Trade Like Crazy has been identified as a risky opportunity by Intelligence Commissioner users. It is similar to Shao Bank. We’ve received over 5 complaints against Trade Like Crazy.

Trade Like Crazy, a platform launched in October 2023, offers AI-driven trading in the MLM industry but has raised serious concerns owing to its opaque operations and Ponzi-like qualities. These concerns are heightened by the lack of open ownership information and the link with Ari Maccabi, who has previously been involved in Ponzi schemes. Despite boasts of breakthrough AI trading, there is little proof of legal operations or regulatory compliance, pointing to a scheme based on new investments rather than actual trading success. This lack of accountability and reliance on continual recruitment indicate a high chance of financial loss, discouraging potential investors from engaging.

Get Your Money Back From These Scammers!

[mychargeback-form]

In October 2023, a new platform called Trade Like Crazy entered the MLM sphere, promising to revolutionize trading through the use of AI. Upon closer examination, it becomes evident that there is a lack of transparency and certain traits that resemble a Ponzi scheme.

Trade Like Crazy was launched with a lack of transparency, keeping important ownership information hidden. The domain, registered in September 2023, suggested the emergence of a new player in the AI trading industry.

The fact that Ari Maccabi has been associated with serial Ponzi schemes is a cause for concern, even though he may not have held a leadership position. The introduction of “Paul,” who is allegedly a Polish national behind the operation, suggests that Maccabi has European roots.

The lack of regulation or the presence of poor regulation is a huge red flag. It means Trade Like Crazy is a scam and most likely, an illegal operation.

Companies offering investment services or opportunities without having a license can vanish without leaving a trace. Furthermore, the lack of a regulatory license allows them to get away with it and face no legal consequences.

It is concerning that there is no clear information available regarding its leadership team. Individuals should exercise caution when contemplating engagement with these less transparent organizations.

That’s why it’s vital for you to always check a company’s regulation status as well as its license information. The presence of a license allows consumers to reach out to an authority if something goes wrong.

In the case of Trade Like Crazy, victims have nowhere to go due to the absence of a watchdog or license.

You should ask yourself the following questions when you come across a new investment firm or opportunity:

- Does the investment provider maintain transparency about its CEO?

- Do they have a license from a renowned regulatory authority?

- If the need arises, can I reach out to an authority to report this company as a scam?

The platform lacks tangible products or services for retail, limiting its affiliates to solely promoting membership. This absence of retail offering often raises concerns about the legitimacy of the MLM model.

Trade Like Crazy offers limited options for contact, including telephone and email, but they do not provide location data. There are concerns about the legitimacy of the contact information provided.

The platform has been accused of employing tactics to avoid fund withdrawals, such as urging clients to make additional trades, charging high withdrawal fees, and ceasing communication entirely when withdrawal requests are made.

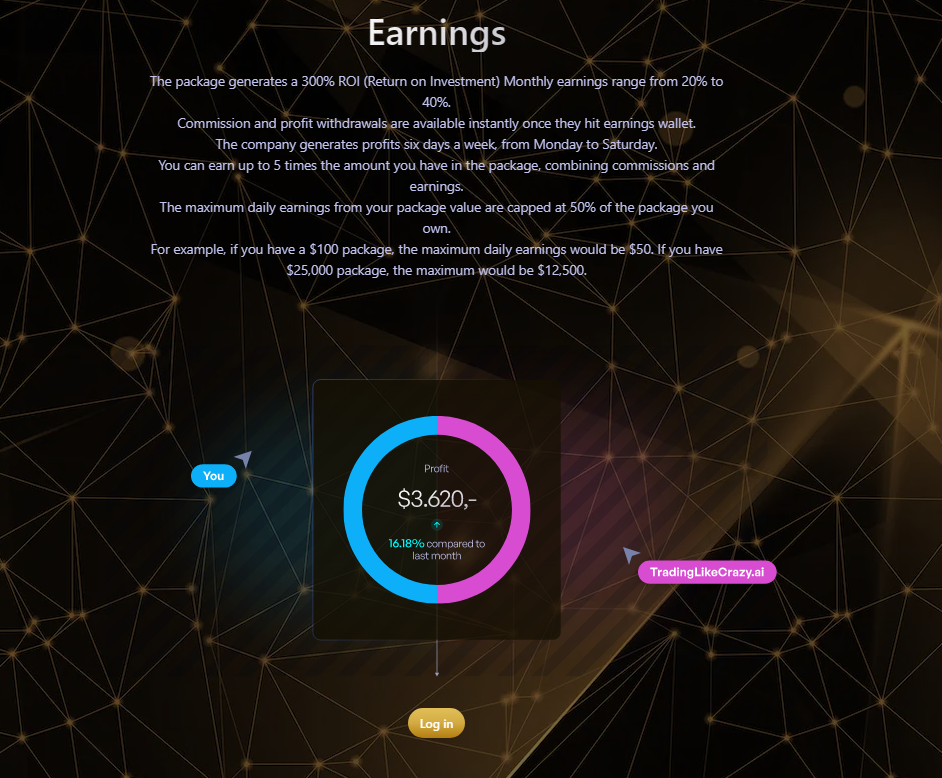

Trade Like Crazy presents an appealing investment model, offering potential returns ranging from $20 to $25,000 for investments. They claim to provide passive ROI of up to 300% or 500% when combined with MLM commissions. The plan incorporates a limit on daily MLM commissions and requires reinvestment once the maximum ROI is achieved.

Levels and Incentives for Affiliates

The compensation plan details six ranks, each with specific criteria tied to downline investment volume. The requirements range from $150,000 to an impressive $10 million, reflecting the company’s ambitious goals. It provides additional incentives for affiliates by offering generous bonuses, such as luxury items and cars, as rewards for reaching these ranks.

One interesting aspect is the return on investment match that is paid out across multiple levels in a unilevel team structure. This system demonstrates a decrease in effectiveness as levels increase, which incentivizes a focus on extensive recruitment strategies.

Although there is no cost to join, in order to fully engage with the platform, a minimum investment of $20 is required. This approach aligns the platform with a pay-to-earn model.

However, it’s worth noting that many scammers disable their payment channels before shutting down their operations.

They might give you multiple reasons including:

- A technical error

- A glitch in their system

- Banking issues

- A “hacking attack”

And many others.

But in 9/10 cases, the scammers actually stop making payments and keep the money to themselves. Hence, the payment methods we discussed here might not work.

If you want to get your money back from a scammer, you’d need to file a chargeback.

Concerns about Trade Like Crazy’s customer service arise from a lack of transparency and an untrustworthy business approach. Without clear ownership information or evidence of a robust customer service organization, it is difficult to trust their abilities to resolve concerns.

The reliance on an unsustainable reward structure raises questions about their commitment to customer satisfaction, hinting that investors may struggle to obtain support or reclaim investments if promised returns fail, indicating potentially inadequate customer service.

Trade Like Crazy has been criticized for poor handling of customer complaints. Customers have reported several issues, such as not being regulated, high fees and commissions, inadequate information on the website, poor communication, and a refusal to answer questions.

Additionally, customers have faced problems in withdrawing money from their accounts, indicating a lack of responsiveness and transparency in addressing grievances.

When it comes to scammers, you should only measure the quality of their customer service if they respond to your complaint.

In the beginning, scammers tend to remain very accessible.

This means their representatives will keep calling you until you invest with them. Furthermore, they will act friendly and make it seem as if you’re one of their most valuable consumers.

However, they do all this just to win your trust.

Scammers understand that in order to convince someone to give them a large sum, they will need to seem like a friend.

Nevertheless, when you have invested a considerable amount of money and need to get it back, their customer support will become inaccessible.

All of a sudden, their numbers would either stop responding or become unavailable.

Still, they might remain accessible to convince you to invest further. Also, they might begin by making a few excuses regarding your payment.

However, in the end, the customer support won’t resolve your issues and become increasingly unavailable.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

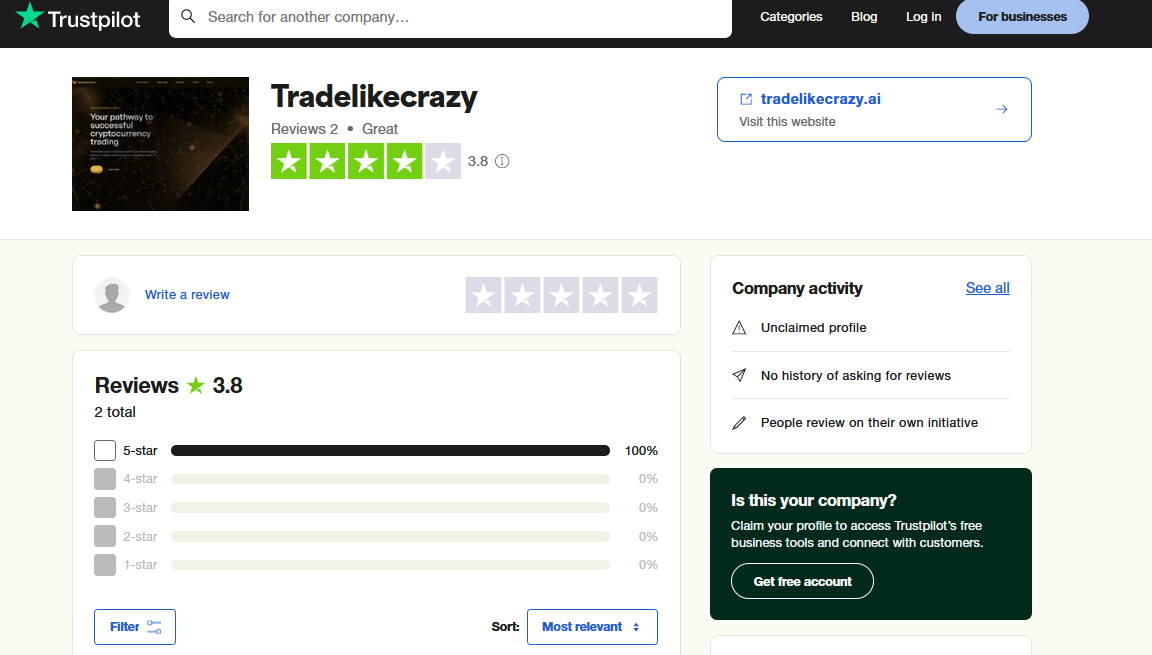

Online customer reviews for Trade Like Crazy are overwhelmingly negative. The platform has received a very low trust score based on an analysis of various factors, including ownership details, contact transparency, and website hosting information.

Customer feedback indicates a general consensus of distrust, with the site garnering an average score of 1 out of 5 stars based on 8 reviews.

These reviews highlight concerns about the platform’s legitimacy and safety for users.

It’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

Scammers like Trade Like Crazy tend to purchase fake reviews for their online profiles to make themselves seem more credible.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why you shouldn’t trust Trade Like Crazy reviews easily.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews that are posted by temporary accounts (profiles which only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of Trade Like Crazy, chances are, you wouldn’t find many legitimate reviews.

Another prominent way scammers like Trade Like Crazy enhance their credibility is by burying negative reviews and complaints under a lot of fake reviews.

This way, when you’ll look up “Trade Like Crazy reviews”, you might not find many complaints. Or, you might find them buried within numerous reviews praising Trade Like Crazy.

You should always look out for consumer complaints. In the case of Trade Like Crazy, the most common complaints I found were about:

- Poor customer support

- Delays in payments

- High fees and charges

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about Trade Like Crazy? You can share your complaint in the comment section or submit an anonymous tip.

Trade Like Crazy asserts that its revenue generation stems from AI-powered crypto trading, but it does not offer any verifiable evidence of these activities or regulatory compliance. The lack of transparency and the dependence on new investments to pay out affiliates are characteristic features of a Ponzi scheme.

It’s important to note that Ponzi schemes are fundamentally unsustainable, as they depend on a constant influx of new recruits to generate returns. When the recruitment process slows down, the entire scheme falls apart, resulting in significant financial losses for those involved, with most participants ending up in a negative financial position.

Trade Like Crazy displays clear indications of a Ponzi scheme, with its limited product options and dependence on fresh investments for profits, along with grandiose claims that lack credible proof. It is highly recommended that potential investors approach these platforms with caution and thoroughly research before making any commitments, as there is a significant risk of financial loss involved.

Trade Like Crazy is an unregulated entity. Although they might fall under the jurisdiction of a watchdog, they don’t have the license to offer financial services to consumers.

The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind Trade Like Crazy can run away with your money without any prior notice. You should be extremely cautious when dealing with an unregulated service provider.

The absence of a watchdog also means you cannot report to them to anyone.

Also, due to the absence of specific regulations, there is no provision protecting you from the insolvency of this entity. If they go bankrupt, you won’t be able to do anything about it.

Can You Trust Trade Like Crazy?

All the evidence suggests that Trade Like Crazy is a scam. If you have lost money to them, there is still a chance you can get it back.

To recover your funds, you’d need to file a chargeback.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.