Monex is a significant gold dealer and has received a lot of praises from Intelligence Commissioner users. They have established themselves as an industry leader.

Monex Precious Metals has established itself as a market leader in precious metals, with over 50 years of experience assisting investors in diversifying their portfolios with gold, silver, platinum, and palladium. The company’s diverse product and service offerings, together with its commitment to client education and openness, make it a reliable choice for both new and experienced investors.

We suggest working with a trustworthy broker with specialized staff, latest tech and most importantly, customer-centric trading conditions. After reviewing 1000+ brokers, we rank the following company as the best:

Monex Precious Metals is a significant trader in the US precious metals industry, with over 50 years of experience. Monex has helped countless investors diversify their portfolios since its founding by providing a wide range of gold, silver, platinum, and palladium options. With a focus on both individual and business clients, Monex has always supplied dependable services in the turbulent realm of precious metals. In this post, we will look at Monex’s offers, the relevance of precious metals, and the reasons behind the company’s strong reputation in the business.

Monex Precious Metals, founded in 1967, has established itself as a trusted name in the precious metals market. The organization serves a wide spectrum of customers, from those new to precious metals to seasoned investors looking to diversify their portfolios further. Monex’s longevity and business knowledge have allowed it to provide a diverse range of services that appeal to both people and institutions.

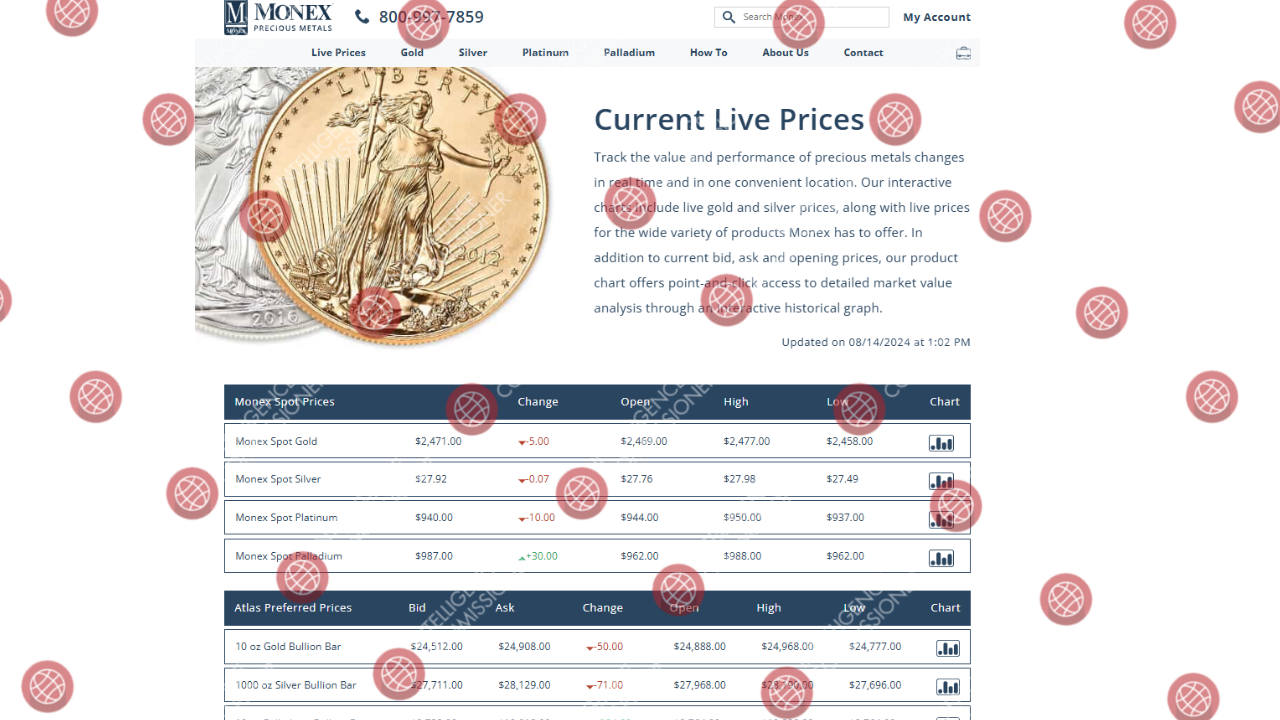

Monex prioritizes openness, giving live market pricing and thorough historical information for gold, silver, platinum, and palladium. The company’s principal purpose is to assist investors in making sound judgments concerning precious metals, which have long been regarded as a safe haven during times of economic instability. With the continuous volatility in global markets, precious metals remain an important part of portfolio diversification and asset protection.

Monex Precious Metals differentiates itself from competitors by providing a wide range of products and services tailored to the needs of its broad clientele. Whether you’re an individual looking to invest in physical gold or a commercial investor trying to diversify your retirement portfolio with precious metals, Monex offers thorough assistance throughout the investment process.

Physical Bullion and Coins

Monex provides a diverse selection of physical bullion products, including gold, silver, platinum, and palladium in bars and coins. These precious metals are sourced from respected mints all across the world, ensuring that investors get high-quality products. Physical bullion provides investors with the tangible benefit of holding precious metals directly, which may be stored either privately or through third-party storage options. This strategy appeals to investors who want to maintain control over their investments and value the security that actual metals provide.

Gold, the most common precious metal, has traditionally been seen as a store of value during times of financial upheaval. Monex provides gold bullion in a variety of formats, including gold bars and coins, which are available in a variety of sizes and weights to suit various investment plans. Whether an investor wants to buy a 1-ounce gold bar or a lower quantity, Monex offers a comprehensive range to satisfy their demands.

Silver is also an essential asset in precious metal investing. It, like gold, provides a hedge against inflation and currency depreciation, but at a lower cost. Monex provides silver bullion in both bar and coin form, allowing investors to select the solution that best meets their needs. In addition to current bullion, Monex sells silver quarters, which have historical and cultural value for collectors and investors alike.

Monex allows investors to diversify their portfolios beyond gold and silver by including platinum and palladium. These metals are not only good investments, but they are also used in industrial applications like car manufacture and electronics. Platinum and palladium are available in both bar and coin forms, enabling additional investment options.

Purchasing and Selling Precious Metals

One of Monex’s primary products is its two-way market, which allows investors to purchase and sell precious metals with ease. The company allows investors to purchase precious metals at current market prices, and when they are ready to sell, they can take advantage of Monex’s Buy Back Program. This program provides a streamlined approach for selling holdings, offering investors the flexibility they need to turn their precious metals into cash.

Investors benefit greatly from the simplicity with which they can buy and sell precious metals. Monex’s experience in market timing, combined with its clear pricing, enables investors to make informed judgments. Furthermore, by providing a two-way market, Monex assures that investors have sufficient liquidity to enter and exit positions when market conditions change.

Precious metals have become a popular retirement savings vehicle, notably through Individual Retirement Accounts (IRAs). Monex enables the inclusion of precious metals in self-directed IRAs, allowing investors to store physical gold, silver, platinum, and palladium in their retirement accounts. This solution combines the tax benefits of an IRA with the security and stability that precious metals bring.

Setting up a precious metals IRA with Monex is simple, and account professionals are ready to walk investors through the process. Monex assists investors in selecting qualified goods that meet IRS standards and gives information on how to manage their accounts successfully. While Monex does not serve as a custodian for these IRAs, it works with third-party custodians who specialize in the storage and maintenance of precious metals in retirement accounts.

As the global economy evolves, precious metals continue to play an important role in investment strategy. Monex Precious Metals is well-positioned to help clients manage the complexity of the precious metals market and guarantee their financial futures with tangible, long-lasting assets. Whether you want to invest in gold for its historical worth or diversify with platinum and palladium, Monex has the expertise and resources to help you reach your financial objectives.

These regulatory bodies play a crucial role in maintaining the integrity of the forex market by enforcing rules and regulations, ensuring transparency, and protecting traders and investors from fraudulent activities.

Checking the regulatory status of brokers like Monex is quite beneficial. It inspires trust in the brand.

While Monex is open about precious metals’ live prices, it is vital to note that these prices do not include commissions. Investors should be aware that purchasing precious metals incurs additional charges, such as commissions and premiums above the spot price. These fees may differ based on the goods and market conditions at the time of purchase.

When acquiring actual bullion from Monex, you must also consider shipping and insurance fees. While insurance is included in the shipment cost, the specific shipping rates are not usually disclosed upfront. Furthermore, investors who want to keep their precious metals in an IRA or another custodial account should be wary of potential storage fees. Monex does not operate as a custodian for precious metals IRAs, thus investors must use a third-party custodian to store and manage their funds.

Despite these increased fees, Monex’s dedication to transparency and diverse range of services position it as a formidable competitor in the precious metals market. The company’s emphasis on customer education and support helps to alleviate concerns about fees while also ensuring that clients are kept informed throughout the investment process.

Staying current with market trends is critical for every investor, and Monex delivers on this front by providing real-time access to live pricing for all of the precious metals it deals in. In addition to current market prices, Monex offers historical charts that allow investors to track price changes over time. These tools are extremely useful for investors who want to make informed decisions on when to buy or sell their holdings.

By providing live pricing and thorough historical data, Monex enables its clients to stay ahead of market trends and make more smart investments. Investors can get this information via Monex’s website, which is routinely updated to reflect the most recent market events. The availability of this data demonstrates Monex’s dedication to transparency and its goal of providing investors with the knowledge they require to succeed.

Investing in precious metals can be difficult, particularly for those new to the market. Monex provides experienced account representatives to help investors make educated decisions. These professionals work directly with clients to explain the advantages of precious metals, answer questions, and provide individualized advice based on their specific investment objectives.

In addition to one-on-one coaching, Monex’s website contains a plethora of instructional tools. These publications cover a wide range of issues, including the significance of precious metals in portfolio diversification, gold’s benefits as an inflation hedge, and how to set up a precious metals IRA. Monex provides individual advice as well as instructional content to ensure that clients have the skills they need to make informed investment decisions.

Precious metals have traditionally been appreciated for their scarcity and intrinsic value, making them an important part of wealth preservation schemes around the world. Their historical position as a store of value, particularly during periods of economic uncertainty, has made them a popular alternative for investors seeking to protect their capital.

One of the key reasons investors like precious metals is their capacity to serve as a hedge against inflation and currency depreciation. During periods of economic instability, when paper currencies may lose purchasing power, precious metals such as gold and silver tend to preserve their value. This makes them an appealing option for investors concerned about the possible loss of capital owing to rising inflation or a weaker dollar.

Gold, in particular, has traditionally been used as an inflation hedge. Its value has remained relatively consistent over the years, giving it a dependable source of wealth even in times of economic crisis. Silver, while more volatile than gold, protects against inflation, particularly during periods of increased demand in areas such as electronics and solar energy.

Diversification is a key tenet of investment strategy, and precious metals play an important role in creating a well-balanced portfolio. Adding gold, silver, platinum, or palladium to their portfolios might help investors minimize their risk exposure in other asset classes like equities and bonds. Precious metals tend to fluctuate independently of typical financial markets, which means that when stocks underperform, their value may rise.

This negative correlation between precious metals and other investments contributes to lower total portfolio risk and smoother returns over time. During moments of market volatility, allocating a portion of a portfolio to precious metals can provide stability and mitigate the impact of downturns in other areas.

Safe Haven During Economic Uncertainty

Precious metals are commonly referred to be “safe haven” assets due to their propensity to retain value during times of economic or geopolitical uncertainty. During times of crisis, investors frequently rush to precious metals to protect their capital from market volatility and uncertainty. During the 2008 global financial crisis, gold prices skyrocketed as investors sought protection from collapsing stock markets and failing banks.

Monex Precious Metals has established itself as a trusted name in the precious metals sector due to its comprehensive service offerings and dedication to customer satisfaction. Over the years, the company has established a reputation for market experience, dependable customer service, and instructional materials, making it a top choice for investors looking to enter the precious metals market.

You should always check the fee structure of a gold dealer.

That’s primarily because they have a direct impact on your potential returns. Moreover, each gold dealer such as Monex has distinct trading conditions.

A major part of checking the trading conditions of a broker is to verify their available payment methods.

In the case of Monex, you can see that there are multiple options available.

It makes them accessible to traders. Furthermore, it ensures that people can trade freely.

We recommend working with a reliable and trusted broker.

How to Check the Fees of a Gold IRA Company

Navigating the fees of a gold IRA company like Monex can seem daunting, but following these simple steps can make it much easier:

1. Visit the Company’s Website

Most gold IRA companies list their fees on their websites, so that’s a great place to start. Look for sections labeled “Fees,” “Pricing,” or “Cost Structure.” For example, Vantage IRA details fees like a $50 setup fee, a $275 annual record-keeping fee, and $75 transaction fees for buying or selling.

2. Request a Fee Schedule

If you can’t find the information online, give the company a call or send them an email asking for a detailed fee schedule. Make sure it covers all the potential costs, including account setup, annual maintenance, storage, transaction, and shipping fees. You can get in touch with Monex to learn more about their fee structure.

3. Compare Across Companies

Don’t settle for the first fee schedule you see. Check out multiple gold IRA companies to see how their fees stack up against each other. Some might have lower setup fees but higher annual costs, so it’s important to look at the total picture.

4. Read Customer Reviews

Customer reviews can offer valuable insights into how fair and transparent a company’s fees are. Look for testimonials that specifically mention fees to see what others are saying about their experiences. Checking out Monex reviews can be quite helpful. That’s a major reason why we prepared this Monex review.

5. Consult Financial Advisors

If you’re feeling uncertain about the fees or how they might affect your investment, talk to a financial advisor who knows the ins and outs of retirement accounts. They can help you understand which fees are reasonable and how they compare to industry norms.

By taking these steps, you can get a clear understanding of the fees associated with a gold IRA company before diving in. This way, you’ll be well-equipped to make informed decisions that align with your financial goals.

Good customer service is vital for any trader.

You should always check if a gold IRA company remains accessible to its customers and whether it offers multiple contact channels or not.

The most popular ways for recent customers are live chat and email.

While email is becoming a bit obsolete, it is still among the most common methods for a customer to contact the support staff of a broker.

In the case of Monex, it’s clear that they offer proper customer support with a significant variety of ways to contact them.

According to multiple users, Monex’s customer support is quite active and responds promptly to general queries and grievances.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

Monex’s long history in the sector has earned them a reputation as a dependable and trustworthy dealer. The company’s emphasis on customer service is seen in several good testimonials from both clients and workers. Investors love the skilled account agents who guide them through the complexity of precious metals investing, while staff value the company’s dedication to providing excellent service.

Monex’s commitment to transparency and client satisfaction is reflected in the tools available on its website. Monex provides its clients with the information they need to make smart investment decisions, including current pricing, detailed historical charts, and educational content.

Precious metals continue to serve an important role in wealth preservation and portfolio diversification, providing protection from inflation, currency depreciation, and economic uncertainty. Monex’s two-way market, precious metals IRAs, and live pricing tools offer investors the flexibility and support they need to make sound investment decisions.

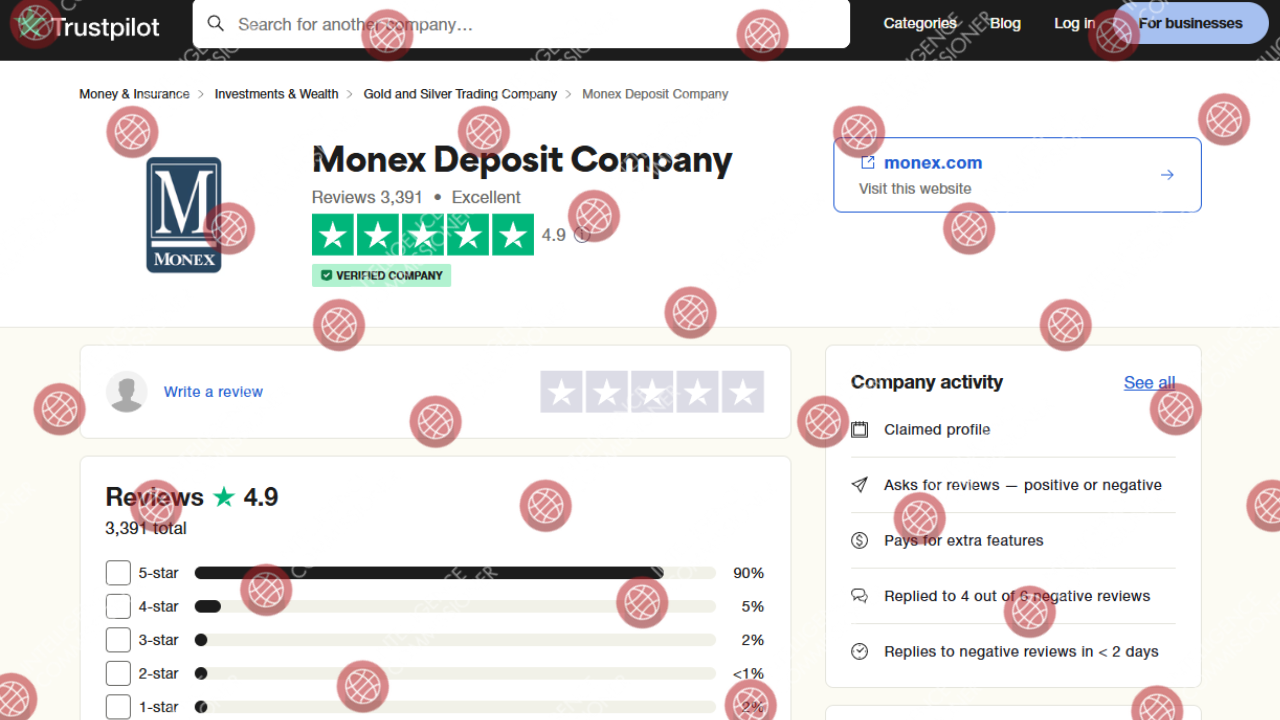

Based on user-submitted reports, most of the Monex reviews are quite positive.

Customers praise the company for its prompt customer service and trader-friendly conditions.

However, it’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

While Monex doesn’t seem like a shady broker, many others rely on fake reviews to increase their credibility.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why we recommend doing extensive research on forex brokers before finalizing your selection.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews posted by temporary accounts (profiles that only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of Monex, however, we noticed that their reviews are legitimate.

Unlike their competitors, it seems Monex has put in a lot of resources into providing its traders with specialized customer service. This way, their customers remain happy and satisfied with their experience.

Also, we didn’t notice many significant Monex complaints. However, if you have any Monex reviews to share, feel free to contact us or share them in the comment section.

You should always look out for consumer complaints. The most common complaints in forex are usually regarding:

- Poor customer support

- Delays in payments

- High fees

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about Monex? You can share your complaint in the comment section or submit an anonymous tip.

Monex is a regulated entity. They are licensed and operate under the watch of a major financial regulator.

So, it’s clear that Monex is a legit gold broker.

You should avoid working with unregulated brokers. The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind the unregulated broker can run away with your money without any prior notice. It would help if you were extremely cautious when dealing with an unregulated service provider.

However, that’s not the case with Monex. It’s clear in our Monex broker review that they are a legitimate entity and enjoy a positive reputation in the market.

Can You Trust Monex?

All the evidence suggests that Monex is legit. However, we recommend checking out more options before finalizing your choice.

That’s why we recommend working with a trusted broker. That way, you can avoid any hiccups and be certain of their reliability.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.