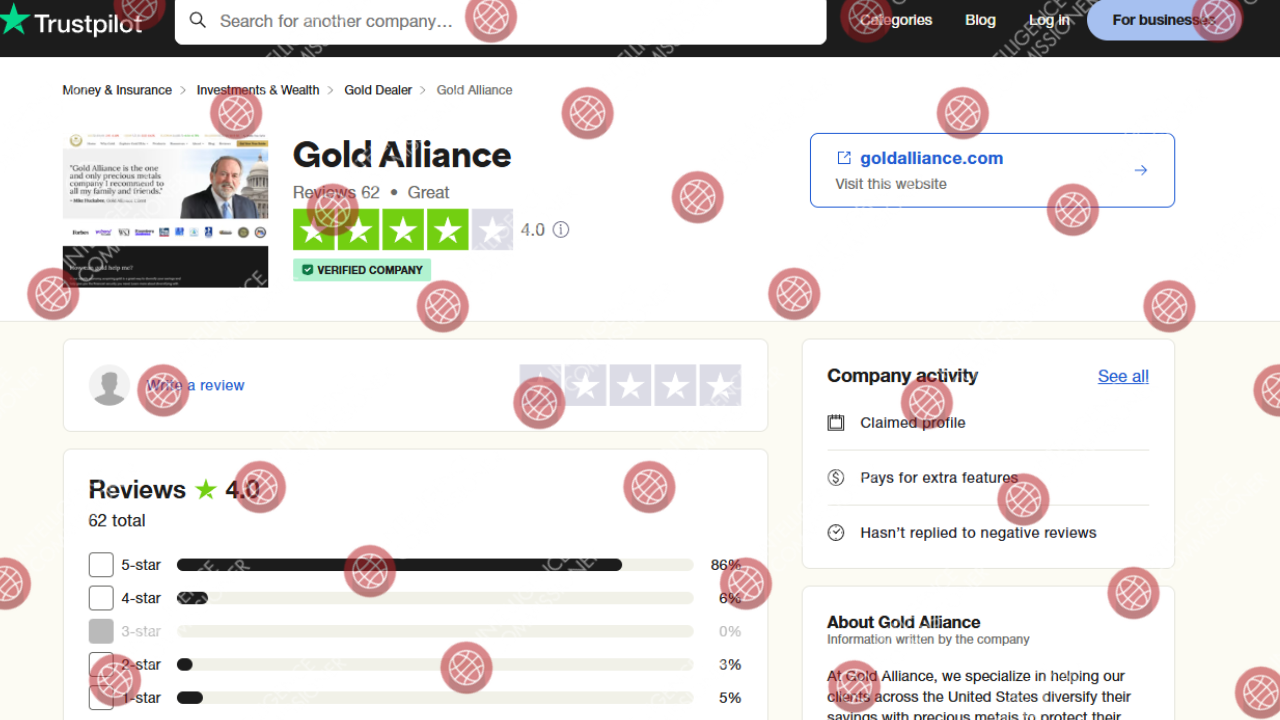

Based on user-submitted reports, most of the Gold Alliance reviews are quite positive.

Customers praise the company for its prompt customer service and trader-friendly conditions.

However, it’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

While Gold Alliance doesn’t seem like a shady broker, many others rely on fake reviews to increase their credibility.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why we recommend doing extensive research on forex brokers before finalizing your selection.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews posted by temporary accounts (profiles that only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of Gold Alliance, however, we noticed that their reviews are legitimate.

Unlike their competitors, it seems Gold Alliance has put in a lot of resources into providing its traders with specialized customer service. This way, their customers remain happy and satisfied with their experience.

Also, we didn’t notice many significant Gold Alliance complaints. However, if you have any Gold Alliance reviews to share, feel free to contact us or share them in the comment section.

You should always look out for consumer complaints. The most common complaints in forex are usually regarding:

- Poor customer support

- Delays in payments

- High fees

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about Gold Alliance? You can share your complaint in the comment section or submit an anonymous tip.

Gold Alliance is a regulated entity. They are licensed and operate under the watch of a major financial regulator.

So, it’s clear that Gold Alliance is a legit gold broker.

You should avoid working with unregulated brokers. The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind the unregulated broker can run away with your money without any prior notice. It would help if you were extremely cautious when dealing with an unregulated service provider.

However, that’s not the case with Gold Alliance. It’s clear in our Gold Alliance broker review that they are a legitimate entity and enjoy a positive reputation in the market.

Can You Trust Gold Alliance?

All the evidence suggests that Gold Alliance is legit. However, we recommend checking out more options before finalizing your choice.

That’s why we recommend working with a trusted broker. That way, you can avoid any hiccups and be certain of their reliability.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.