Prime Assets Pro has been identified as a risky opportunity by Intelligence Commissioner users. It is similar to TrustsCapital. We’ve received over 6 complaints against Prime Assets Pro.

Prime Assets Pro claims to be a regulated forex broker, however there are numerous red flags and anomalies that cause caution. It lacks key safeguards, transparency, and proper license, implying possible illegality. The platform misrepresents its offerings and charges excessive prices. Users should proceed with utmost caution and pick well-regulated brokers for a secure trading experience.

We suggest working with a trustworthy broker with specialized staff, latest tech and most importantly, customer-centric trading conditions. After reviewing 1000+ brokers, we rank the following company as the best:

Prime Assets Pro advertises itself as a regulated forex broker, but a deeper look exposes numerous irregularities and red flags. This essay examines the important components of Prime Assets Pro and explains why it may not be a legal financial services company.

Prime Assets Pro claims to be a regulated firm. However, there are considerable inconsistencies in the regulatory assertions. Prime Assets Pro, unlike UK, EU, AU, and US licensed brokers, does not provide critical safeguards such as guaranteed money, segregated accounts, or negative balance protection. The lack of a corporate name and access to legal papers further erodes its legitimacy. While the website has a UK contact address and an image of a certificate, the paperwork only references the brand name “Wave Pro Trade,” not Prime Assets Pro.

The British financial authorities have given unambiguous warnings about the dubious nature of Prime Assets Pro, emphasizing that it is not a reliable business.

The lack of regulation or the presence of poor regulation is a huge red flag. It means Prime Assets Pro might be a scam or most likely, an illegal operation.

Companies offering investment services or opportunities without having a license can vanish without leaving a trace. Furthermore, the lack of a regulatory license allows them to get away with it and face no legal consequences.

That’s why it’s vital for you to always check a company’s regulation status as well as its license information. The presence of a license allows consumers to reach out to an authority if something goes wrong.

In the case of Prime Assets Pro, victims have nowhere to go due to the absence of a watchdog or license.

You should ask yourself the following questions when you come across a new investment firm or opportunity:

- Does the investment provider maintain transparency about its CEO?

- Do they have a license from a renowned regulatory authority?

- If the need arises, can I reach out to an authority to report this company as a scam?

Trading Platform Issues

Prime Assets Pro advertises access to the MetaTrader 5 (MT5) platform, which is renowned for its extensive tools and features. Users are instead given a basic web platform that lacks functionality and is unrelated to MT5. This disparity suggests that Prime Assets Pro may be employing a fraudulent platform to defraud users.

Legitimate brokers provide dependable and feature-rich platforms such as MT4, MT5, and cTrader, which contain many indicators, custom indicators, auto trading features, and mobile apps for Android and iOS.

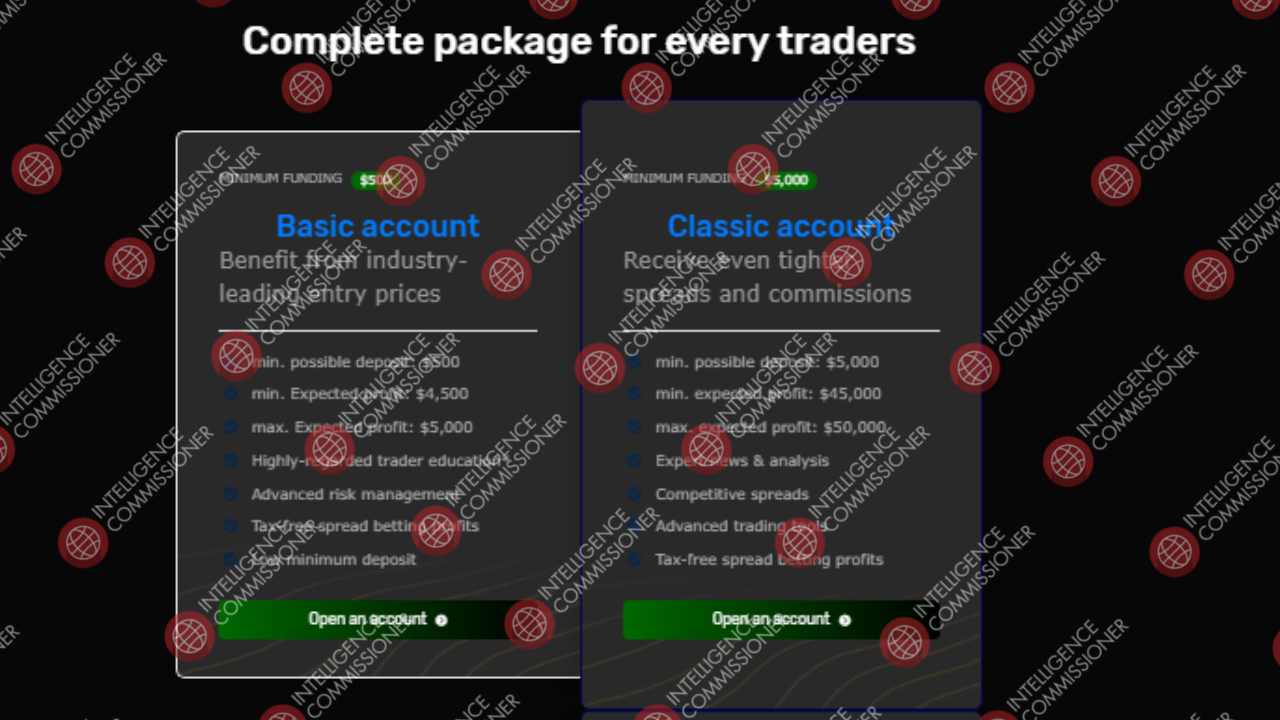

Prime Assets Pro has a $500 minimum deposit, which is much higher than many respectable brokers in the business. For example, FP Markets demands a $100 minimum deposit, XM only needs $5, while HFM accepts deposits as low as $0. This high entry hurdle may dissuade beginner traders and signal an attempt to take further dollars from naïve consumers.

Although Prime Assets Pro promises to handle a variety of payment options, only Bitcoin deposits are accepted. Because bitcoin transactions are irreversible and difficult to track, dishonest brokers sometimes choose them. Legitimate brokers, on the other hand, offer a wide range of transparent payment methods, including credit/debit cards, bank transfers, and popular e-wallets such as PayPal, Neteller, and Skrill.

Prime Assets Pro claims to offer trading in all major asset classes, including currencies, equities, indices, cryptocurrencies, and commodities. However, the platform lacks the legal authority or technical capacity to facilitate such transactions. Furthermore, FCA regulations restrict genuine UK brokers from selling cryptocurrency derivatives trading to retail users.

When it comes to spreads, Prime Assets Pro does not disclose particular information, instead making broad assurances of solid gains. Genuine brokers, on the other hand, explicitly define their trading terms, including spreads, leverage, and other critical parameters.

Prime Assets Pro fails to reveal its leverage ratios, which is a warning indicator. To safeguard retail traders from large losses, regulated brokers in the United Kingdom, the European Union, Australia, and the United States must follow rigorous leverage limitations. For example, in the UK and EU, the maximum leverage allowed for major currency pairings is 1:30, whereas in the US it is 1:50, and similar limits apply to other assets. High leverage offerings without adequate disclosure can be indicative of potential scams.

Prime Assets Pro does not disclose any details about its withdrawal procedures, fees, or minimum withdrawal amounts. This lack of transparency raises concerns that the broker may impose hidden fees or impossible withdrawal conditions, both of which are standard methods employed by fraudulent firms to hold client cash.

However, it’s worth noting that many forex scams disable their payment channels before shutting down their operations.

They might give you multiple reasons including:

- A technical error

- A glitch in their system

- Banking issues

- A “hacking attack”

And many others.

But in 9/10 cases, shady forex brokers stop making payments and keep the money to themselves. Hence, the payment methods we discussed here might not work.

To avoid such scenarios, it’s best to work with a reliable and trusted broker.

When it comes to forex brokers, you should only measure the quality of their customer service if they respond to your complaint.

In the beginning, shady brokers tend to remain very accessible.

This means their representatives will keep calling you until you invest with them. Furthermore, they will act friendly and make it seem as if you’re one of their most valuable consumers.

However, they do all this just to win your trust.

Shady brokers understand that to convince someone to give them a large sum, they will need to seem like a friend.

Nevertheless, when you have invested a considerable amount of money and need to get it back, their customer support will become inaccessible.

All of a sudden, their numbers would either stop responding or become unavailable.

Still, they might remain accessible to convince you to invest further. Also, they might begin by making a few excuses regarding your payment.

However, in the end, customer support won’t resolve your issues and become increasingly unavailable.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

It’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

Even if Prime Assets Pro might not be a scam, brokers like them rely on fake reviews to increase their credibility.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why you shouldn’t trust the online Prime Assets Pro reviews easily.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews posted by temporary accounts (profiles that only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of Prime Assets Pro, chances are, you wouldn’t find many legitimate reviews.

Another prominent way brokers like Prime Assets Pro enhance their credibility is by burying negative reviews and complaints under a lot of fake reviews.

This way, when you’ll look up “Prime Assets Pro reviews”, you might not find many complaints. Or, you might find them buried within numerous reviews praising Prime Assets Pro.

You should always look out for consumer complaints. In the case of Prime Assets Pro, the most common complaints I found were about:

- Poor customer support

- Delays in payments

- High fees

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about Prime Assets Pro? You can share your complaint in the comment section or submit an anonymous tip.

Prime Assets Pro is an unregulated entity. Although they might fall under the jurisdiction of a watchdog, they don’t have the license to offer financial services to consumers.

The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind Prime Assets Pro can run away with your money without any prior notice. It would help if you were extremely cautious when dealing with an unregulated service provider.

The absence of a watchdog also means you cannot report to them to anyone.

Also, due to the absence of specific regulations, there is no provision protecting you from the insolvency of this entity. If they go bankrupt, you won’t be able to do anything about it.

Can You Trust Prime Assets Pro?

Prime Assets Pro exhibits multiple red flags of an untrustworthy and maybe unscrupulous broker. From a lack of regulatory compliance and transparency to false information regarding its trading platform and payment methods, the evidence clearly suggests that traders should proceed with extreme care. For a safe and secure trading experience, it is best to use well-regulated brokers who operate from established financial hubs. These brokers follow strict standards to ensure financial stability and the safety of client cash.

All the evidence suggests that Prime Assets Pro might be a scam. You shouldn’t risk your funds with a broker you don’t fully trust.

That’s why we recommend working with a trusted broker. That way, you can avoid any hiccups and be certain of

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.