Rosland Capital is a significant gold dealer and has received a lot of praises from Intelligence Commissioner users. They have established themselves as an industry leader.

Rosland Capital has established itself as a reliable and recognized participant in the precious metals market, providing a diverse range of products and services to fulfill the demands of investors worldwide. Whether you want to buy gold and silver for direct ownership or invest in precious metals through a tax-advantaged IRA, Rosland Capital offers the knowledge, transparency, and customer service you need to make sound investment decisions.

We suggest working with a trustworthy broker with specialized staff, latest tech and most importantly, customer-centric trading conditions. After reviewing 1000+ brokers, we rank the following company as the best:

Rosland Capital, founded in 2008 by Marin Aleksov, has established itself as a market leader in the precious metals business, specialized in the selling of gold, silver, platinum, and palladium products. The corporation, headquartered in Los Angeles, California, has expanded its footprint both in the United States and worldwide, with independent offices in London, Paris, and Munich. Rosland Capital’s aim is to provide customers with the chance to diversify their investment portfolios by incorporating real assets that have traditionally served as a buffer against economic volatility and inflation.

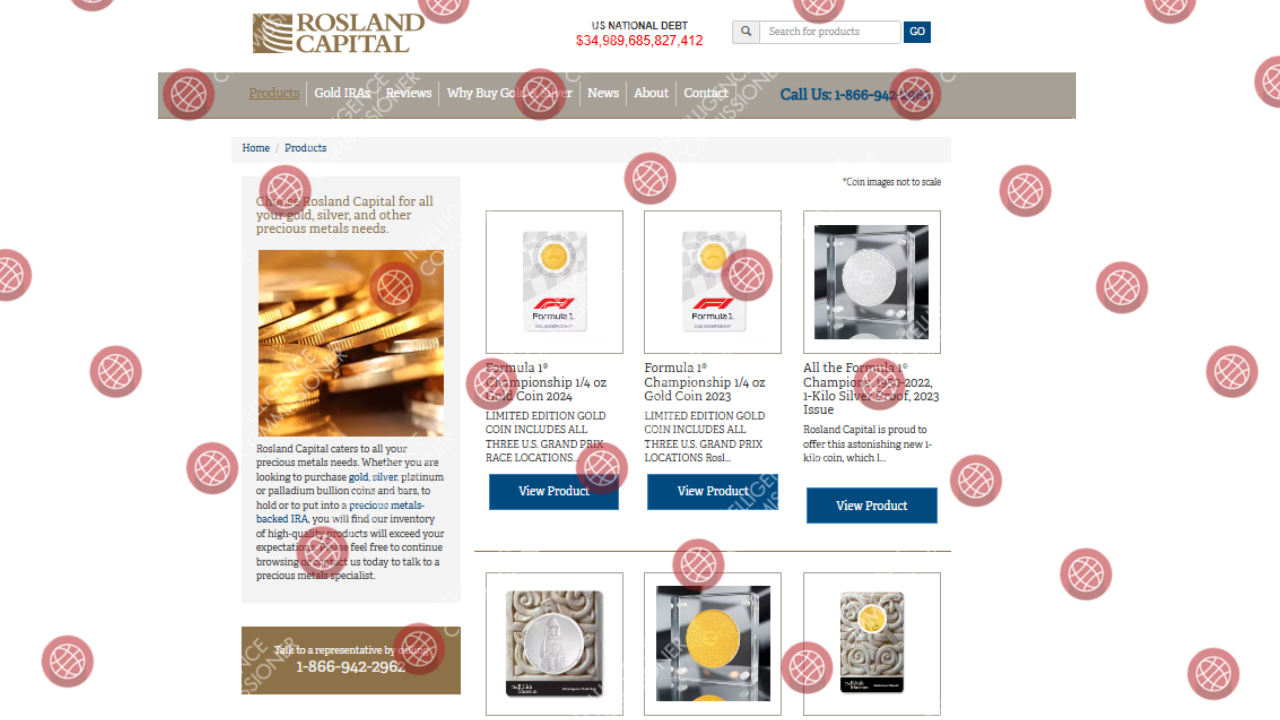

Products & Services

Rosland Capital’s product offerings are diverse, catering to both individual investors intending to buy precious metals directly and those seeking to include these assets into their retirement portfolios via precious metal-backed Individual Retirement Accounts (IRAs). The following is a summary of the key products and services offered by the company:

Bullion containing gold, silver, platinum, and palladium

Rosland Capital provides a diverse range of bullion goods, including bars and coins made of gold, silver, platinum, and palladium. These bullion items are available for direct purchase, allowing investors to gain physical possession of their assets. These bullion items can also be included in a gold-backed IRA, which allows you to invest in precious metals while saving money on taxes.

The company’s bullion offers are intended to fulfill the needs of a wide range of customers, from first-time investors to experienced collectors. The bars and coins are available in a variety of weights and denominations, allowing consumers to select the solution that best suits their investment objectives and budget. Whether you want to buy a single gold coin to hedge against inflation or a large amount of silver bullion as a long-term investment, Rosland Capital has a product to fit your requirements.

Specialty Coins

One of Rosland Capital’s most notable offerings is its collection of rare specialty coins. These coins were created in partnership with famous institutions such as Formula One, the PGA Tour, and the British Museum, making them highly desirable to collectors and investors alike. These limited-edition coins come in a variety of weights and materials, including gold and silver, and frequently honor noteworthy events, figures, or achievements.

For example, Rosland Capital’s collaboration with Formula 1 has resulted in a collection of coins commemorating historic occasions and individuals in motorsport. Similarly, the company’s relationship with the PGA Tour has resulted in a collection of coins that golf lovers will cherish. These specialty coins have both inherent worth due to their precious metal content and added value as collected goods, making them a distinctive addition to any financial portfolio.

Rosland Capital has a solid offering for customers looking to invest in precious metals via Individual Retirement Accounts (IRAs). The organization provides both standard and Roth IRAs, allowing investors to select the option that best meets their financial objectives and tax planning techniques. Gold IRAs combine the tax benefits of retirement savings with the security of investing in real assets such as gold, silver, platinum, and palladium.

Rosland Capital’s gold IRA investment method is uncomplicated. The company’s team of professionals helps clients set up their IRA accounts, choose appropriate precious metals to include, and arrange for secure asset storage. Rosland Capital prioritizes transparency throughout the process, ensuring that clients are fully aware of all aspects of their investment, including potential risks and rewards.

Rosland Capital distinguishes itself from other precious metals enterprises by participating in innovative initiatives and humanitarian projects. These initiatives not only improve the company’s brand image, but also add value to customers who want to support worthwhile causes with their investments.

One of Rosland Capital’s significant philanthropic projects was the release of a $5 Fisher House coin in 2014. A portion of the proceeds from the sale of these coins were contributed to the Fisher House Foundation, which offers temporary accommodation to families of veterans and military service members undergoing treatment at military medical facilities. This project demonstrates Rosland Capital’s dedication to assisting veterans and their families, and it allows consumers to donate to a worthwhile cause while investing in precious metals.

In addition to its humanitarian endeavors, Rosland Capital sells a variety of commemorative coin collections honoring historical personalities and events. One such collection celebrates the career of the renowned Formula One driver Ayrton Senna. This collection was developed in partnership with the Senna Institute, a non-profit organization that promotes educational and social projects in Brazil. The Ayrton Senna collection features limited-edition coins made of gold and silver, which are very sought among collectors and motorsport enthusiasts.

Global Presence

While Rosland Capital is primarily based in the United States, it has grown its global presence through autonomous offices in the United Kingdom, Germany, and France. These offices are manned by precious metals professionals who offer specialized services suited to the demands of consumers from various locations.

Rosland Capital’s UK office, located in London, provides a variety of goods and services identical to those offered in the United States. The UK team is well-versed in local market conditions and laws, which helps British investors understand the complexity of precious metals investing. The London office also plays an important part in the company’s affiliations with organizations such as the British Museum, lending prominence to Rosland Capital’s products.

Rosland Capital has an office in Munich, Germany, where it serves German investors interested in precious metals. The Munich team offers specialist advice on the different investment choices available, such as direct purchases of gold and silver and precious metal-backed IRAs. The German office also serves as a hub for the company’s European activities, ensuring that customers around the continent receive the same high level of service and support.

These regulatory bodies play a crucial role in maintaining the integrity of the forex market by enforcing rules and regulations, ensuring transparency, and protecting traders and investors from fraudulent activities.

Checking the regulatory status of brokers like Rosland Capital is quite beneficial. It inspires trust in the brand.

Understanding the accompanying fees is crucial when investing in precious metals, especially through an IRA. Rosland Capital is devoted to fee transparency, ensuring that clients understand the costs associated with their investments. Rosland Capital charges the following fees for its services:

Account Setup and Maintenance Fees: Rosland Capital charges a $50 one-time account setup fee and a $100 annual maintenance cost for IRAs. These fees cover the administrative costs of operating the IRA and complying with IRS rules.

Storage Fees: Precious metals purchased through an IRA must be maintained in an approved depository to maintain the account’s tax-advantaged status. Rosland Capital offers a variety of storage alternatives, with annual rates ranging from $100 to $150, depending on the type of storage selected. The organization collaborates with reliable storage providers to ensure the safety and security of its clients’ valuables.

hardcopy Statement cost: While electronic statements are free, clients who prefer hardcopy statements pay a $40 cost. This fee covers the expense of printing and mailing statements.

Transaction Fees: Rosland Capital charges transaction commission fees and spreads, which can vary greatly depending on the product and market conditions. The costs might range from 4% to 33%. The organization guarantees that clients are aware of these fees up front, allowing them to make informed investing decisions.

Rosland Capital offers a wide range of investment alternatives to meet the diverse needs of its clients. Whether you want to buy actual gold and silver for direct ownership or invest in precious metals through a tax-advantaged IRA, the organization has options to suit your needs.

Rosland Capital allows anyone interested in owning physical precious metals to purchase gold, silver, platinum, and palladium directly. These purchases can be made on the company’s website or by contacting a customer service agent. Direct ownership of precious metals gives investors the assurance of having a tangible asset that can be swiftly liquidated if necessary.

Investing in a precious metal-backed IRA with Rosland Capital helps people to diversify their retirement portfolios with assets that have traditionally held their value during times of economic turmoil. The company’s gold IRA alternatives are intended to give investors with a tax-efficient way to invest in precious metals, with the potential for both capital appreciation and inflation protection.

Rosland Capital’s operation in France is concentrated on its Paris office, which provides the same goods and services as the company’s other worldwide sites. The Paris team is dedicated to assisting French investors in diversifying their portfolios with precious metals, providing personalized advice and support to ensure that customers make sound investment decisions. The Paris office also plays an important role in the company’s European cooperation, adding to Rosland Capital’s reputation as a reliable partner for precious metals investments around the world.

One of Rosland Capital’s basic concepts is the need of diversification in an investment portfolio. In an era of economic uncertainty, where traditional assets such as equities and bonds can be highly volatile, precious metals provide a solid and dependable alternative.

Gold and other precious metals have long been considered a safeguard against inflation. Unlike paper currency, which can lose value over time owing to inflationary pressures, precious metals tend to hold their value and even grow during times of economic uncertainty. This makes them an appealing option for investors trying to maintain their purchasing power and wealth in the long run.

In addition to acting as an inflation hedge, precious metals can also guard against stock market volatility. When financial markets suffer a downturn, the value of precious metals frequently rises, providing a counterbalance to losses in other areas of an investment portfolio. Because of their inverse relationship with traditional assets, precious metals are an effective risk management strategy.

Another benefit of investing in precious metals is the ability to own a physical asset. Unlike stocks and bonds, which reflect firm ownership or financial obligations, precious metals are tangible assets that can be kept, stored, and transferred. This tangibility creates a sense of security and control that other sorts of investments cannot always offer.

You should always check the fee structure of a gold dealer.

That’s primarily because they have a direct impact on your potential returns. Moreover, each gold dealer such as Rosland Capital has distinct trading conditions.

A major part of checking the trading conditions of a broker is to verify their available payment methods.

In the case of Rosland Capital, you can see that there are multiple options available.

It makes them accessible to traders. Furthermore, it ensures that people can trade freely.

We recommend working with a reliable and trusted broker.

How to Check the Fees of a Gold IRA Company

Navigating the fees of a gold IRA company like Rosland Capital can seem daunting, but following these simple steps can make it much easier:

1. Visit the Company’s Website

Most gold IRA companies list their fees on their websites, so that’s a great place to start. Look for sections labeled “Fees,” “Pricing,” or “Cost Structure.” For example, Vantage IRA details fees like a $50 setup fee, a $275 annual record-keeping fee, and $75 transaction fees for buying or selling.

2. Request a Fee Schedule

If you can’t find the information online, give the company a call or send them an email asking for a detailed fee schedule. Make sure it covers all the potential costs, including account setup, annual maintenance, storage, transaction, and shipping fees. You can get in touch with Rosland Capital to learn more about their fee structure.

3. Compare Across Companies

Don’t settle for the first fee schedule you see. Check out multiple gold IRA companies to see how their fees stack up against each other. Some might have lower setup fees but higher annual costs, so it’s important to look at the total picture.

4. Read Customer Reviews

Customer reviews can offer valuable insights into how fair and transparent a company’s fees are. Look for testimonials that specifically mention fees to see what others are saying about their experiences. Checking out Rosland Capital reviews can be quite helpful. That’s a major reason why we prepared this Rosland Capitalreview.

5. Consult Financial Advisors

If you’re feeling uncertain about the fees or how they might affect your investment, talk to a financial advisor who knows the ins and outs of retirement accounts. They can help you understand which fees are reasonable and how they compare to industry norms.

By taking these steps, you can get a clear understanding of the fees associated with a gold IRA company before diving in. This way, you’ll be well-equipped to make informed decisions that align with your financial goals.

Rosland Capital prioritizes client service and education, understanding that knowledgeable investors are more likely to make sound investment decisions. The organization provides a variety of materials to help both rookie and expert investors understand the rewards and hazards of investing in precious metals.

Rosland Capital’s website contains a multitude of educational information, including articles, videos, and tutorials on all areas of precious metals investing. These tools are intended to help investors understand the market dynamics, historical performance, and possible benefits of including gold, silver, platinum, and palladium into their portfolios.

Furthermore, the company’s customer care representatives are accessible to offer individual assistance and answer any queries consumers may have concerning their investments. Whether you’re new to precious metals investing or want to increase your current portfolio, Rosland Capital’s team of professionals is here to help you every step of the way.

However, some customers have expressed concerns about the company’s fees and marketing strategies. While Rosland Capital stresses transparency in its fee structure, some investors have discovered that the fees associated with their investments are more than expected. A few consumers have also suggested that the company’s website and marketing materials be updated to a more current and user-friendly style.

Good customer service is vital for any trader.

You should always check if a gold IRA company remains accessible to its customers and whether it offers multiple contact channels or not.

The most popular ways for recent customers are live chat and email.

While email is becoming a bit obsolete, it is still among the most common methods for a customer to contact the support staff of a broker.

In the case of Rosland Capital, it’s clear that they offer proper customer support with a significant variety of ways to contact them.

According to multiple users, Rosland Capital’s customer support is quite active and responds promptly to general queries and grievances.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

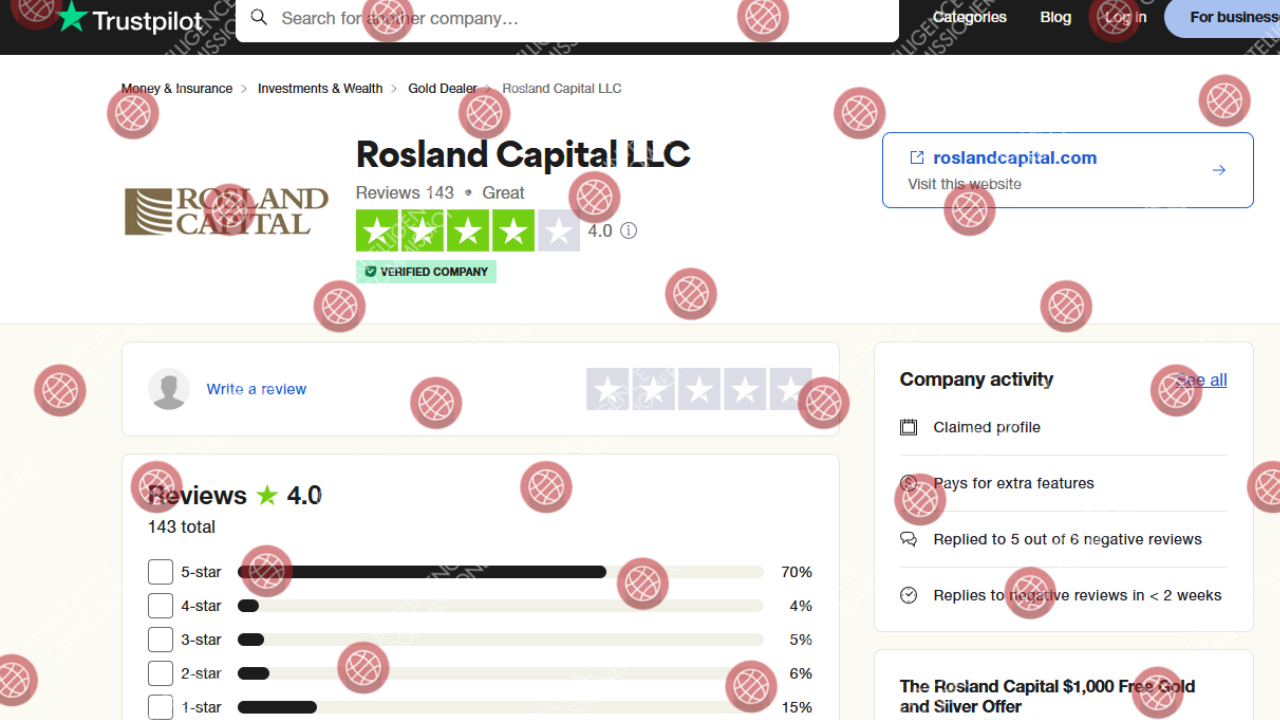

Rosland Capital’s commitment to client satisfaction is demonstrated by its ratings and reviews from numerous consumer organizations. The company has obtained a “A+” rating from the Better Business Bureau (BBB) and a AAA rating from the Business Consumer Alliance (BCA), signifying a high degree of trust and dependability. These scores are based on characteristics such as the company’s response time to consumer inquiries, transparency in business procedures, and overall satisfaction.

Rosland Capital has a 4-star rating from Trustpilot, based on 143 reviews. Customer feedback is divided, with many favorable evaluations praising the helpfulness and professionalism of certain customer service representatives. Customers have appreciated personnel such as George and Heather Ho for their knowledge and support in guiding them through the gold-purchasing process. Others have praised the promptness and quality of the things they received.

Based on user-submitted reports, most of the Rosland Capital reviews are quite positive.

Customers praise the company for its prompt customer service and trader-friendly conditions.

However, it’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

While Rosland Capital doesn’t seem like a shady broker, many others rely on fake reviews to increase their credibility.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why we recommend doing extensive research on forex brokers before finalizing your selection.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews posted by temporary accounts (profiles that only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of Rosland Capital, however, we noticed that their reviews are legitimate.

Unlike their competitors, it seems Rosland Capital has put in a lot of resources into providing its traders with specialized customer service. This way, their customers remain happy and satisfied with their experience.

Also, we didn’t notice many significant Rosland Capital complaints. However, if you have any Rosland Capital reviews to share, feel free to contact us or share them in the comment section.

You should always look out for consumer complaints. The most common complaints in forex are usually regarding:

- Poor customer support

- Delays in payments

- High fees

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about Rosland Capital? You can share your complaint in the comment section or submit an anonymous tip.

The company’s devotion to customer service and education, together with its innovative initiatives and global reach, distinguishes it from other precious metals companies. While some potential investors may regard Rosland Capital’s costs and marketing efforts to be less current than those of other firms, the overall value and security it provides make it a competitive challenger in the precious metals market.

Rosland Capital provides a comprehensive solution to investors looking to diversify their portfolios with real assets that have traditionally kept their value throughout periods of economic turmoil. Rosland Capital, with its diverse product options, transparent fee structure, and commitment to customer satisfaction, is well-positioned to assist clients in achieving their financial objectives through strategic investments in precious metals.

Rosland Capital is a regulated entity. They are licensed and operate under the watch of a major financial regulator.

So, it’s clear that Rosland Capital is a legit gold broker.

You should avoid working with unregulated brokers. The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind the unregulated broker can run away with your money without any prior notice. It would help if you were extremely cautious when dealing with an unregulated service provider.

However, that’s not the case with Rosland Capital. It’s clear in our Rosland Capital broker review that they are a legitimate entity and enjoy a positive reputation in the market.

Can You Trust Rosland Capital?

All the evidence suggests that Rosland Capital is legit. However, we recommend checking out more options before finalizing your choice.

That’s why we recommend working with a trusted broker. That way, you can avoid any hiccups and be certain of their reliability.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.