MangoMarkets has been identified as a risky opportunity by Intelligence Commissioner users. It is similar to Wecoinx. We’ve received over 5 complaints against MangoMarkets.

MangoMarkets is a DeFi platform on the Solana blockchain that has been involved in major scams, such as security breaches and market manipulation. Avraham Eisenberg, in particular, used market manipulation to get over $110 million by selling MangoMarkets tokens. These risks are made worse by the fact that the platform depends on outside services and that the Solana software has bugs. It then faced legal actions and regulatory responses that had an effect on its business and image. The DAO of MangoMarkets has taken steps to limit the damage, such as offering a large compensation plan to users who were harmed.

Get Your Money Back From These Scammers!

[mychargeback-form]

MangoMarkets, a decentralized finance (DeFi) network built on the Solana blockchain, has been embroiled in multiple major scandals. These include security breaches and market manipulation instances that have caused significant financial and reputational damage.

MangoMarkets runs on the Solana blockchain and is vulnerable to a variety of operational threats. Potential vulnerabilities in the Solana software might cause everything from improper behavior to a complete loss of cash.

The platform’s reliance on external services such as scrapers and cranks increases these risks because breakdowns in these services can cause substantial disruptions and display outdated or erroneous data to users.

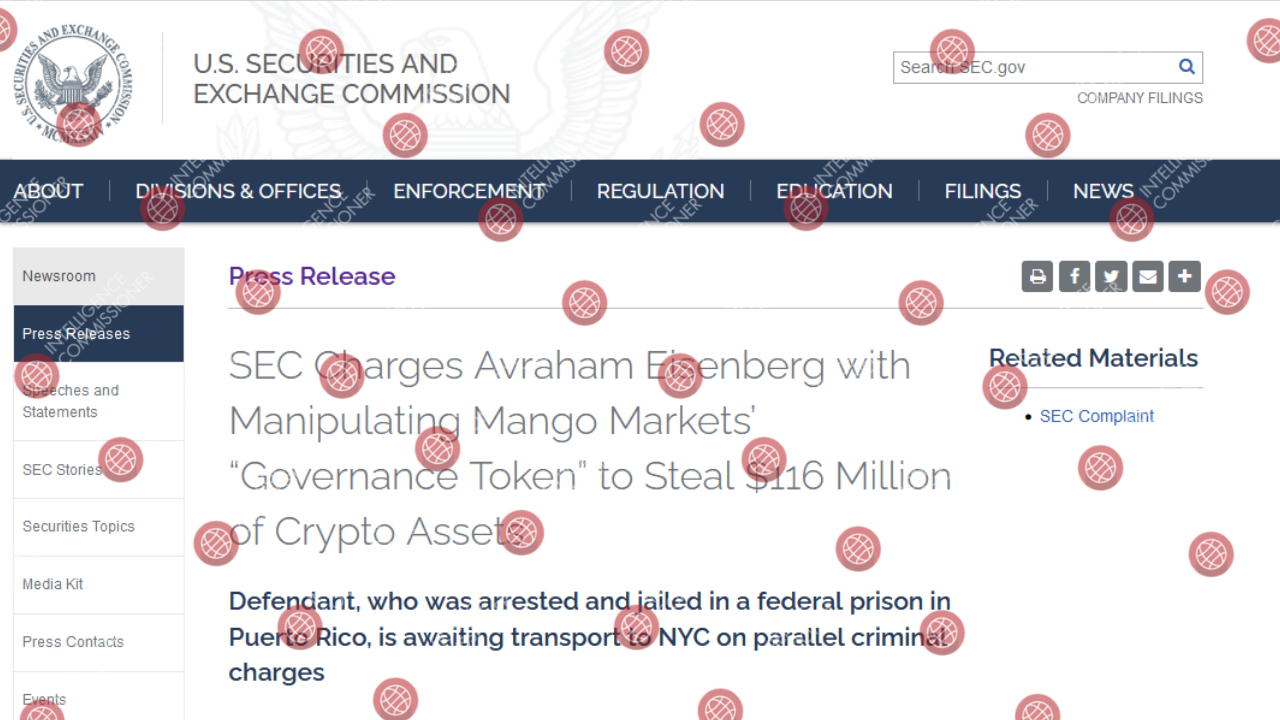

In October 2022, Avraham Eisenberg carried out a massive market manipulation incident on MangoMarkets. He manipulated the price of Mango’s governance token, MNGO, increasing its worth by more than 13 times in just 30 minutes. This enabled him to withdraw more than $110 million from MangoMarkets, using the inflated values of his investments as collateral.

Following the manipulation, Eisenberg was charged by the US Department of Justice, the Commodity Futures Trading Commission, and the Securities and Exchange Commission. The charges included commodities fraud, commodity manipulation, and wire fraud. MangoMarkets took private legal action against Eisenberg as well.

Mango DAO, MangoMarkets’ governing decentralized autonomous organization, responded to the exploit by passing a governance vote to utilize $42 million in USD Coin to reimburse affected customers, with the goal of mitigating financial harm.

In April 2024, Avraham Eisenberg was convicted of fraud and market manipulation for his acts on MangoMarkets. This case established an important legal precedent in the United States’ treatment of DeFi exploits, highlighting the difficulty of applying standard legal frameworks to blockchain technologies.

The incidents at MangoMarkets have aroused extensive debate regarding the security of DeFi platforms, the legal ramifications of blockchain vulnerabilities, and the roles of decentralized governance. These occurrences highlight the necessity of improved security measures, clearer legal frameworks, and better governance structures in preventing such incidents.

Avraham Eisenberg used MangoMarkets in October 2022 by significantly manipulating the platform to extract approximately $100 million in digital assets.

The lack of regulation or the presence of poor regulation is a huge red flag. It means MangoMarkets is a scam and most likely, an illegal operation.

Companies offering investment services or opportunities without having a license can vanish without leaving a trace. Furthermore, the lack of a regulatory license allows them to get away with it and face no legal consequences.

That’s why it’s vital for you to always check a company’s regulation status as well as its license information. The presence of a license allows consumers to reach out to an authority if something goes wrong.

In the case of MangoMarkets, victims have nowhere to go due to the absence of a watchdog or license.

You should ask yourself the following questions when you come across a new investment firm or opportunity:

- Does the investment provider maintain transparency about its CEO?

- Do they have a license from a renowned regulatory authority?

- If the need arises, can I reach out to an authority to report this company as a scam?

MangoMarkets offers a range of trading conditions and financial transaction methods tailored to the preferences of various traders. This detailed overview explores the trading environment and the facilities for deposits and withdrawals on the platform.

Trading Conditions on MangoMarkets

- Leverage and Margin Trading: Traders at MangMarkets can utilize up to 20x leverage on perpetual futures, enhancing potential trading outcomes through borrowed funds. The platform also supports cross-margin trading, allowing the use of all assets in a trader’s account as collateral, thus offering greater flexibility in trading strategies.

- Variety of Order Types: To suit different trading tactics, MangoMarkets supports various order types. This includes market orders, which are executed immediately at current market prices, and limit orders, where traders specify the maximum or minimum price they are willing to accept, ensuring better control over trading execution.

- Decentralized Exchange Model: Operating as a decentralized exchange (DEX) on the Solana blockchain, MangoMarkets facilitates direct peer-to-peer transactions, reducing reliance on intermediaries, enhancing security, and minimizing potential system failures.

- Enhanced Security Features: The platform incorporates numerous security protocols to safeguard user assets and mitigate risks linked to market volatility and manipulation, tailored specifically to the decentralized nature of the platform.

Deposit and Withdrawal Options

- Cryptocurrency Transactions: Users can deposit a variety of cryptocurrencies directly into their MangMarkets accounts, which can also be used as collateral for trading activities.

- Flexible Withdrawal Processes: MangoMarkets enables users to withdraw their assets directly to personal wallets or other external addresses, following the decentralized ethos of the platform.

- Wallet Integration: The platform supports integration with multiple cryptocurrency wallets, streamlining the process of deposits and withdrawals while ensuring secure and efficient fund management.

- Non-Support for Fiat Currency: In line with its decentralized framework, MangoMarkets does not directly support fiat currency deposits or withdrawals. Users are required to convert fiat currencies into cryptocurrencies through other exchanges prior to trading on MangoMarkets.

These features ensure that MangoMarkets remains a flexible and secure option for cryptocurrency trading, catering to a diverse range of trader needs with sophisticated trading tools and a robust operational infrastructure.

However, it’s worth noting that many scammers disable their payment channels before shutting down their operations.

They might give you multiple reasons including:

- A technical error

- A glitch in their system

- Banking issues

- A “hacking attack”

And many others.

But in 9/10 cases, the scammers stop making payments and keep the money to themselves. Hence, the payment methods we discussed here might not work.

If you want to get your money back from a scammer, you’d need to file a chargeback.

When it comes to scammers, you should only measure the quality of their customer service if they respond to your complaint.

In the beginning, scammers tend to remain very accessible.

This means their representatives will keep calling you until you invest with them. Furthermore, they will act friendly and make it seem as if you’re one of their most valuable consumers.

However, they do all this just to win your trust.

Scammers understand that to convince someone to give them a large sum, they will need to seem like a friend.

Nevertheless, when you have invested a considerable amount of money and need to get it back, their customer support will become inaccessible.

All of a sudden, their numbers would either stop responding or become unavailable.

Still, they might remain accessible to convince you to invest further. Also, they might begin by making a few excuses regarding your payment.

However, in the end, customer support won’t resolve your issues and become increasingly unavailable.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

It’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

Scammers like MangoMarkets tend to purchase fake reviews for their online profiles to make themselves seem more credible.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why you shouldn’t trust MangoMarkets reviews easily.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews posted by temporary accounts (profiles that only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of MangoMarkets, chances are, you wouldn’t find many legitimate reviews.

Another prominent way scammers like MangoMarkets enhance their credibility is by burying negative reviews and complaints under a lot of fake reviews.

This way, when you’ll look up “MangoMarkets reviews”, you might not find many complaints. Or, you might find them buried within numerous reviews praising MangoMarkets.

You should always look out for consumer complaints. In the case of MangoMarkets, the most common complaints I found were about:

- Poor customer support

- Delays in payments

- High fees

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about MangoMarkets? You can share your complaint in the comment section or submit an anonymous tip.

Eisenberg and his crew manipulated the MNGO price by transferring USDC into various accounts and holding large positions in MNGO perpetual swaps. These activities altered the price oracles, thereby increasing the value of MNGO.

The fake increase in MNGO prices enabled Eisenberg to obtain substantial loans against the inflated collateral value, taking significantly more from MangoMarkets than the true worth of his initial contributions.

Following the market manipulation, the community and legal authorities responded strongly. Eisenberg faced various charges, and MangoMarkets and its community worked to remedy the vulnerabilities and recover from the financial harm through governance initiatives and legal measures.

These instances have revealed key weaknesses in DeFi platforms, notably those involving pricing oracles and liquidity, and have sparked debate about the need for more security and regulatory control in the DeFi sector.

MangoMarkets is an unregulated entity. Although they might fall under the jurisdiction of a watchdog, they don’t have the license to offer financial services to consumers.

The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind MangoMarkets can run away with your money without any prior notice. It would help if you were extremely cautious when dealing with an unregulated service provider.

The absence of a watchdog also means you cannot report to them to anyone.

Also, due to the absence of specific regulations, there is no provision protecting you from the insolvency of this entity. If they go bankrupt, you won’t be able to do anything about it.

Can You Trust MangoMarkets?

All the evidence suggests that MangoMarkets is a scam. If you have lost money to them, there is still a chance you can get it back.

To recover your funds, you’d need to file a chargeback.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.