True Forex Funds has been identified as a risky opportunity by Intelligence Commissioner users. It is similar to Nations Trading. We’ve received over 3 complaints against True Forex Funds.

True Forex Funds, a well-known prop trading firm, is in crisis due to the termination of its MetaQuotes license, which has caused services to halt. In search of reliability, they seek Alibaba Cloud solutions. CEO Richard Nagy assures of a settlement in the midst of negotiations, while also investigating alternative brokers. Traders were cautioned to stay informed. To prevent being a victim of True Forex Funds’ deceptive methods, report scams, seek chargebacks, and keep an eye out for common scam strategies.

Get Your Money Back From These Scammers!

[mychargeback-form]

In an unexpected turn of events, True Forex Funds, a well-known prop trading firm, is embroiled in disarray when MetaQuotes, the operator of the MT4 and MT5 platforms, terminated licenses critical to its trading activities. This unexpected outage has prompted the company to temporarily suspend its services, putting traders in limbo.

True Forex Funds seeks stability amid the turbulence by leveraging Alibaba Cloud’s specific Forex cloud solutions. Alibaba Cloud, with its steady and quick cross-border connectivity targeted to high-demand scenarios, guarantees secure and worldwide operations for Forex traders. Click to learn more about protecting your investment.

Richard Nagy, CEO of True Forex Funds, has pledged an unshakable commitment to resolving the situation and restoring trader confidence. Despite the setback, the firm is committed to finding solutions, including negotiating with MetaQuotes and considering options such as account movement to other brokers.

True Forex Funds promises its traders that company is determined to recover from the inconvenience. Urging traders to stay informed, the firm vows to handle the hurdles, assuring the settlement of pending dividends and examining all options for resuming operations smoothly.

To delve deeper into the complexities of proprietary trading, it is critical to distinguish between proprietary trading enterprises and trader-funded entities. While both may have similar evaluation processes and access to financing, their core business strategies differ dramatically. Proprietary trading firms engage in active trading, using resources and skills, whereas trader-funded entities behave differently.

My Forex Funds experienced regulatory scrutiny and eventually closed, leaving echoes of disturbance in the past. As regulatory agencies tighten down on misleading activities, the industry’s landscape becomes plagued with legal ambiguity. The saga highlights the value of transparency and compliance in the turbulent world of Forex trading.

As storm clouds gather around True Forex Funds, traders must be vigilant while crossing hazardous waters. As regulatory scrutiny grows and market dynamics shift, remaining informed and exercising caution are critical to protecting investments in the volatile world of Forex trading.

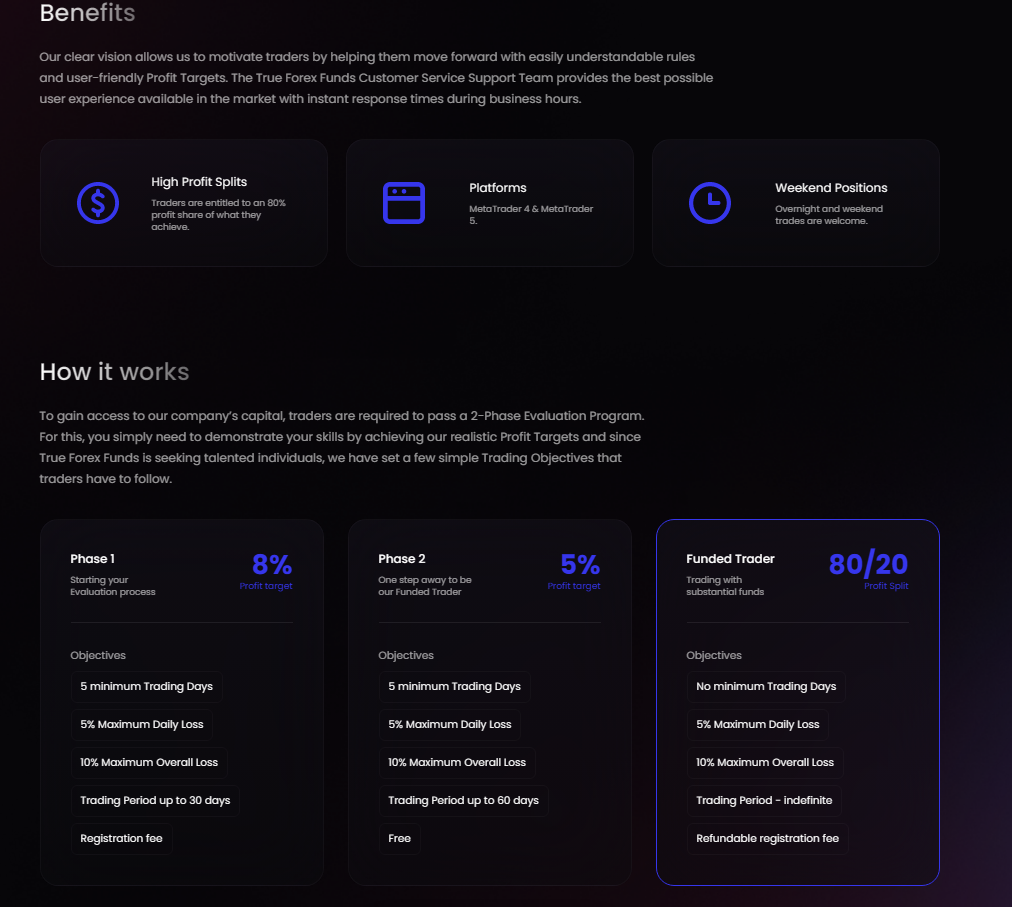

True Forex Funds presents a compelling picture of unrivaled trading conditions and benefits, but behind the surface is a labyrinth of deception and abuse. Let us examine the so-called benefits promised by this bogus entity:

Liquidity Partnerships: An Illusion of Trust

True Forex Funds has connections with several liquidity providers and cryptocurrency exchanges, ensuring world-class trading conditions. However, these collaborations act as a smokescreen, concealing the genuine nature of their operations. Traders are lured into a trap of deceptive spreads and faulty trade execution, resulting in significant losses.

Raw Spread Accounts: A trap for the unwary

The promise of raw spread accounts with little slippage entices traders looking for a competitive advantage. However, beneath this mask is a plan meant to drain traders’ accounts via hidden fees and controlled market circumstances. Traders, beware: what appears to be a profitable opportunity is actually a path to financial catastrophe.

Profit Targets: The Illusion of Success

True Forex Funds offers traders attainable profit targets and a clear route to financial success. However, these targets are used as bait to entice naive traders into a loop of false optimism and unavoidable losses. Traders are locked in a rigged game, where victory is elusive and the odds are stacked against them.

Minimum Trading Days: A Show of Flexibility

True Forex Funds create the illusion of flexibility by requiring only 5 trading days. However, underneath this surface is a rigorous structure meant to exploit traders’ time and resources. True Forex Funds’ manipulative tactics trap traders in a never-ending trading loop.

Bi-weekly payouts: A Mirage of Stability

The promise of steady bi-weekly rewards gives traders a false sense of security. However, these payouts are used to keep traders hooked, perpetuating True Forex Funds’ dishonest activities. Traders quickly find that these dividends are a phantom that vanishes when they are most needed.

Loss Limits and Free Retry: A Trap for the Desperate

True Forex Funds claims to focus risk control by providing free retries to traders who stick to loss limitations. However, these so-called free retries are used to trap traders in a loop of losses and misery. Traders are locked in a vicious circle, unable to break free from True Forex Funds’ hold.

The lack of regulation or the presence of poor regulation is a huge red flag. It means True Forex Funds is a scam and most likely, an illegal operation.

Companies offering investment services or opportunities without having a license can vanish without leaving a trace. Furthermore, the lack of a regulatory license allows them to get away with it and face no legal consequences.

That’s why it’s vital for you to always check a company’s regulation status as well as its license information. The presence of a license allows consumers to reach out to an authority if something goes wrong.

In the case of True Forex Funds, victims have nowhere to go due to the absence of a watchdog or license.

You should ask yourself the following questions when you come across a new investment firm or opportunity:

- Does the investment provider maintain transparency about its CEO?

- Do they have a license from a renowned regulatory authority?

- If the need arises, can I reach out to an authority to report this company as a scam?

However, it’s worth noting that many scammers disable their payment channels before shutting down their operations.

They might give you multiple reasons including:

- A technical error

- A glitch in their system

- Banking issues

- A “hacking attack”

And many others.

But in 9/10 cases, the scammers actually stop making payments and keep the money to themselves. Hence, the payment methods we discussed here might not work.

If you want to get your money back from a scammer, you’d need to file a chargeback.

When it comes to scammers, you should only measure the quality of their customer service if they respond to your complaint.

In the beginning, scammers tend to remain very accessible.

This means their representatives will keep calling you until you invest with them. Furthermore, they will act friendly and make it seem as if you’re one of their most valuable consumers.

However, they do all this just to win your trust.

Scammers understand that in order to convince someone to give them a large sum, they will need to seem like a friend.

Nevertheless, when you have invested a considerable amount of money and need to get it back, their customer support will become inaccessible.

All of a sudden, their numbers would either stop responding or become unavailable.

Still, they might remain accessible to convince you to invest further. Also, they might begin by making a few excuses regarding your payment.

However, in the end, the customer support won’t resolve your issues and become increasingly unavailable.

If you have information on a scam or criminal operation, you can get access to 40+ investigative journalists & news outlets for free. Send us a detailed report here and if you qualify, we will forward your case ahead.

It’s worth noting that many scammers tend to purchase fake reviews. Buying fake reviews has become extremely easy and it’s a multi-million dollar industry.

Scammers like True Forex Funds tend to purchase fake reviews for their online profiles to make themselves seem more credible.

TIME Magazine investigated the fake review industry and estimated it to be worth more than $150 million. Certainly, there are a ton of scammers who want to seem legitimate and a bunch of fake reviews is the most effective way to do so.

That’s why you shouldn’t trust True Forex Funds reviews easily.

It’s easy to identify fake reviews as well. You should look out for 5-star reviews that are posted by temporary accounts (profiles which only posted 1 or 2 reviews on the platform). Also, you should see if the positive reviews share any detailed information about their experience with the firm or not.

In the case of True Forex Funds, chances are, you wouldn’t find many legitimate reviews.

Another prominent way scammers like True Forex Funds enhance their credibility is by burying negative reviews and complaints under a lot of fake reviews.

This way, when you’ll look up “True Forex Funds reviews”, you might not find many complaints. Or, you might find them buried within numerous reviews praising True Forex Funds.

You should always look out for consumer complaints. In the case of True Forex Funds, the most common complaints I found were about:

- Poor customer support

- Delays in payments

- High fees and charges

- Lack of transparency regarding their leadership team

- Aggressive sales staff

Do you have a similar complaint about True Forex Funds? You can share your complaint in the comment section or submit an anonymous tip.

True Forex Funds presents itself as a light of hope in the forex market, but it is actually a predatory institution preying on unwary traders.

Traders should use extreme caution when dealing with True Forex Funds and other similar firms, as the risks considerably exceed the rewards. Stay watchful, and remember that if something seems too good to be true, it generally is. Don’t succumb to the seduction of fraudulent forex funds.

True Forex Funds is an unregulated entity. Although they might fall under the jurisdiction of a watchdog, they don’t have the license to offer financial services to consumers.

The lack of a license means they are not answerable to any regulatory authority. As a result, the people behind True Forex Funds can run away with your money without any prior notice. You should be extremely cautious when dealing with an unregulated service provider.

The absence of a watchdog also means you cannot report to them to anyone.

Also, due to the absence of specific regulations, there is no provision protecting you from the insolvency of this entity. If they go bankrupt, you won’t be able to do anything about it.

Can You Trust True Forex Funds?

All the evidence suggests that True Forex Funds is a scam. If you have lost money to them, there is still a chance you can get it back.

To recover your funds, you’d need to file a chargeback.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.

Intelligence Commissioner investigates & reviews online money-making opportunities. We strive to provide critically helpful information to our readers and assist them in identifying scams.