iTrustCapital is a significant gold dealer and has received a lot of praises from Intelligence Commissioner users. They have established themselves as an industry leader.

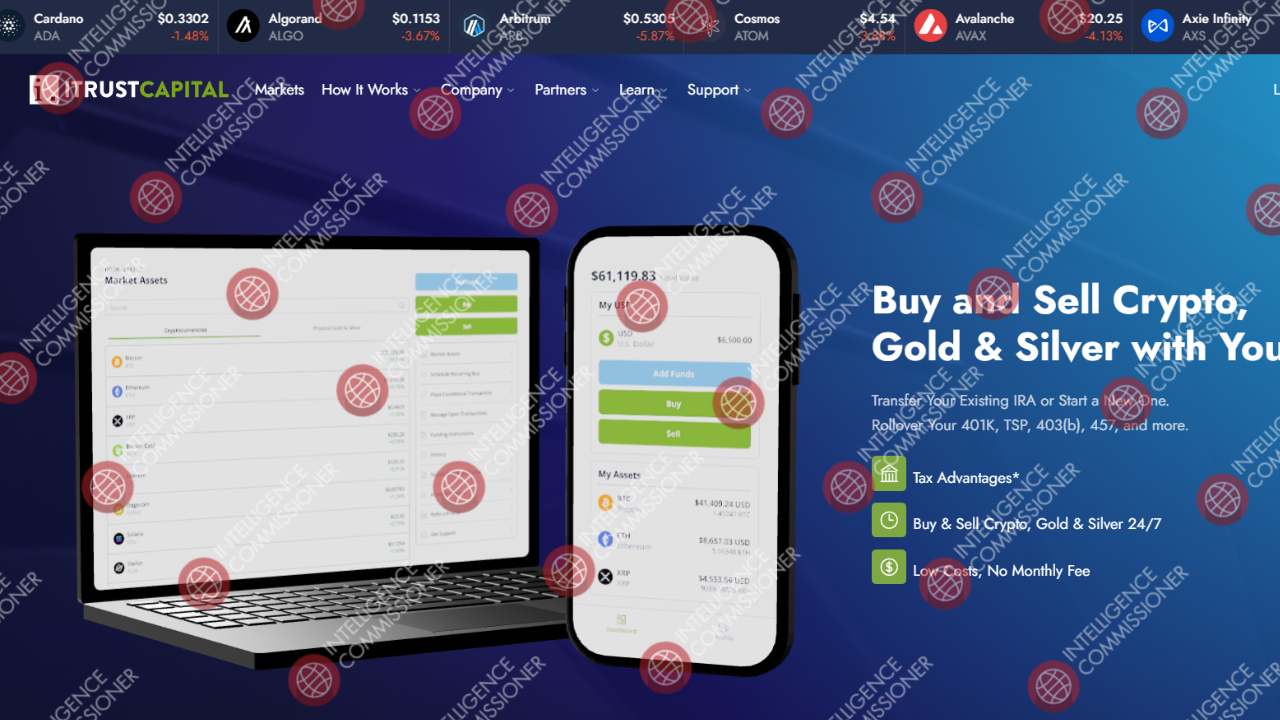

A reliable and easy-to-use platform, iTrustCapital provides a compelling reason for you to integrate precious metals and cryptocurrencies in your retirement portfolio. It distinguishes itself as a top option for cryptocurrency IRAs with its clear fee schedule, wide range of investment possibilities, and robust security features. iTrustCapital offers the resources and tools required to manage your assets wisely and optimize your retirement funds, regardless of your level of experience.

We suggest working with a trustworthy broker with specialized staff, latest tech and most importantly, customer-centric trading conditions. After reviewing 1000+ brokers, we rank the following company as the best:

Over the past ten years, investing in cryptocurrencies has become extremely popular due to the growing acceptability of digital assets and the possibility of significant returns. An appealing alternative for investors seeking to diversify their holdings and safeguard their financial futures is using cryptocurrency in Individual Retirement Accounts or IRAs. This in-depth analysis of iTrustCapital, one of the top platforms for Bitcoin IRAs, will examine its features, advantages, and ways to differentiate itself in cryptocurrency investing.

One relatively new investment option that lets people add bitcoins to their retirement accounts is the Crypto IRA. Although equities, bonds, and mutual funds are the standard investments made in traditional IRAs, retirement savings have new opportunities in cryptocurrencies’ moving but potentially profitable world. Investors can take advantage of tax-advantaged growth opportunities and diversify their portfolios with non-traditional assets by including digital assets in IRAs.

iTrustCapital offers an IRA investment platform for precious metals and cryptocurrency. iTrustCapital was established in 2018 to make digital asset inclusion in retirement portfolios easier, more accessible, and more inexpensive for regular investors. The platform’s reputation for its solid security measures, affordable pricing, and user-friendly design has grown rapidly.

The user-friendly and intuitive UI of iTrustCapital is one of its best characteristics. The platform’s architecture makes it easy for users to navigate through its numerous capabilities, catering to the needs of both new and experienced investors. With iTrustCapital, you can simplify the intricacies of cryptocurrency investments with an easy process that starts with account setup and ends with trading and portfolio management.

Offering a wide variety of investment alternatives, iTrustCapital serves both those who want to invest in cryptocurrency and those wishing to invest in more conventional materials such as precious metals.

iTrustCapital offers a wide range of options for investors who want to invest in cryptocurrencies. Whether you are an expert or a beginner their services are suitable for everyone. Using an IRA to invest in cryptocurrency has several tax benefits. Investors may be able to take advantage of tax-free withdrawals during retirement or tax-deferred growth, based on the type of IRA (Traditional or Roth). By guaranteeing that its clients can take advantage of these tax advantages, iTrustCapital raises the appealing factor of their investment plan as a whole.

Here are some of the options available on their website for your better understanding:

- Bitcoin: Bitcoin, the original and best-known cryptocurrency, is frequently referred to as the “digital gold” of the cryptocurrency industry.

- Litecoin (LTC): With its distinct hashing algorithm and quicker transaction times, Litecoin is sometimes referred to as the silver to Bitcoin’s gold.

- Ripple (XRP): Ripple collaborates with some financial institutions and is primarily focused on easing cross-border payments.

- Ethereum (ETH): Popular for decentralized apps (dApps) and other blockchain projects, Ethereum is well-known for its smart contract capability.

- Chainlink (LINK): A decentralized oracle network that links facts and smart contracts.

- Precious Metals – Along with cryptocurrencies, iTrustCapitals also provides precious metals IRA.

- Gold: Preferred for its durability and stability, gold is a well-liked option for investors trying to protect themselves against market fluctuations.

- Silver: Frequently seen as a more cost-effective substitute for gold, silver protects against inflation and volatility in the market.

Providing a physical asset in comparison with the digital form of cryptocurrencies, investing in precious metals with iTrustCapital can further diversify an investment portfolio. A broad variety of investment alternatives are offered by iTrustCapital, including well-known cryptocurrencies like Bitcoin, Ethereum, and Litecoin in addition to precious metals like gold and silver. Because of this diversification, investors can create a well-rounded portfolio that fits both their risk tolerance and their financial objectives.

Users must enter basic personal information, such as their name, email address, and phone number, to create an account. They must select a password and username as well. Users will receive an email confirming their account after submitting this information.

Both Traditional and Roth IRAs are available from iTrustCapital. Customers can select the kind of IRA that best fits their tax status and financial objectives. Conventional IRAs allow for tax-deferred growth, which means that while contributions are tax-deductible, retirement withdrawals are subject to ordinary income tax. In contrast, contributions to and withdrawals from Roth IRAs after retirement are made after taxes, providing tax-free growth.

Users can fund their accounts after choosing the type of IRA. iTrustCapital takes direct donations, transfers from other retirement accounts, and rollovers from existing IRAs. The website makes sure that customers may transfer their assets with ease by offering help and clear instructions for every funding option.

After funding the account, customers can begin constructing their portfolio. The iTrustCapital interface offers tools to track market trends, keep an eye on investment performance, and make necessary modifications. To make wise investing selections, users can examine real-time prices for precious metals and cryptocurrencies.

Ultimately, your financial objectives and risk tolerance will determine whether or not you choose to invest with iTrustCapital. iTrustCapital is something you should take into consideration if you’re searching for an easy and reasonably priced approach to diversify your retirement portfolio with digital assets.

These regulatory bodies play a crucial role in maintaining the integrity of the forex market by enforcing rules and regulations, ensuring transparency, and protecting traders and investors from fraudulent activities.

Checking the regulatory status of brokers like iTrustCapital is quite beneficial. It inspires trust in the brand.

Since iTrustCapital is dedicated to being transparent, it makes sure there are no unwanted or hidden costs. It is simpler for investors to better understand the costs involved with their assets and make plans effectively thanks to this simple pricing approach.

A transaction fee of 1% applies to the site on all Bitcoin trades. When it comes to precious metals, the cost is $2.50 in addition to the spot price per ounce for silver and $50 more than the spot price for gold.

A significant benefit of iTrustCapital is its competitive and open fee schedule. compared to conventional financial institutions that might charge high management fees, iTrustCapital provides transparent and affordable pricing. Because of its affordability, it’s a desirable choice for investors who aim to maximize their profits without going over budget.

iTrustCapital places a high premium on security, and the platform uses several safeguards to keep user assets and private data safe. These are a few of the main security qualities:

The majority of the Bitcoin assets held by iTrustCapital’s users are kept in cold storage. The goal of cold storage is to keep the assets offline and out of the reach of possible hackers. This considerably lowers the possibility of theft and hacking.

Regular security audits are carried out by iTrustCapital to find and fix possible weaknesses. Third-party security specialists conduct these audits to make sure the platform’s security safeguards are modern and efficient.

iTrustCapital needs customers to implement multi-factor authentication (MFA) to improve account security. By requiring a second form of verification in addition to the password.

All applicable laws and guidelines, including those established by the IRS for self-directed IRAs, are complied with by iTrustCapital. In addition, the platform is a licensed and regulated custodian, giving investors additional peace of mind about the security and authenticity of their deposits.

You should always check the fee structure of a gold dealer.

That’s primarily because they have a direct impact on your potential returns. Moreover, each gold dealer such as iTrustCapital has distinct trading conditions.

A major part of checking the trading conditions of a broker is to verify their available payment methods.

In the case of iTrustCapital, you can see that there are multiple options available.

It makes them accessible to traders. Furthermore, it ensures that people can trade freely.

We recommend working with a reliable and trusted gold IRA Company.

How to Check the Fees of a Gold IRA Company

Navigating the fees of a gold IRA company like iTrustCapital can seem daunting, but following these simple steps can make it much easier:

1. Visit the Company’s Website

Most gold IRA companies list their fees on their websites, so that’s a great place to start. Look for sections labeled “Fees,” “Pricing,” or “Cost Structure.” For example, Vantage IRA details fees like a $50 setup fee, a $275 annual record-keeping fee, and $75 transaction fees for buying or selling.

2. Request a Fee Schedule

If you can’t find the information online, give the company a call or send them an email asking for a detailed fee schedule. Make sure it covers all the potential costs, including account setup, annual maintenance, storage, transaction, and shipping fees. You can get in touch with iTrustCapital to learn more about their fee structure.

3. Compare Across Companies

Don’t settle for the first fee schedule you see. Check out multiple gold IRA companies to see how their fees stack up against each other. Some might have lower setup fees but higher annual costs, so it’s important to look at the total picture.

4. Read Customer Reviews

Customer reviews can offer valuable insights into how fair and transparent a company’s fees are. Look for testimonials that specifically mention fees to see what others are saying about their experiences. Checking out iTrustCapital reviews can be quite helpful. That’s a major reason why we prepared this iTrustCapital review.

5. Consult Financial Advisors

If you’re feeling uncertain about the fees or how they might affect your investment, talk to a financial advisor who knows the ins and outs of retirement accounts. They can help you understand which fees are reasonable and how they compare to industry norms.

By taking these steps, you can get a clear understanding of the fees associated with a gold IRA company before diving in. This way, you’ll be well-equipped to make informed decisions that align with your financial goals.

To ensure that users get the most out of their investments, iTrustCapital provides strong customer service along with several resources.

iTrustCapital’s website offers users immediate access to live chat support, enabling them to receive prompt assistance with any queries or problems.

Users can email the iTrustCapital support team with less urgent questions. Usually, the staff gets back to you within a day. For customers who would rather talk to a representative over the phone, iTrustCapital also provides phone help. To assist consumers in comprehending the specifics of cryptocurrency IRAs and making wise investment decisions, iTrustCapital offers a variety of instructional tools.

Good customer service is vital for any trader.

You should always check if a gold IRA company remains accessible to its customers and whether it offers multiple contact channels or not.

The most popular ways for recent customers are live chat and email.

While email is becoming a bit obsolete, it is still among the most common methods for a customer to contact the support staff of a broker.

In the case of iTrustCapital, it’s clear that they offer proper customer support with a significant variety of ways to contact them.

According to multiple users, iTrustCapital’s customer support is quite active and responds promptly to general queries and grievances.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

Several customers share their satisfaction with iTrustCapital, particularly the user-friendliness, customer service, and investing alternatives of the platform. The platform’s user-friendly design, which makes handling a self-directed IRA easier, is appreciated by investors. Both inexperienced and seasoned investors can easily navigate it, as demonstrated by the simple and seamless account setup. Customers are very happy with the wide variety of investment possibilities that iTrustCapital offers. This diversity improves an investor’s overall investing strategy by allowing them to customize their portfolios based on their unique risk tolerance and financial objectives.

iTrustCapital’s open and reasonable charge plan is another popular feature. Users like the flat monthly price and the transparent breakdown of transaction expenses. This affordability is a big attraction for people who want to invest as much as possible but don’t want to pay too much.

Customer service at iTrustCapital is also regularly praised in ratings. Users may easily and swiftly address any problems or inquiries they may have thanks to the availability of phone, email, and live chat help. The overall user experience is improved by this attentive and informed support staff, which gives investors a sense of value and support.

Overall, iTrustCapital’s user base gives it great ratings for its user-friendliness, variety of investment alternatives, clear pricing, strong security protocols, and first-rate customer service.

Here are some of the reviews shared by their customers:

Based on user-submitted reports, most of the iTrustCapital reviews are quite positive.

Customers praise the company for its prompt customer service and trader-friendly conditions.

However, it’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

While iTrustCapital doesn’t seem like a shady broker, many others rely on fake reviews to increase their credibility.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why we recommend doing extensive research on forex brokers before finalizing your selection.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews posted by temporary accounts (profiles that only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of iTrustCapital, however, we noticed that their reviews are legitimate.

Unlike their competitors, it seems iTrustCapital has put in a lot of resources into providing its traders with specialized customer service. This way, their customers remain happy and satisfied with their experience.

Also, we didn’t notice many significant iTrustCapital complaints. However, if you have any iTrustCapital reviews to share, feel free to contact us or share them in the comment section.

You should always look out for consumer complaints. The most common complaints in forex are usually regarding:

- Poor customer support

- Delays in payments

- High fees

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about iTrustCapital? You can share your complaint in the comment section or submit an anonymous tip.

iTrustCapital is a regulated entity. They are licensed and operate under the watch of a major financial regulator.

So, it’s clear that iTrustCapital is a legit gold broker.

You should avoid working with unregulated brokers. The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind the unregulated broker can run away with your money without any prior notice. It would help if you were extremely cautious when dealing with an unregulated service provider.

However, that’s not the case with iTrustCapital. It’s clear in our iTrustCapital broker review that they are a legitimate entity and enjoy a positive reputation in the market.

Can You Trust iTrustCapital?

All the evidence suggests that iTrustCapital is legit. However, we recommend checking out more options before finalizing your choice.

That’s why we recommend working with a trusted gold dealer. That way, you can avoid any hiccups and be certain of their reliability.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.