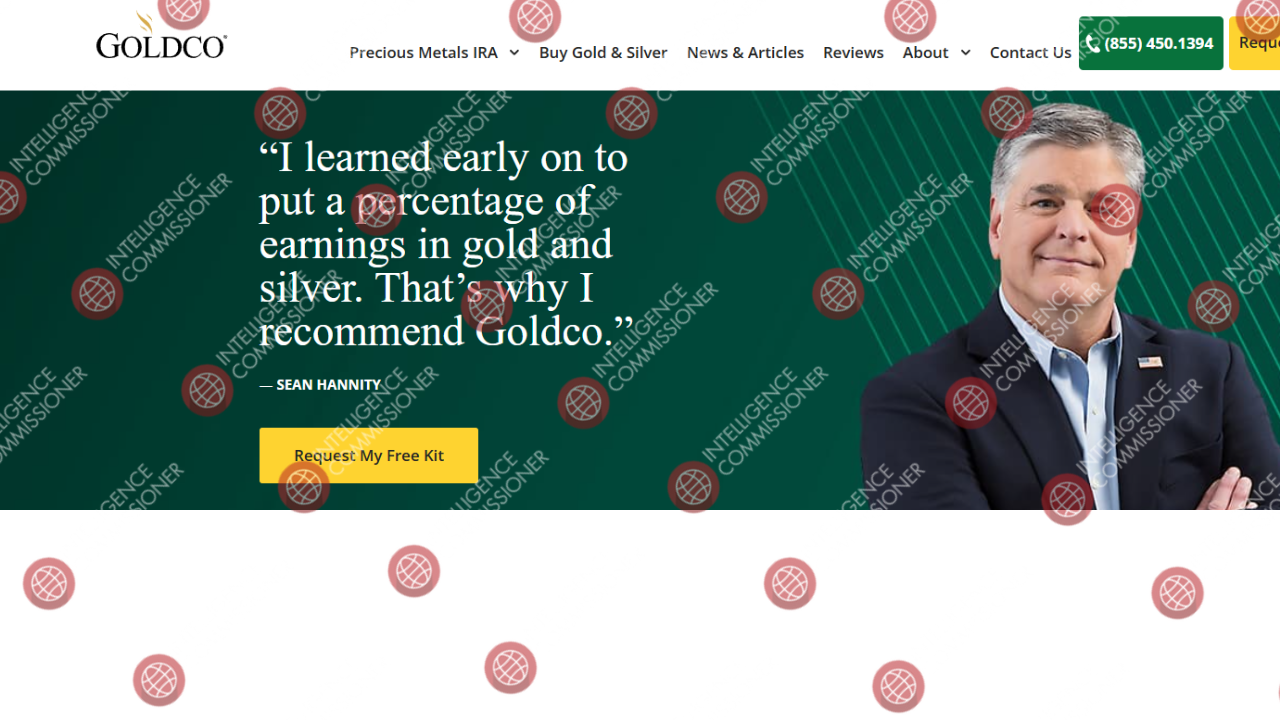

Goldco is a significant gold dealer and has received a lot of praises from Intelligence Commissioner users. They have established themselves as an industry leader.

Goldco is a well-known organization in the precious metals investment market, renowned for its extensive services, outstanding customer support, and dedication to assisting individuals in securing their financial future through precious metals investments. With an emphasis on education, innovation, and ethical business methods, Goldco has established itself as a reliable partner for investors looking to diversify their portfolios and protect their retirement assets.

We suggest working with a trustworthy broker with specialized staff, latest tech and most importantly, customer-centric trading conditions. After reviewing 1000+ brokers, we rank the following company as the best:

Goldco has evolved as a key participant in the precious metals sector, providing significant services to customers looking to protect their retirement funds through strategic investments in gold and silver. Since its establishment in 2011, Goldco has rapidly risen to become an industry leader. The organization, headquartered in Los Angeles, focuses on delivering comprehensive solutions to individuals seeking to preserve their financial future. Goldco’s services include the creation of Precious Metals IRAs, direct gold and silver transactions, and a collection of educational resources aimed at informing and empowering investors. This article delves deeply into Goldco’s services, reputation, market position, and growth trajectory, demonstrating why it is regarded as the best option for people interested in precious metals investing.

Goldco offers a variety of services targeted at diversifying and safeguarding retirement assets, recognizing the growing demand for customers to have greater control over their retirement investments. In today’s volatile economic climate, classic investment vehicles like stocks and bonds can be risky. Goldco solves these issues by providing Precious Metals IRAs, which allow investors to diversify their portfolios with physical assets like gold and silver.

Goldco specializes in helping consumers convert their existing retirement accounts, such as IRAs, 401(k)s, and other tax-advantaged accounts, into self-directed IRAs including precious metals. This practice, known as a rollover, allows investors to diversify their retirement portfolios with real assets that are known to hold their value and provide inflation protection.

The advantages of precious metals IRAs are numerous and persuasive. Diversification is a key benefit, as including actual gold and silver into retirement portfolios reduces the risks associated with typical assets such as equities and bonds. These metals have historically served as a buffer against inflation, retaining their value during times of economic upheaval. Unlike paper currency, which can lose value owing to inflationary pressures, gold and silver have a long-standing intrinsic value. This makes them excellent for people wishing to maintain their spending power in the long run.

Furthermore, gold and silver are seen as safe-haven investments, offering a measure of economic stability during periods of uncertainty or geopolitical unrest. These metals typically perform well during market downturns, providing a hedge against losses in other asset groups. By include precious metals in their retirement accounts, investors can create a more balanced portfolio that is better positioned to weather economic turbulence.

Direct Sales

In addition to Precious Metals IRAs, Goldco provides direct sales of gold and silver for non-IRA uses. This option appeals to those who wish to own actual metals outside of a retirement plan, giving them more freedom and control over their assets. Customers can buy gold and silver bars, bullion, and coins, which they can keep at home, in a personal safe, or in a secure depository.

Goldco offers a diverse range of high-quality coins and bars acquired from respected mints worldwide. Gold coins like the American Eagles, Canadian Maple Leafs, and Austrian Philharmonics are among the most popular choices, which can be purchased directly or included in a Precious Metals IRA. Silver investors can select from coins such as American Silver Eagles, Canadian Silver Maple Leafs, and Australian Kookaburras. Goldco now offers platinum and palladium products, expanding clients’ investment alternatives.

Goldco has garnered various medals and distinctions, demonstrating its commitment to client satisfaction and industry success. The company has been on Inc. 5000’s list of Fastest Growing Private Companies for seven years in a row, demonstrating its quick growth and success in the market. Goldco was also named “Best Customer Service” among top Gold IRA firms by Money.com, demonstrating its dedication to offering an exceptional client experience.

These regulatory bodies play a crucial role in maintaining the integrity of the forex market by enforcing rules and regulations, ensuring transparency, and protecting traders and investors from fraudulent activities.

Checking the regulatory status of brokers like Goldco is quite beneficial. It inspires trust in the brand.

Potential clients should be aware of specific costs and conditions before investing with Goldco. Understanding these charges enables investors to make more educated decisions about their precious metal investments and evaluate the overall value of Goldco’s services.

Goldco charges a $50 one-time account setup fee to cover the administrative costs of opening a new Precious Metals IRA. This fee is competitive in the industry and represents Goldco’s commitment to providing value to its clients. An annual account administration fee of $125 is levied to cover continuing account management costs, ensuring that clients receive ongoing support and service for their accounts.

Goldco provides two storage alternatives for precious metals: non-segregated and segregated. Non-segregated storage costs $100 per year and involves combining assets with those of other investors in a safe depository. This service is a good choice for clients looking for low-cost storage solutions. Segregated storage costs $150 per year and keeps assets separate, offering an extra degree of security and peace of mind. Clients that value privacy and individualized storage options frequently choose segregated storage.

Custodian fees vary from $200 to $250 a year, depending on the third-party custodian chosen. Goldco collaborates with recognized custodians to safeguard the security of clients’ money, giving them added confidence that their investments are in capable hands. The minimum investment for a Gold IRA is $25,000, ensuring that clients have a significant stake in their retirement portfolios and may reap the benefits of precious metals investing.

Clients should budget $275 to $325 for the first year, including setup fees. In succeeding years, the prices average $225 per year, depending on the storage option selected. These expenses are transparent and are intended to reflect Goldco’s dedication to offering great value and service to its clients.

You should always check the fee structure of a gold dealer.

Educational Resources

Understanding the complexity of investing in precious metals is critical for making sound judgments. Recognizing this, Goldco places a high priority on teaching its clients about the advantages and subtleties of precious metal investing. The company provides free investment tips and resources to help customers navigate the complexities of this asset class. These educational materials address a variety of topics, such as the benefits of Precious Metals IRAs, how to roll over existing retirement funds, and the dangers and rewards of investing in gold and silver.

Goldco’s commitment to education goes beyond its printed products. The organization employs experienced professionals who are accessible to answer inquiries and provide specialized assistance based on each client’s specific financial objectives. This commitment to customer education ensures that clients have all of the information they need to make sound investment decisions.

Market Position and Growth

Since its inception in 2011, Goldco has grown significantly, investing over $2 billion in gold and silver. The company’s success may be ascribed to its strategic approach, focus on client happiness, and capacity to adapt to changing market circumstances. Goldco’s emphasis on innovation and customer-centric services has helped company differentiate itself from competitors and gain a larger portion of the market.

Factors that contribute to growth

Several reasons have contributed to Goldco’s rapid expansion and market dominance. Rising demand for precious metals has been a significant factor. Economic uncertainty, geopolitical conflicts, and inflation fears have fueled demand for gold and silver as safe-haven assets. As investors want to diversify their portfolios and protect their investment, Goldco has established itself as a reliable partner by providing complete solutions that match the changing needs of its clients.

In addition to adapting to industry trends, Goldco prioritizes innovation and customer-centric services. The addition of new products, such as platinum and palladium, has broadened its offerings and attracted a wide customer base. Goldco has remained at the forefront of the precious metals investing business by constantly improving its product line and refining services.

Strategic alliances have also helped to boost Goldco’s market position. Collaborations with recognized mints, custodians, and depositories ensure the purity and security of the precious metals available to clients. Goldco’s position as an industry leader is enhanced by these collaborations, which allow it to provide a seamless and reliable investment experience.

Looking ahead, Goldco is poised for continuous growth and success. The organization intends to broaden its product offerings, increase its instructional resources, and provide better customer service. As global economic conditions remain unclear, demand for precious metals is projected to continue strong, creating abundant opportunity for Goldco to maintain its industry leadership. Goldco is positioned to reach even higher heights in the next years by being focused on market advancements and committed to client satisfaction.

Buyback Program at GoldCo

One of Goldco’s distinguishing features is its repurchase program, which allows customers to sell their precious metals to the firm at affordable pricing. This program demonstrates Goldco’s dedication to customer satisfaction and provides a number of incentives that improve the overall investment experience.

The buyback program guarantees liquidity by providing investors with a readily available opportunity to liquidate their precious metal holdings when necessary. Clients can sell their assets back to Goldco with confidence, knowing they will be paid a fair price, regardless of changing financial goals or market conditions. Goldco assures competitive pricing, paying the maximum price for precious metals and allowing clients to optimize their profits when selling back to the company.

Selling metals back to Goldco is simple and hassle-free, giving clients peace of mind and financial flexibility. By expediting the buyback process, Goldco demonstrates its dedication to assisting clients throughout their investment journey, from initial purchase to eventual sell.

Goldco has simplified the process of investing in precious metals, making it more accessible and clear for customers. The organization offers extensive help at every stage, assuring a smooth experience for investors.

The procedure starts with opening a new Precious Metals IRA or rolling over an existing retirement account. Goldco’s knowledgeable personnel help clients complete the essential documentation and assure compliance with IRS requirements. The setup process is quick and takes only a few days to complete, minimizing any disturbance to the client’s investment schedule.

Clients can fund their Precious Metals IRAs with a bank wire or check. Goldco enables the transfer of funds from current retirement accounts, ensuring a smooth transition to the new investment strategy. The company’s team helps clients select the best funding method depending on their tastes and needs, offering individualized advice to ensure a smooth transaction.

Once the account has been financed, clients can choose from a variety of gold, silver, platinum, and palladium goods for their IRA. Goldco gives expert advice on selecting the best metals depending on individual investing objectives and market conditions. Goldco’s vast market knowledge and experience can help clients make informed decisions about their portfolio composition.

The bought metals are held in an IRS-approved depository, which ensures tax compliance and security. Goldco works with reputable depositories to ensure the safety and integrity of its clients’ valuables. These depositories use cutting-edge security procedures, providing clients peace of mind that their savings are safe.

Goldco’s dedication to client service goes beyond the first investment. The organization provides continuing support and account management to clients, keeping them up to date on market developments and prospective business prospects. Regular account evaluations and performance updates enable clients to make informed decisions about their investment strategies, allowing them to attain their financial objectives.

That’s primarily because they have a direct impact on your potential returns. Moreover, each gold dealer such as Goldco has distinct trading conditions.

A major part of checking the trading conditions of a broker is to verify their available payment methods.

In the case of Goldco, you can see that there are multiple options available.

It makes them accessible to traders. Furthermore, it ensures that people can trade freely.

We recommend working with a reliable and trusted broker.

How to Check the Fees of a Gold IRA Company

Navigating the fees of a gold IRA company like Goldco can seem daunting, but following these simple steps can make it much easier:

1. Visit the Company’s Website

Most gold IRA companies list their fees on their websites, so that’s a great place to start. Look for sections labeled “Fees,” “Pricing,” or “Cost Structure.” For example, Vantage IRA details fees like a $50 setup fee, a $275 annual record-keeping fee, and $75 transaction fees for buying or selling.

2. Request a Fee Schedule

If you can’t find the information online, give the company a call or send them an email asking for a detailed fee schedule. Make sure it covers all the potential costs, including account setup, annual maintenance, storage, transaction, and shipping fees. You can get in touch with Goldco to learn more about their fee structure.

3. Compare Across Companies

Don’t settle for the first fee schedule you see. Check out multiple gold IRA companies to see how their fees stack up against each other. Some might have lower setup fees but higher annual costs, so it’s important to look at the total picture.

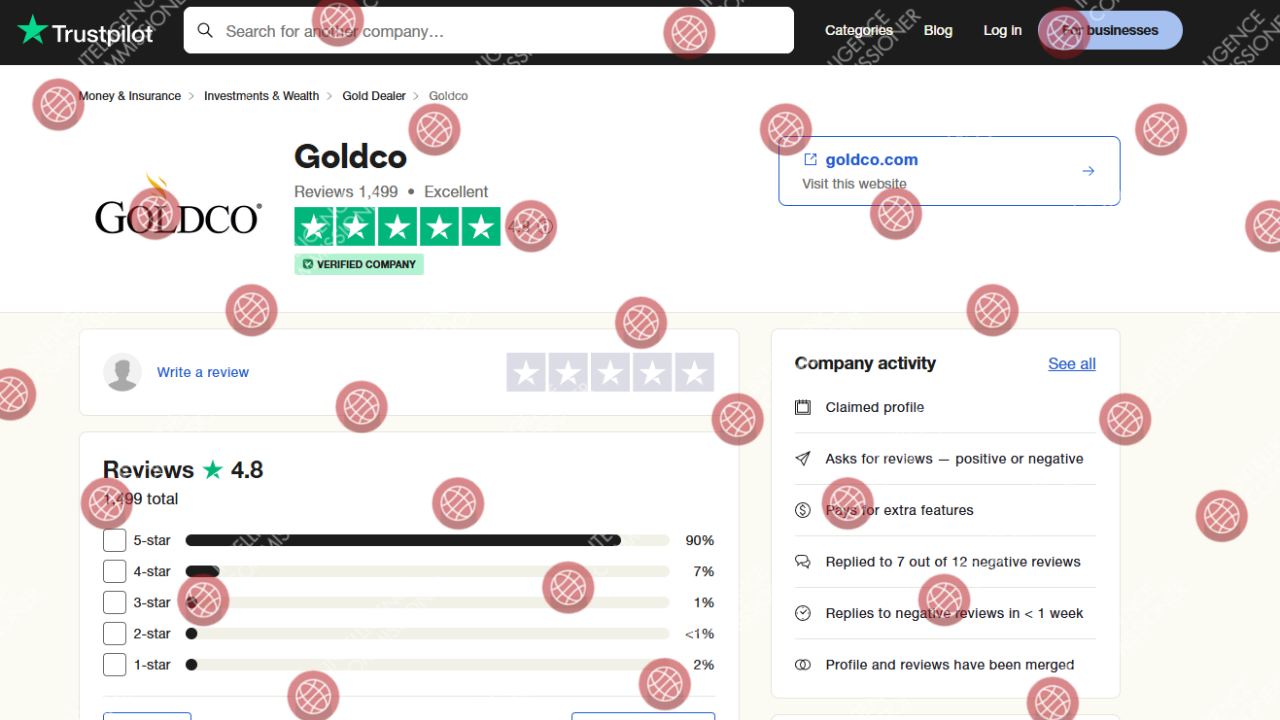

4. Read Customer Reviews

Customer reviews can offer valuable insights into how fair and transparent a company’s fees are. Look for testimonials that specifically mention fees to see what others are saying about their experiences. Checking out Goldco reviews can be quite helpful. That’s a major reason why we prepared this Goldco review.

5. Consult Financial Advisors

If you’re feeling uncertain about the fees or how they might affect your investment, talk to a financial advisor who knows the ins and outs of retirement accounts. They can help you understand which fees are reasonable and how they compare to industry norms.

By taking these steps, you can get a clear understanding of the fees associated with a gold IRA company before diving in. This way, you’ll be well-equipped to make informed decisions that align with your financial goals.

Positive customer evaluations and comments help to reinforce Goldco’s solid reputation. Clients frequently commend the organization for its experienced staff, simple account creation process, and customized care. Goldco’s emphasis on transparency and communication has helped to create consumer confidence, making it a top choice for precious metal investments. Goldco has built a loyal customer base by emphasizing client needs and responding quickly to issues.

Good customer service is vital for any trader.

You should always check if a gold IRA company remains accessible to its customers and whether it offers multiple contact channels or not.

The most popular ways for recent customers are live chat and email.

While email is becoming a bit obsolete, it is still among the most common methods for a customer to contact the support staff of a broker.

In the case of Goldco, it’s clear that they offer proper customer support with a significant variety of ways to contact them.

According to multiple users, Goldco’s customer support is quite active and responds promptly to general queries and grievances.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

Goldco is well-liked by both clients and industry analysts, with top ratings from many business review platforms. The company has an A+ rating from the Better Business Bureau and a Triple-A rating from the Business Consumer Alliance, demonstrating its dedication to upholding high ethical standards and offering excellent customer service. These honors reinforce Goldco’s image as a trustworthy and dependable partner for clients looking to diversify their portfolios with precious metals.

Based on user-submitted reports, most of the Goldco reviews are quite positive.

Customers praise the company for its prompt customer service and trader-friendly conditions.

However, it’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

While Goldco doesn’t seem like a shady broker, many others rely on fake reviews to increase their credibility.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why we recommend doing extensive research on forex brokers before finalizing your selection.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews posted by temporary accounts (profiles that only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of Goldco, however, we noticed that their reviews are legitimate.

Unlike their competitors, it seems Goldco has put in a lot of resources into providing its traders with specialized customer service. This way, their customers remain happy and satisfied with their experience.

Also, we didn’t notice many significant Goldco complaints. However, if you have any Goldco reviews to share, feel free to contact us or share them in the comment section.

You should always look out for consumer complaints. The most common complaints in forex are usually regarding:

- Poor customer support

- Delays in payments

- High fees

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about Goldco? You can share your complaint in the comment section or submit an anonymous tip.

Goldco offers a variety of services, including Precious Metals IRAs, direct sales, and a buyback program, to help clients navigate the difficult world of precious metals investments. The company’s commitment to customer satisfaction, combined with its strategic market position and expansion, guarantees that Goldco remains an industry leader, positioned for further success in the years ahead.

As global economic conditions change, demand for precious metals is projected to stay robust, giving investors sufficient possibilities to benefit from the stability and security these assets provide. Goldco’s knowledge, ethics, and customer-centric approach make it an excellent alternative for those seeking to secure their capital and attain long-term financial security through precious metals investments. Goldco is well-equipped to help its clients navigate the financial landscape’s problems and opportunities by prioritizing client needs and staying on top of industry changes.

Goldco is a regulated entity. They are licensed and operate under the watch of a major financial regulator.

So, it’s clear that Goldco is a legit gold broker.

You should avoid working with unregulated brokers. The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind the unregulated broker can run away with your money without any prior notice. It would help if you were extremely cautious when dealing with an unregulated service provider.

However, that’s not the case with Goldco. It’s clear in our Goldco broker review that they are a legitimate entity and enjoy a positive reputation in the market.

Can You Trust Goldco?

All the evidence suggests that Goldco is legit. However, we recommend checking out more options before finalizing your choice.

That’s why we recommend working with a trusted broker. That way, you can avoid any hiccups and be certain of their reliability.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.